The euros brief reaction to Fridays sharp decline has lost steam, with the currency trading below the 1.05 level it touched earlier on Monday. Despite the initial bounce, the euros gains are uncertain

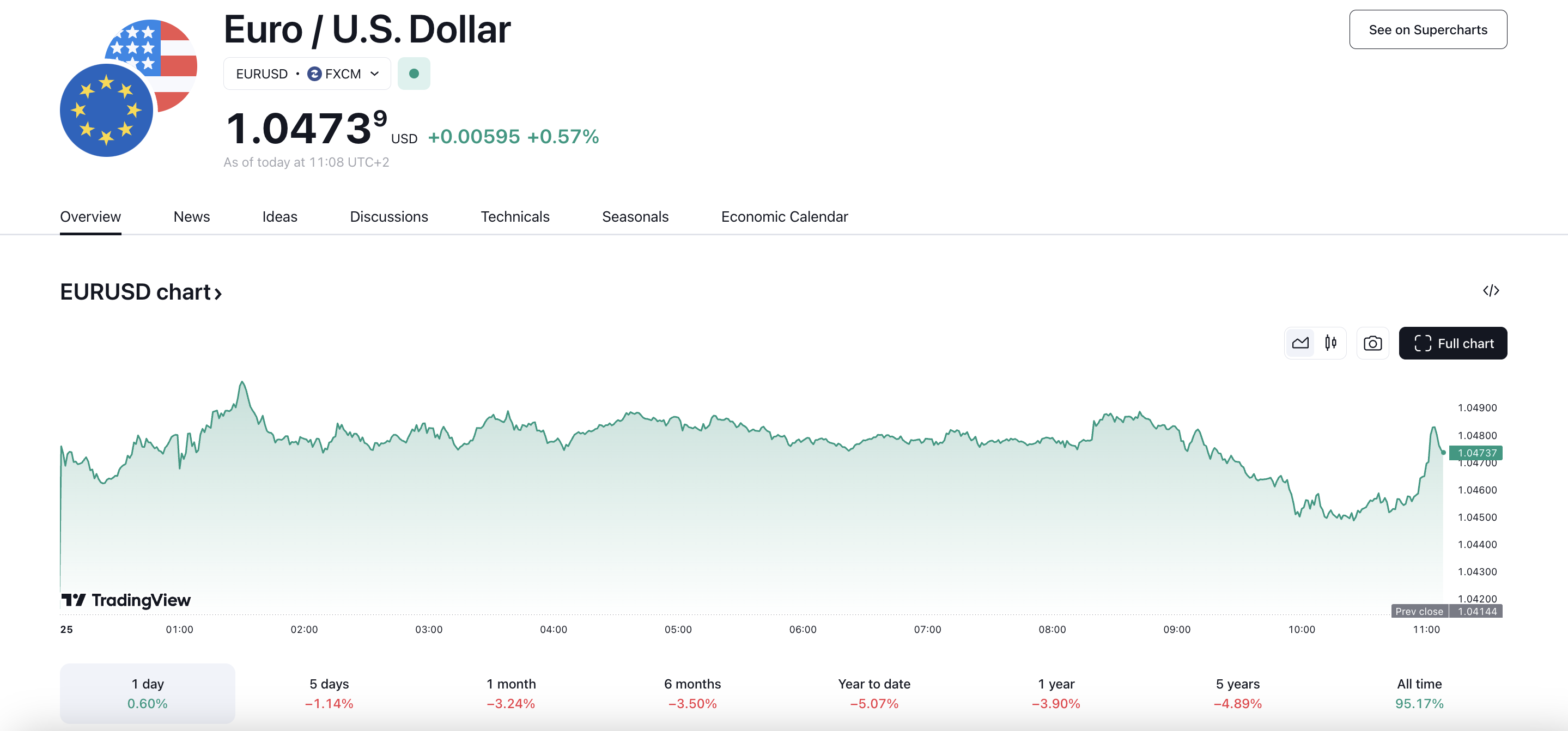

EUR/USD Taps 1.047

The euro’s brief reaction to Friday’s sharp decline has lost steam, with the currency trading below the 1.05 level it touched earlier on Monday. Despite the initial bounce, the euro’s gains are uncertain, as the underlying concerns about the European economy persist.

Friday’s disappointing data on the services and manufacturing sectors in the eurozone has increased bets on another interest rate cut by the European Central Bank, with a 25-basis-point cut likely and a 50-point cut also on the table. In contrast, the US economy’s positive data has maintained optimism, widening the gap in outlook between the two major economies.

While the euro’s reaction has been strong, the overall market picture remains unchanged, with critical issues weighing on the European currency. Geopolitical risks and concerns about the European economy’s trajectory continue to dominate the agenda, keeping the euro under pressure.

Today’s agenda is light, with the IFO index for the German economy being the only notable event. The market’s behavior, with the sharp drop to 1.04 levels, has confirmed the need for caution, and it’s advisable to lock in some profits and adopt a wait-and-see stance.

However, the US currency’s significant gains in recent weeks may be showing signs of fatigue, and buying the European currency on new dips could be a viable strategy. As the challenges facing the European currency persist, it’s essential to remain vigilant and adapt to changing market conditions.