Key momentsCurrency Plunge: The Canadian dollar and Mexican peso both fell to their lowest levels in a monthTariff Implementation: New U.S. tariffs of 25% on goods from Mexico and Canada took effect,

Loonie and Peso Under Pressure: US Tariffs Trigger One-Month Lows

Key moments

- Currency Plunge: The Canadian dollar and Mexican peso both fell to their lowest levels in a month

- Tariff Implementation: New U.S. tariffs of 25% on goods from Mexico and Canada took effect, along with a doubling of duties on Chinese goods to 20%

- Retaliatory Response: China announced it would impose additional tariffs of 10%-15% on certain U.S. imports, with Canada expected to follow suit with retaliatory tariffs

Analyzing the Impact on USDCAD and USDMXN Exchange Rates

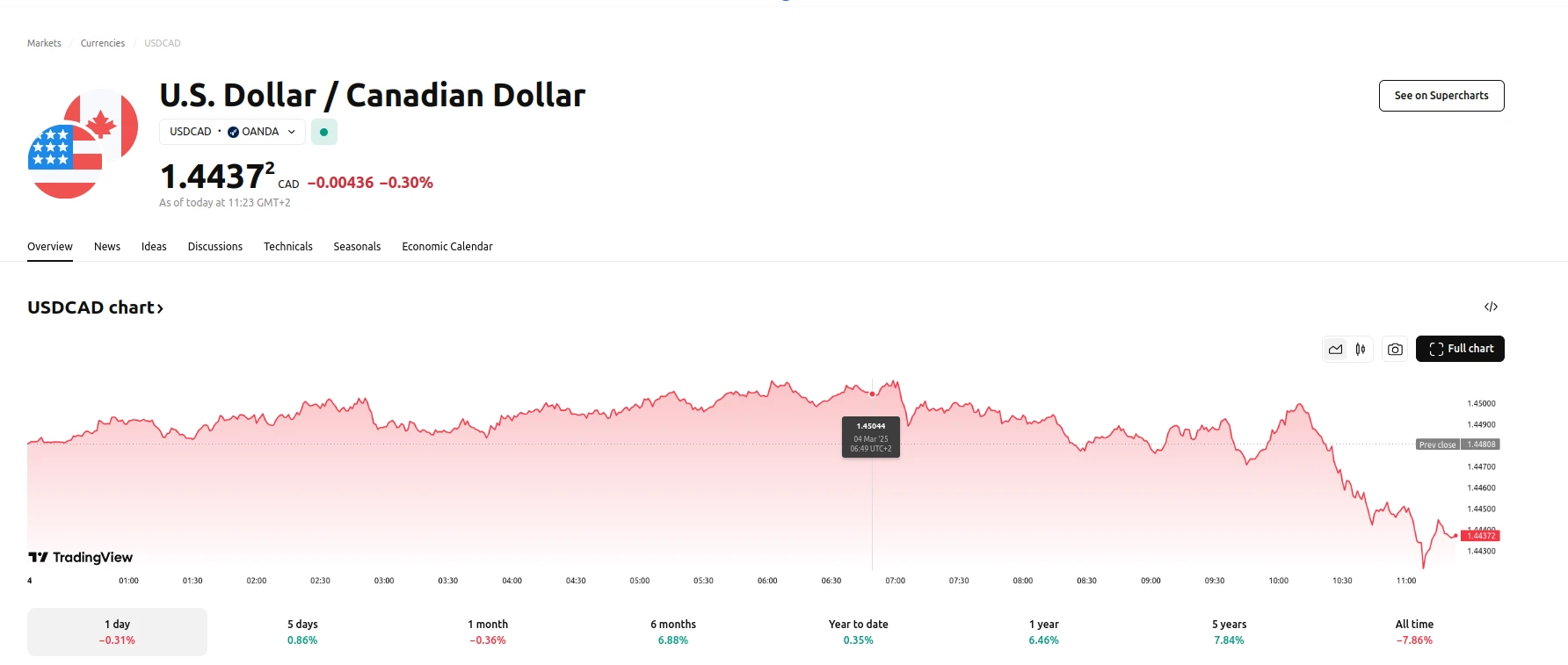

The Canadian dollar weakened to $1.4491, after hitting a one-month low of $1.45415 on Monday. The Mexican peso also slid over 0.5% to 20.821 per dollar, its lowest since February 3, before settling at 20.739. This currency depreciation reflects investor concerns about the economic implications of the trade dispute.

The implementation of tariffs and the subsequent retaliatory measures have rattled currency markets, contributing to the decline of the loonie and peso. Vasu Menon, managing director of investment strategy at OCBC, noted that Trump’s decision to proceed with tariffs on Mexico and Canada has turned “fear into reality.” He also said the tariffs will rattle markets as investors worry that the move will cause inflation expectations to rise and cause U.S. growth to slow down as these countries make up a large part of U.S. imports.

The risk-sensitive Australian dollar also felt the impact, sliding to a one-month low of $0.6187. Charu Chanana, chief investment strategist at Saxo, suggested that while China’s moves may not be particularly bold, they indicate a desire to negotiate with the U.S., but also carry the risk of escalating trade tensions.

In the wake of the tariff actions, U.S. Treasuries experienced a rally, with the yield on the benchmark 10-year U.S. Treasury note hitting its lowest level since October 22. This flight to safety reflects investor uncertainty and a preference for less risky assets amid the escalating trade war.