Key momentsEURUSD Climbs Above 50-Day EMA, Approaches 1.0530 ResistanceFed Rate Expectation Shift Fuels Dollar Weakness, Boosting EuroU.S. Tariffs Pose Significant Downside Risk to Euro RallyEURUSD Se

EURUSD Surges, Eyes Key 1.0530 Resistance Amid Shifting Fed Expectations

Key moments

- EURUSD Climbs Above 50-Day EMA, Approaches 1.0530 Resistance

- Fed Rate Expectation Shift Fuels Dollar Weakness, Boosting Euro

- U.S. Tariffs Pose Significant Downside Risk to Euro Rally

EURUSD Sees Notable Gains, Testing Critical Resistance Amid Evolving Monetary Policy Outlook

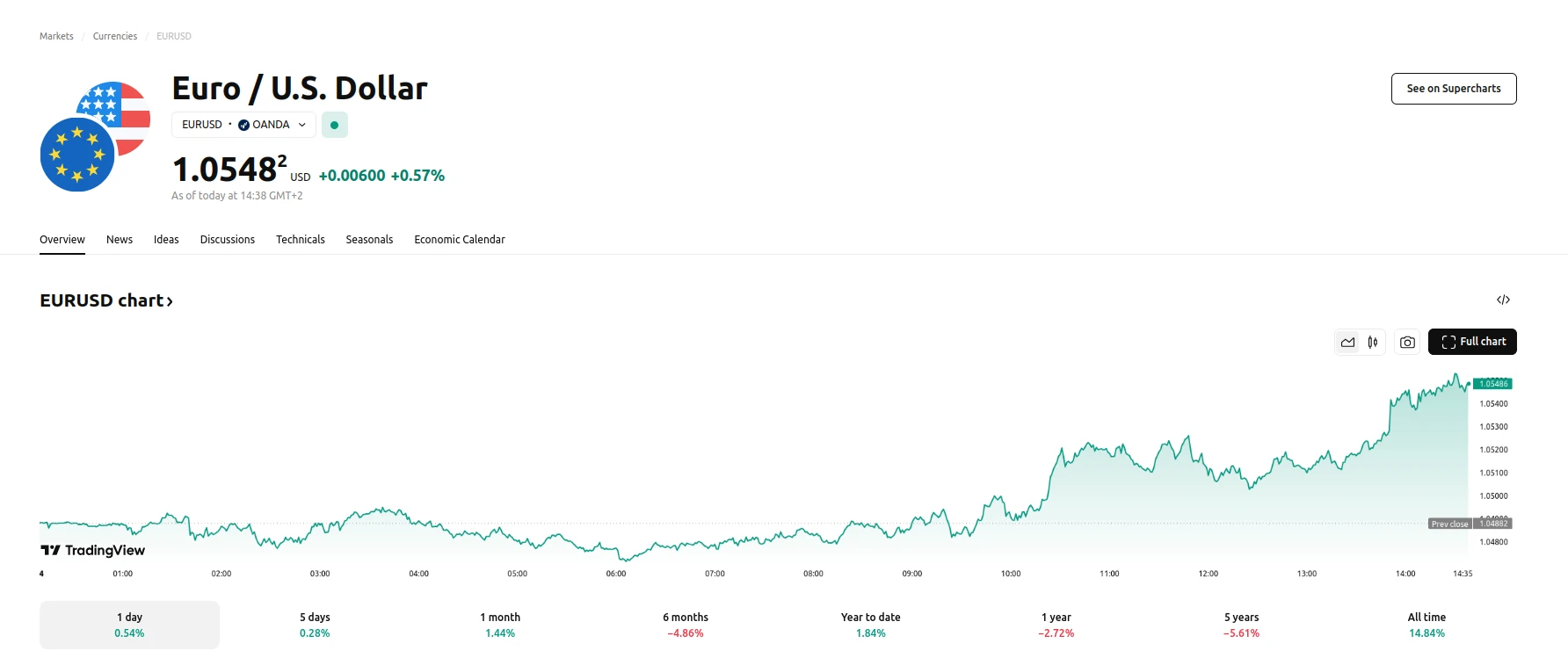

The EURUSD currency pair commenced March with a pronounced upward trajectory, registering a 1% increase on Monday and extending its gains into the European trading session on Tuesday. This surge propelled the pair above the 50-day exponential moving average (EMA) and beyond the 1.0460 resistance level, positioning it to test the critical 1.0530 resistance. This level has historically acted as a ceiling for the pair over the preceding three months, making it a pivotal point for determining near-term price direction.

The recent upward momentum of the EURUSD pair can be largely attributed to evolving market expectations regarding the Federal Reserve’s monetary policy. A deceleration in U.S. economic data has resulted in a 35 basis-point reduction in the transatlantic two-year yield spread over the past month. This narrowing spread reflects market anticipation of a less aggressive stance from the Fed, which has exerted downward pressure on the U.S. dollar, thereby creating favorable conditions for the EURUSD pair. Furthermore, heightened investor confidence in Europe, spurred by a significant rally in European defense stocks, has additionally bolstered the euro.

However, the potential imposition of U.S. tariffs presents a substantial risk to the euro’s recent gains. The eurozone’s open economy is particularly vulnerable to trade-related disruptions, and any tariffs on key European exports could trigger a rapid shift in market sentiment against the euro, limiting its potential for further appreciation. The 1.0530 resistance level remains a crucial test for the EURUSD pair. Failure to breach this level could precipitate a reversal, potentially driving the price back towards the 50-day EMA support. Conversely, even if a breakout occurs, the fundamental risks associated with trade tensions could undermine confidence in a sustained euro rally. Therefore, traders should closely monitor price action around the 1.0530 level, as a rejection at this juncture could signal renewed selling pressure.