Key momentsThe USD/CAD pair rose by 0.19% on Thursday, almost reaching 1.4400.The Canadian dollar surged after the Bank of Canada implemented an interest cut rate of 2.75%.Favorable U.S. inflation rep

BoC Lowers Interest Rate to 2.75%, USD/CAD Climbs Near 0.20% to 1.4397 BoC Lowers Interest Rate to 2.75%, USD/CAD Climbs Near 0.20% to 1.4397

Key moments

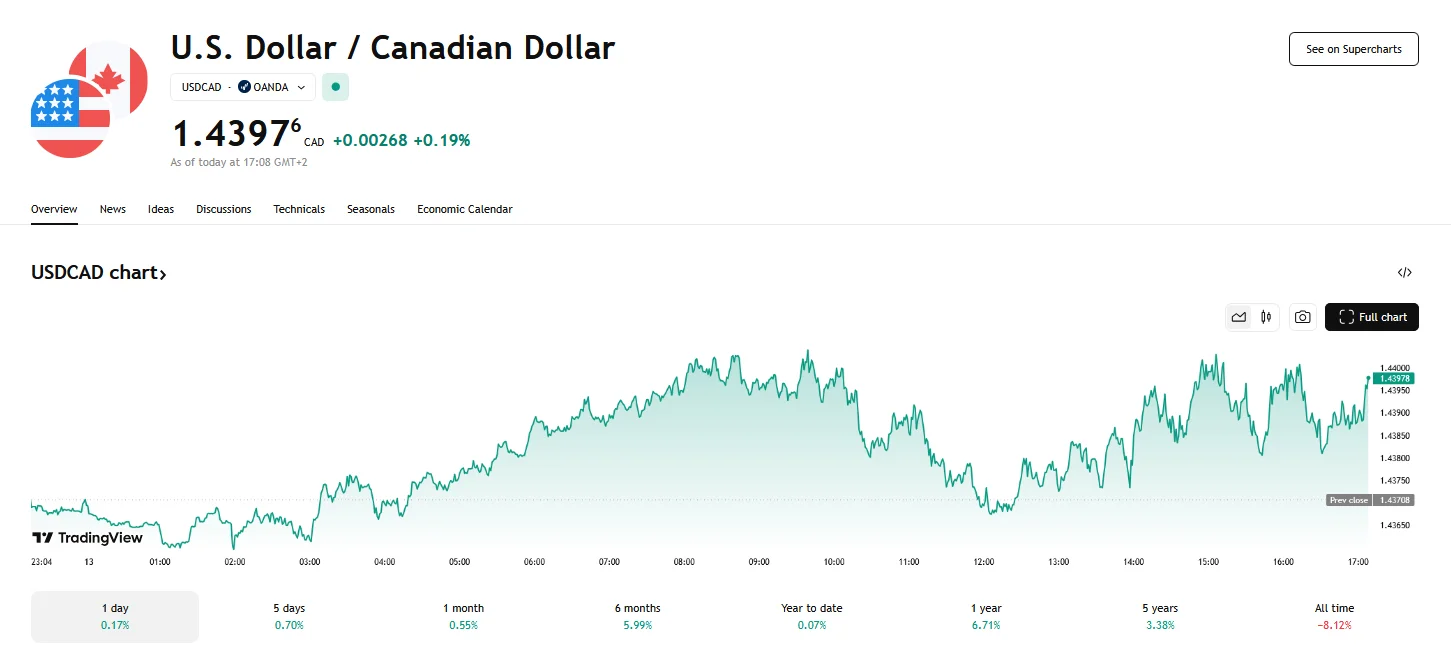

- The USD/CAD pair rose by 0.19% on Thursday, almost reaching 1.4400.

- The Canadian dollar surged after the Bank of Canada implemented an interest cut rate of 2.75%.

- Favorable U.S. inflation reports, showing a decline to 2.8% annually, have reduced the likelihood of a Federal Reserve rate cut in spring.

BoC Rate Cut Triggers USD/CAD Rise

Thursday witnessed USD/CAD ascend by 0.19%. The pair hit 1.4397 a day after the Bank of Canada (BoC) implemented a 25 basis point (bps) reduction in its key interest rate, bringing it to 2.75%. This upward movement of the USD/CAD reflects a complex interplay of monetary policy decisions and persistent trade-related uncertainties between the United States and Canada.

A factor behind the BoC’s decision to lower rates was the central bank’s growing concern over the economic implications of the ongoing trade dispute. This sentiment, shared by U.S. Governor Macklem, put an emphasis on the uncertainty surrounding the tariffs and their consequences. The central bank also cautioned that “monetary policy cannot offset the impacts of a trade war.”

Conversely, the United States has seen a more favorable inflation report, with inflation experiencing a 0.2% month-over-month drop in February, down from the 0.5% reported last month. Inflation also decreased compared to the previous year, falling below the 2.9% forecast and settling at 2.8%. Core CPI followed a similar trend, declining to 0.2% from 0.4%.

Whether the Federal Reserve will implement a rate cut this May is still uncertain, but the above data has lowered that likelihood by 30%, according to analysts. From a technical perspective, the Canadian dollar experienced an initial surge following the BoC’s rate cut, but the USD/CAD has since regained ground. The BoC’s Governor Macklem indicated that the central bank considers its current policy rate to be at a neutral level, neither restrictive nor stimulative, centered around 2.75%. The BoC has also cautioned that heightened “trade tensions” could disrupt “job market recovery,” increase “inflationary pressures and curb growth,” and projected moderate growth in the first quarter of the year due to the trade conflict’s impact on “sentiment and activity.”

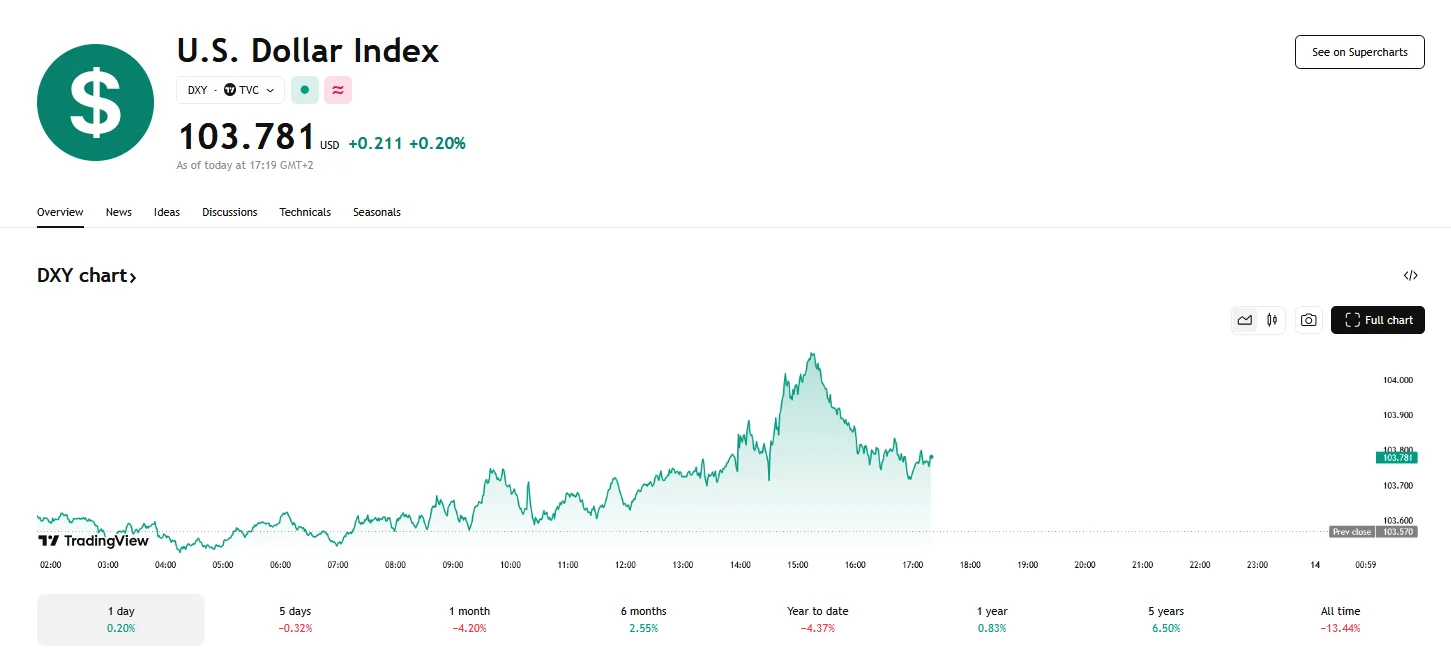

Following a four-month low near 103.20, the U.S. Dollar Index (DXY) is now in a recovery phase. This stabilization is largely due to the cautious market sentiment created by President Trump’s threats of retaliatory tariffs against the European Commission.