Key momentsFriday saw XRP experience a surge of 3.19%The price increase was fueled by Ripples successful acquisition of a financial license from the Dubai Financial Services Authority (DFSA).Speculati

XRP Jumps 3.19% to 2.32184 After Ripple Secures Dubai License XRP Jumps 3.19% to 2.32184 After Ripple Secures Dubai License

Key moments

- Friday saw XRP experience a surge of 3.19%

- The price increase was fueled by Ripple’s successful acquisition of a financial license from the Dubai Financial Services Authority (DFSA).

- Speculation surrounding a potential settlement between Ripple and the SEC is also contributing to the asset’s positive performance.

Regulatory Nod in Dubai Sends Ripple’s XRP Up 3.19%

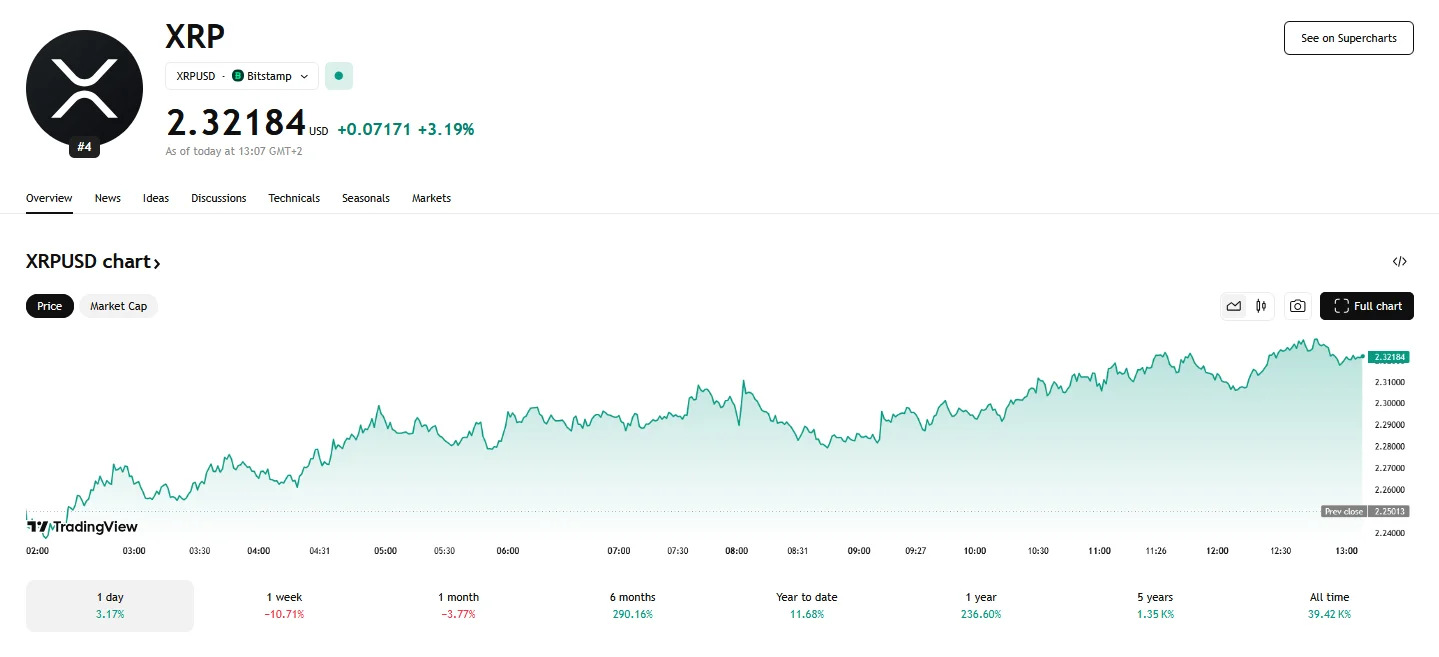

On a Friday marked by renewed optimism, XRP demonstrated a notable upward trajectory as the coin surged nearly 3.20% over the preceding 24 hours. The day began with XRP/USD trading at a more modest 2.2375, but a consistent climb ensued, pushing the pairing to the 2.32184 figure. This serves as a stark contrast to the plunge that took place earlier this week, which saw XRP fall to levels below $2.

This surge arrives amidst a broader period of gains spanning several days, suggesting a significant shift in investor sentiment after a period of downward price adjustments. A key factor driving this resurgence is the recent regulatory triumph achieved by XRP’s company, Ripple, in Dubai. According to an announcement issued by Ripple on Thursday, the Dubai Financial Services Authority (DFSA) granted the company a financial license. This development is perceived as a significant step forward, unlocking the potential for regulated cross-border digital asset payment services within the United Arab Emirates.

The timing of this regulatory approval has clearly resonated with investors, contributing to the asset’s positive momentum on Friday. The license is seen as validating Ripple’s technology and its potential to facilitate faster, more cost-effective, and transparent international transactions.

Furthermore, the price of XRP has been impacted by ongoing speculation surrounding the resolution of the legal dispute between Ripple and the United States Securities and Exchange Commission (SEC). Market observers are increasingly hopeful that a settlement could be reached before mid-April, with some anticipating a reduced penalty for Ripple. This optimism is fueled by changes within the SEC, including the departure of its previous leadership and a perceived shift towards a more accommodating stance on digital assets.

These developments have led to a general perception that the SEC is reconsidering its approach to the cryptocurrency sector, with several lawsuits against prominent industry players either being dropped or paused. The lingering case involving Ripple, however, remains a focal point, and the prospect of a favorable resolution is bolstering investor confidence.