Key momentsBoK will maintain its traditional reserve strategy as officials fear price fluctuations could lead to high transaction costs, undermining reserve stability.Bitcoins price has fluctuated, re

Bank of Korea Excludes Bitcoin from Reserves, Bitcoin Slips Below $84,000 as Market Capitalization Dips 1.08% to $1.65T Bank of Korea Excludes Bitcoin from Reserves, Bitcoin Slips Below $84,000 as Market Capitalization Dips 1.08% to $1.65T

Key moments

- BoK will maintain its traditional reserve strategy as officials fear price fluctuations could lead to high transaction costs, undermining reserve stability.

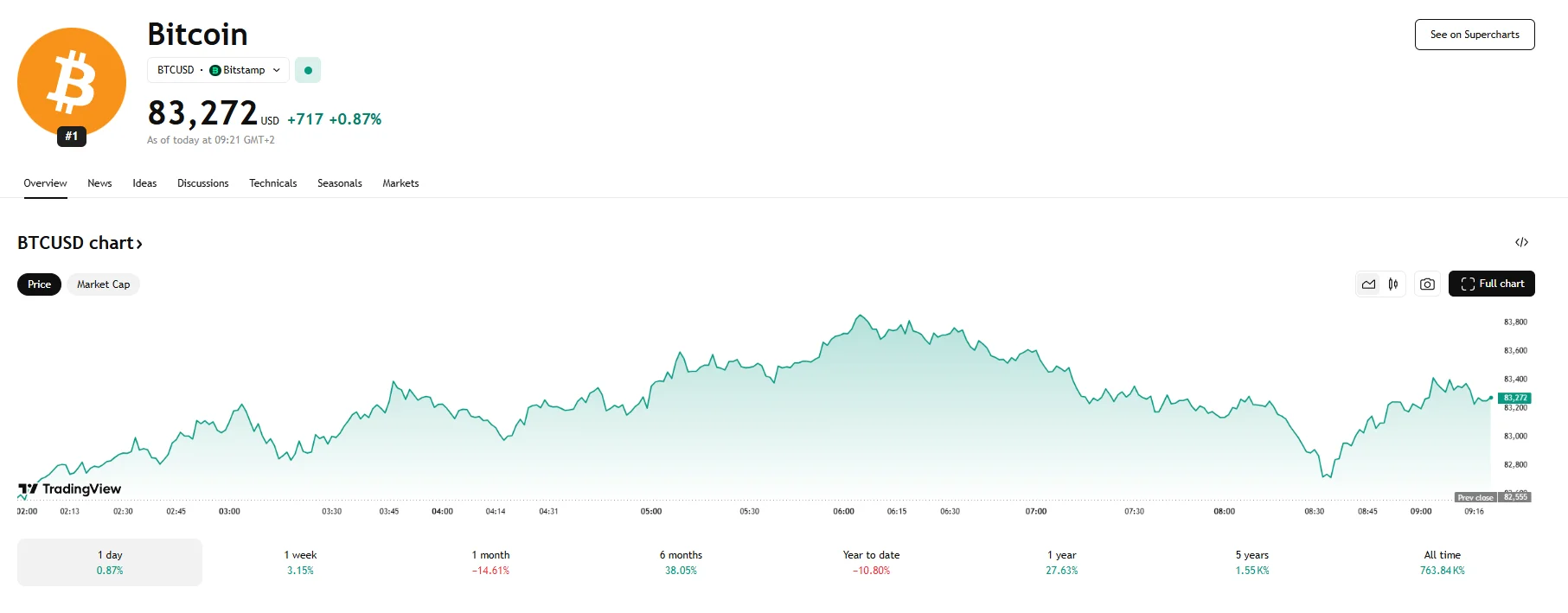

- Bitcoin’s price has fluctuated, recently dipping below $84,000 on Monday.

- Bitcoin’s market capitalization has decreased by 1.08%, settling at $1.65 trillion.

Bitcoin Has Been Deemed a Non-Viable Reserve Asset for Korea

The Bank of Korea (BoK) has ruled out the prospect of integrating Bitcoin into its foreign exchange reserves, citing concerns over the cryptocurrency’s inherent volatility and its incompatibility with established international financial guidelines. This decision arises amidst a global debate regarding the role of digital assets in national reserve portfolios.

Central to the BoK’s stance is the instability of Bitcoin’s price. Officials have expressed apprehension that the significant fluctuations in its value could lead to substantial transaction costs, particularly during periods of market stress, when converting the cryptocurrency to fiat currency. They emphasize that such volatility creates unacceptable risks for a reserve asset intended to maintain stability and liquidity.

Furthermore, the BoK contends that Bitcoin fails to align with the International Monetary Fund’s (IMF) criteria for effective foreign exchange reserve management. The IMF mandates that reserves must prioritize liquidity, market risk, and credit risk management in a prudent manner. The central bank suggests Bitcoin does not meet these stipulations. In contrast to the BoK’s cautious approach, developments in other nations have stirred considerable interest, a notable example being the U.S. as President Donald Trump will be moving forward with a Strategic Bitcoin Reserve.

Bitcoin has experienced fluctuations, most recently trading below the $84,000 mark, and its market capitalization decreased by 1.08% to $1.65 trillion. Bitcoin’s value generally remained above $84,000 on Saturday, then fell to around $82,000 the following day before climbing past $83,000 on Monday.

Alankar Saxena, CTO and Co-founder of Mudrex, highlighted the delicate balance the cryptocurrency currently holds. He observed that Bitcoin is navigating a narrow trading range, moving towards resistance around $85,000. According to Saxena, breaching this resistance could propel Bitcoin toward $90,000, while a decline could find support at $81,200.

Crypto market participants are particularly attentive to the upcoming Federal Reserve policy meeting. The Fed’s commentary regarding trade policies and their potential impact on inflation is of particular concern to these investors. Economic events have been shown to heavily impact the cryptocurrency markets. The market waits to see how economic announcements will impact monetary policies and market conditions.