Key momentsThe euro remains resilient against the dollar, continuing to trade around $1.09 as the EUR/USD pair stays above 1.0880.Traders are closely watching the Federal Reserves upcoming interest ra

EUR/USD Trades Just Shy of 1.0900 as Market Awaits Fed Rate Announcement EUR/USD Trades Just Shy of 1.0900 as Market Awaits Fed Rate Announcement

Key moments

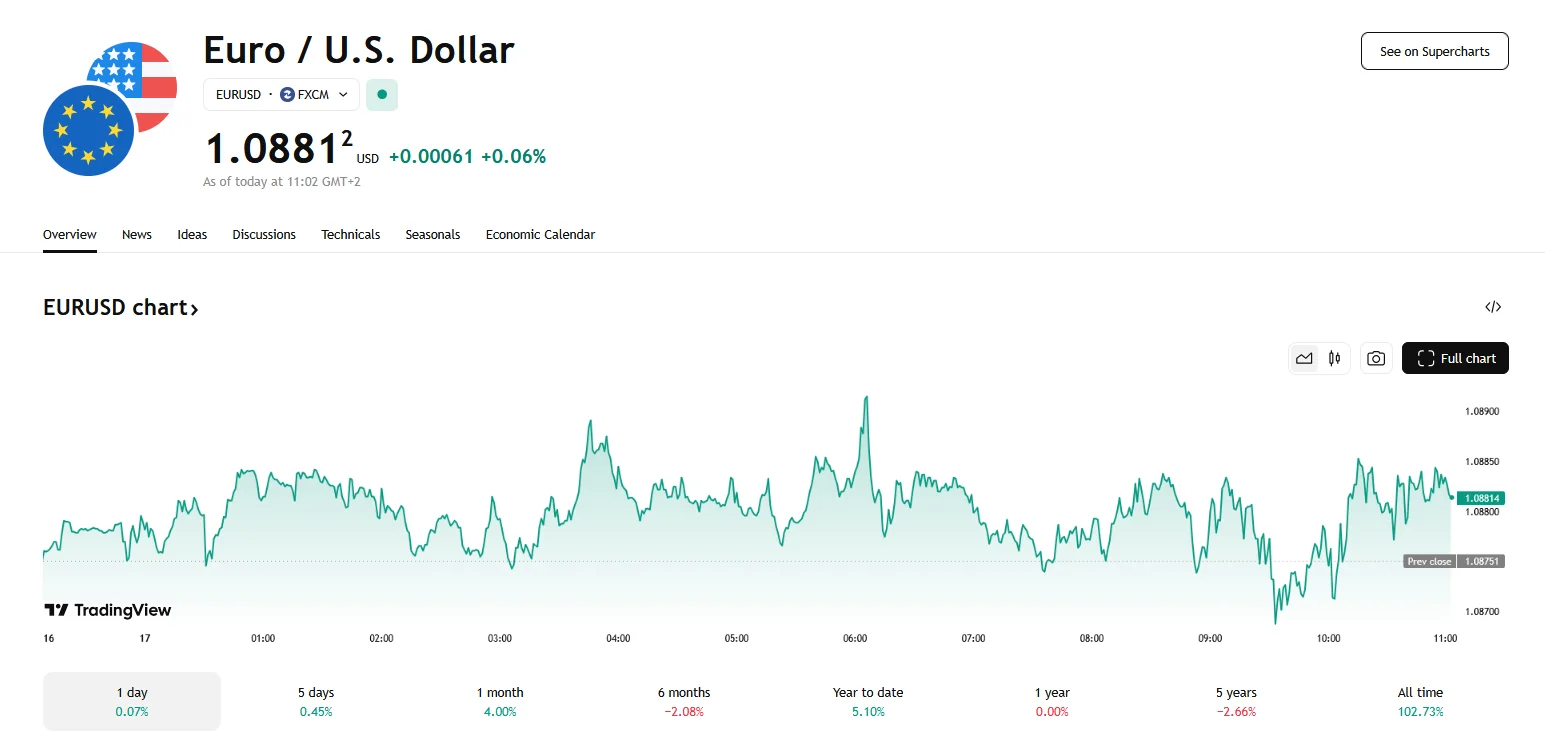

- The euro remains resilient against the dollar, continuing to trade around $1.09 as the EUR/USD pair stays above 1.0880.

- Traders are closely watching the Federal Reserve’s upcoming interest rate announcement, as well as Germany’s upcoming vote on a potential debt deal.

- Tariff tensions continue affecting the U.S. dollar.

EUR/USD Stays Stable, Investors Anticipate Fed Rate Decision and German Policy Shifts

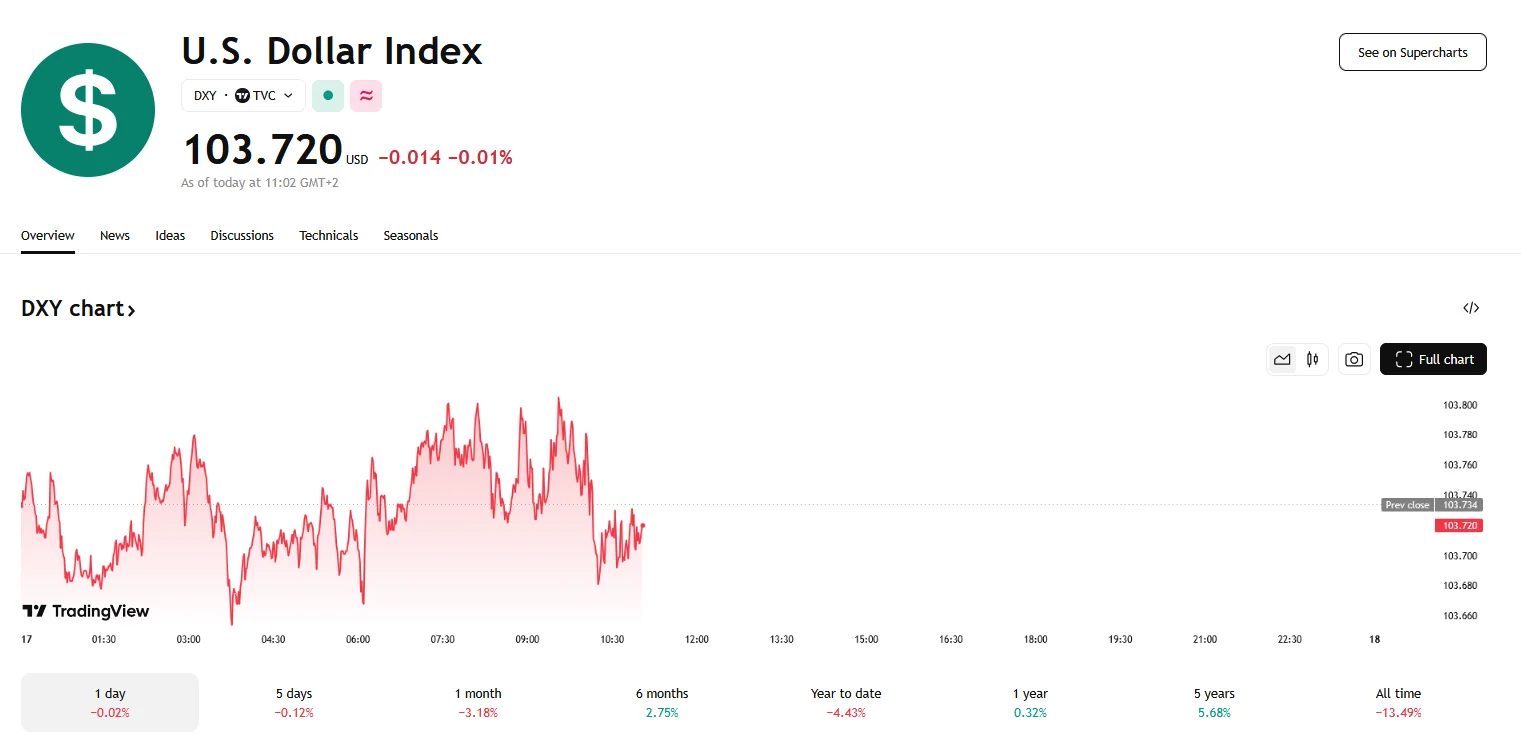

The euro against the U.S. dollar has exhibited a period of relative stability, hovering close to the $1.09 mark as a week filled with crucial economic events unfolds. The EUR/USD exchange rate, having demonstrated a robust upward trajectory, remains buoyant as it trades comfortably above the 1.0880 threshold. This sustained strength has manifested in a nearly 5% appreciation since the beginning of March.

From a technical perspective, the EUR/USD pair is currently displaying indecisiveness, with the Relative Strength Index (RSI) hovering around 50. Immediate support for the pair lies in the 1.0850-1.0860 range, while resistance is observed around the 1.0900 mark. The euro’s position above key moving averages in terms of the 50 to 200-day lines signals that investor sentiments remain bullish. However, the current period is characterized by consolidation, with the pair exhibiting sideways movement as traders brace for potential volatility.

A critical event on the economic calendar is the forthcoming decision by the U.S. Federal Reserve regarding its interest rate policy. Scheduled for Wednesday, this announcement will be closely scrutinized by currency traders. At present, it is expected that the Fed will maintain the current interest rate range of 4.25% to 4.50%. However, the focus will primarily be on the Federal Reserve’s forward guidance. Specifically, market participants are eager to ascertain how the Fed intends to address potential inflationary pressures and economic uncertainties arising from recent trade policies.

Adding to the week’s significance is Germany’s impending vote on a proposed fiscal spending package. The outcome of this vote, involving key political parties, could significantly influence market sentiment and the euro’s trajectory. Optimistic views on the German fiscal plan could bolster the euro, further solidifying its position against the dollar.

The recent tariff measures implemented by the U.S. administration have further contributed to the complexity of the economic landscape. These policies have exerted downward pressure on the U.S. dollar, leading to a shift in investor preference toward alternative currencies. A weakening dollar, while potentially beneficial for domestic businesses, carries the risk of reigniting inflationary pressures, which could prompt the Federal Reserve to adopt a more aggressive monetary policy stance.