Key momentsFueled by strong economic data, the 10-year US Treasury yield reached a three-week peak of 4.33%.Data reveals strong economic momentum, highlighted by residential construction, retail sales

US Treasury Yield Hits 3-Week High of 4.33% Amid Robust Economic Signals

Key moments

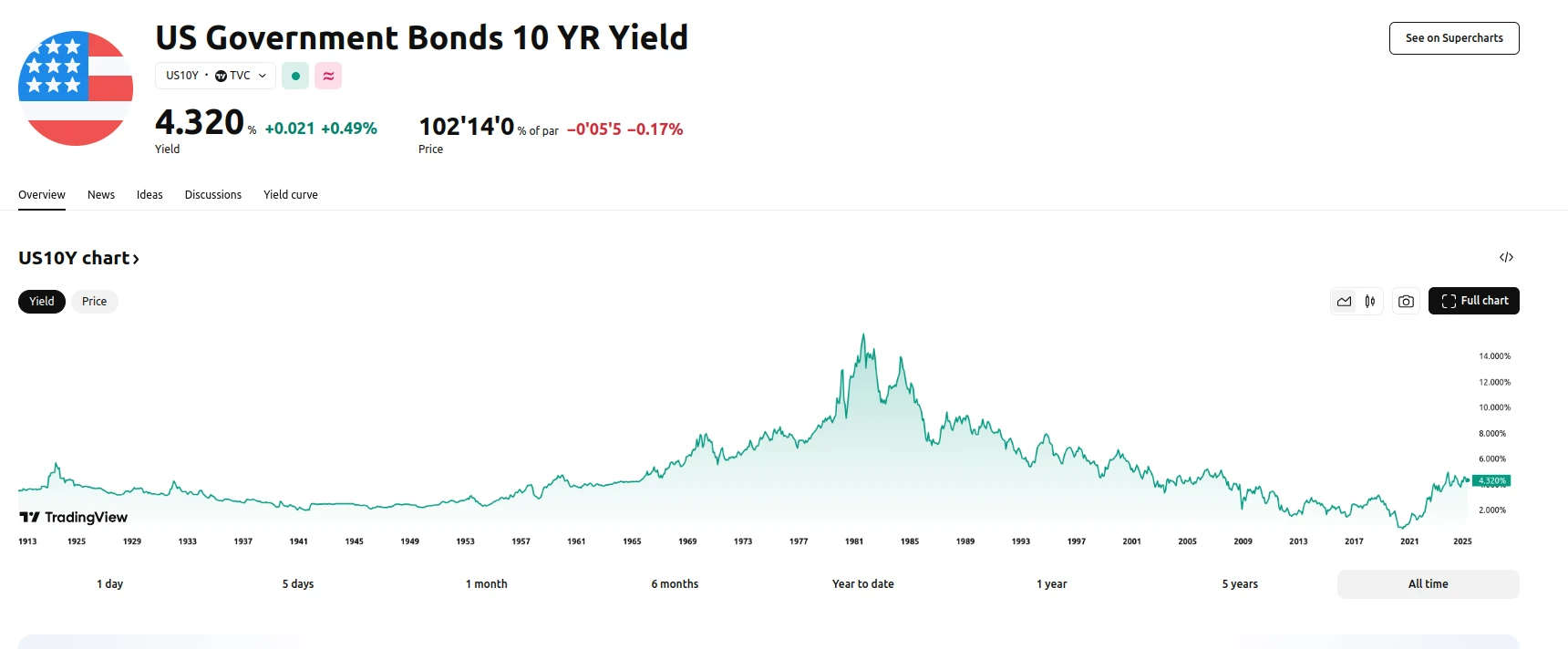

- Fueled by strong economic data, the 10-year US Treasury yield reached a three-week peak of 4.33%.

- Data reveals strong economic momentum, highlighted by residential construction, retail sales, and import prices that have outperformed expectations.

- Rising consumer inflation expectations and tariff threats influence market anticipation of the Federal Reserve’s upcoming decision.

US Treasury Yields Rise Amid Strong Economic Signals and Fed Anticipation

The yield on the 10-year US Treasury note experienced an upward movement, reaching 4.33%, a level not seen in three weeks. This increase is attributed to a series of positive economic indicators released ahead of the Federal Reserve’s policy decision. Data concerning residential construction exceeded anticipated figures, while core retail sales demonstrated a robust level of private consumption, suggesting a strong contribution to the upcoming US GDP calculation. Furthermore, import prices also surpassed consensus estimates, indicating potential inflationary pressures.

Consumer inflation expectations, as measured by the University of Michigan, have risen to multi-year highs. This surge, coupled with the recent pronouncements of aggressive tariff threats by the Presidential Administration, suggests a potential shift in spending patterns among households and businesses. Market participants are now closely monitoring the Federal Reserve’s upcoming decision, with expectations of unchanged interest rates. The Federal Open Market Committee’s (FOMC) Summary of Economic Projections will, nevertheless, offer clarity on how policymakers are weighing inflationary pressures against the potential for tariffs to hinder economic growth.

The Federal Reserve’s decision is anticipated to reflect the complexities of balancing strong economic data with potential inflationary risks. The market has already factored in the possibility of two additional rate cuts within the current year. The FOMC’s statements and projections will be scrutinized for indications of how they intend to navigate the current economic landscape, particularly in light of the evolving trade policies and their potential impacts on both inflation and economic growth.