Key momentsThe EUR/USD surged to a five-month high near 1.0950 before retracting. However, the euro demonstrated resilience, stabilizing above the 1.0910 level.The Euros recent gains are largely attri

EUR/USD Holds Above 1.0910 After Reaching Five-Month High EUR/USD Holds Above 1.0910 After Reaching Five-Month High

Key moments

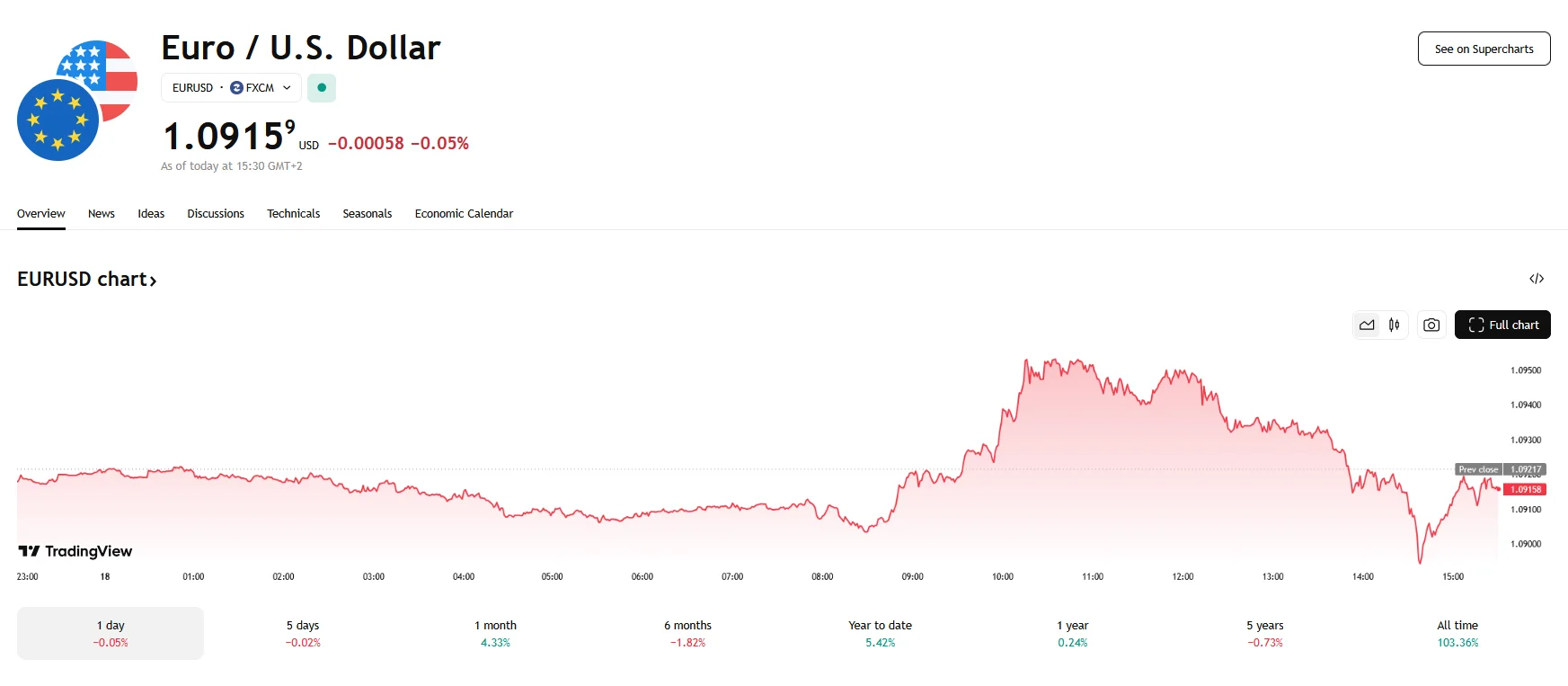

- The EUR/USD surged to a five-month high near 1.0950 before retracting. However, the euro demonstrated resilience, stabilizing above the 1.0910 level.

- The Euro’s recent gains are largely attributed to the anticipation of Germany’s potential relaxation of borrowing rules.

- The US Dollar is under pressure ahead of the Federal Reserve’s expected rate hold. President Trump’s tariff threats are causing market uncertainty, raising concerns about inflation and economic instability, thereby weakening the Dollar.

Geopolitical Factors Impact EUR/USD

The currency markets on Tuesday witnessed a fluctuating EUR/USD pair, with it reaching its five-month peak near the 1.0950 mark. After experiencing a decrease, the pair once again settled above 1.0910 as the euro regained its momentum.

A key driver of the euro’s recent strength lies in the prospect of Germany significantly relaxing its borrowing rules. The German parliament is poised to vote on a substantial fiscal stimulus package, designed to bolster infrastructure and increase defense spending. This potential shift away from the nation’s traditionally conservative fiscal stance, adopted after the 2008 financial crisis, has generated considerable optimism among market participants. The expectation is that increased government spending will stimulate economic growth and potentially lead to higher inflation within the Eurozone’s largest economy.

The German ZEW economic sentiment index further reinforced this optimism, revealing a marked improvement in investor confidence. This data, coupled with the anticipation of relaxed borrowing constraints, has fueled speculation that the European Central Bank (ECB) may reconsider its current monetary easing cycle. There’s a growing sentiment that the ECB might elect to maintain interest rates at their present level, especially given the potential for inflationary pressures stemming from both German fiscal expansion and the uncertainties surrounding U.S. trade policies.

Concurrently, the U.S. Dollar faces headwinds as the Federal Reserve prepares to announce its latest interest rate decision. The prevailing expectation is that the Fed will maintain the current interest rate range. This decision is being made amid a backdrop of uncertainty surrounding the economic policies of President Trump, particularly his stance on tariffs. The threat of reciprocal and sectoral tariffs has raised concerns about potential inflationary pressures and economic instability, leading to downward revisions of U.S. GDP growth forecasts by organizations like the OECD. The U.S. Dollar Index (DXY) has reflected this weakness, hovering near multi-month lows.

Geopolitical factors also played a role in the day’s market movements. The market is closely watching developments related to a potential ceasefire in Ukraine, with discussions between U.S. and Russian officials being closely monitored. Any signs of de-escalation in the region are generally viewed as positive for the euro.