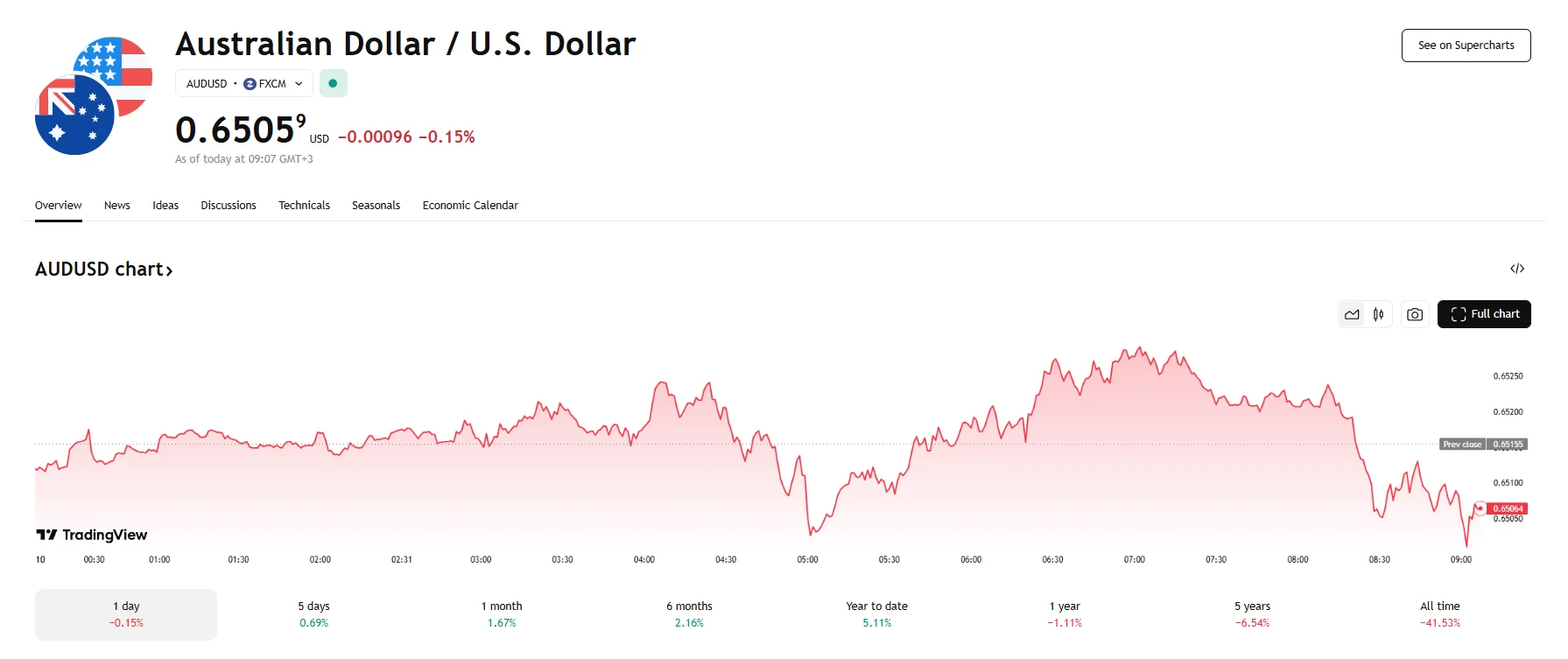

Key Moments:AUD/USD weakened 0.15% to 0.6505 ahead of Tuesday’s discussions between US and Chinese officials.Australia’s consumer confidence gained just 0.5% in June, slowing from the 2.2% increase re

AUD/USD Drops 0.15% to 0.6505 as US Trade Optimism and Inflation Outlook Boost Greenback AUD/USD Drops 0.15% to 0.6505 as US Trade Optimism and Inflation Outlook Boost Greenback

Key Moments:

- AUD/USD weakened 0.15% to 0.6505 ahead of Tuesday’s discussions between US and Chinese officials.

- Australia’s consumer confidence gained just 0.5% in June, slowing from the 2.2% increase reported in May.

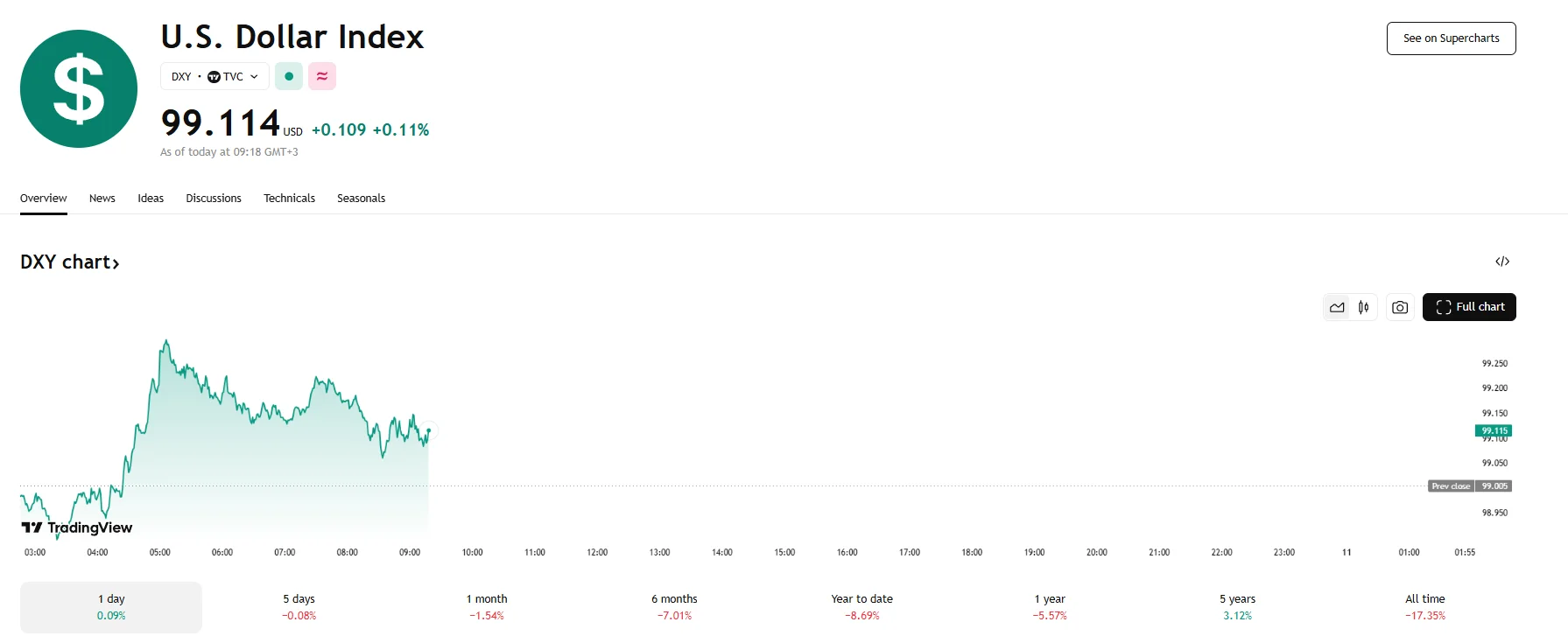

- The US Dollar Index is trading above the 99.00 mark.

Aussie Dollar Pressured by Strengthening US Currency

AUD/USD eased during Tuesday trading by sliding 0.15% and reaching 0.6505. The decline was mitigated by investor anticipation of the results of the latest round of US-China trade discussions. As both countries are Australia’s major trade partners, any de-escalation of tariff-fueled frictions can aid the Aussie dollar. The meetings commenced on Monday and are set to resume today at 10:00 am London time, with the focus being on technology goods and rare earth exports, as reported by Bloomberg.

Australian Confidence Inches Higher, Yet Trade Worries Linger

Consumer confidence in Australia, as measured by Westpac, advanced by 0.5% month-over-month this month. Despite global trade uncertainties dragging on sentiment, June marked the fourth consecutive month of improvement thanks to softening inflation and the Reserve Bank of Australia’s interest rate reduction in May and indications of softening inflation. However, it should be noted that June’s increase still marked a notable deceleration from May’s 2.2% growth.

US Data Lifts Dollar as Investors Eye Inflation Figures

Tuesday’s trading hours saw the US Dollar Index maintain a position above the 99.00 level after dropping from earlier heights near 99.300. This stability has been attributed to Washington and Beijing’s ongoing negotiations.

Investors are now focused on a series of upcoming releases that should shed more light on the States’ economic stability. US CPI inflation data, expected on Wednesday, will be of particular interest. In April, inflation stood at 2.3%, and current forecasts point to May’s CPI growth landing higher at 2.5%.