Key Moments:The Reserve Bank of India reduced its key policy repo rate by 50 basis points to 5.5%.The central bank also announced a 100-basis-point cut to the cash reserve ratio, to be implemented in

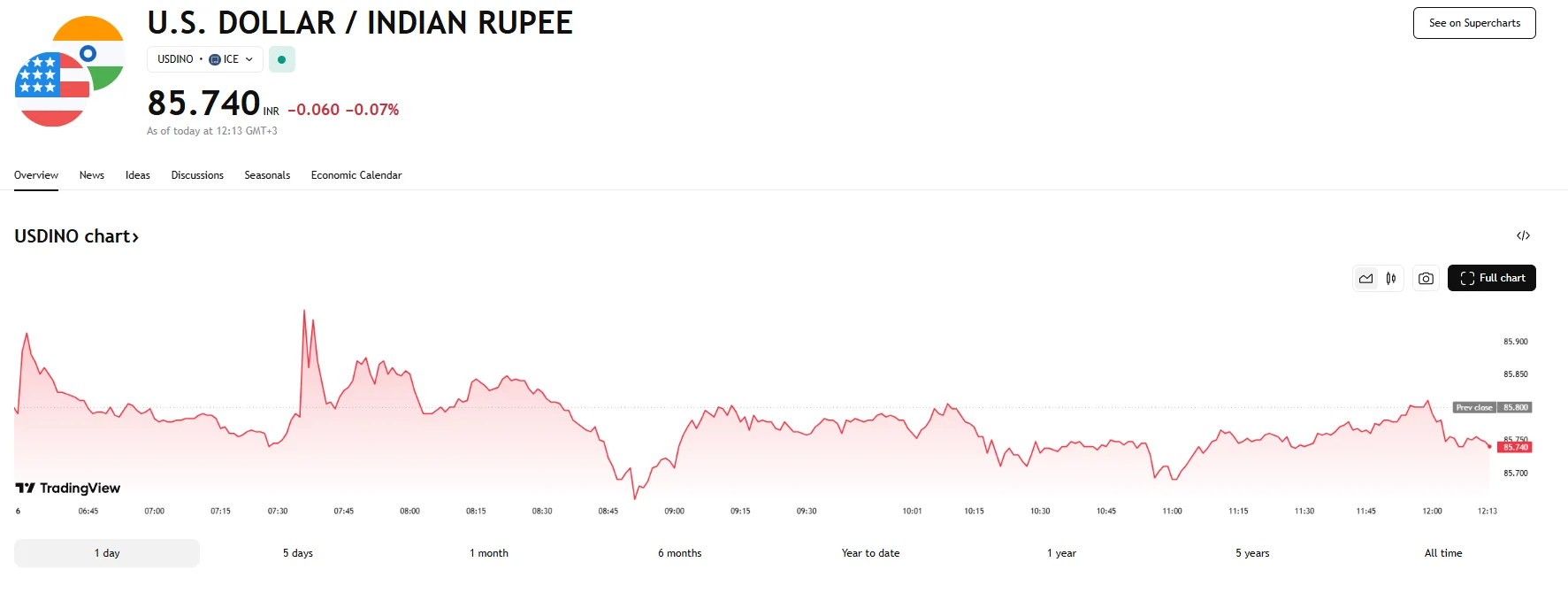

RBI Delivers 50-bps Rate Cut, USD/INR Slides to 85.740 RBI Delivers 50-bps Rate Cut, USD/INR Slides to 85.740

Key Moments:

- The Reserve Bank of India reduced its key policy repo rate by 50 basis points to 5.5%.

- The central bank also announced a 100-basis-point cut to the cash reserve ratio, to be implemented in stages until December.

- The USD/INR dropped below the 85.800 mark.

Monetary Policy Shift Comes Amid Uncertain Global Backdrop

The Reserve Bank of India (RBI) announced a larger-than-anticipated 50-basis-point cut to its benchmark repo rate on Friday, reducing it to 5.5%. This marks the third trimming of rates since the start of 2025.

Officials also slashed the banks’ cash reserve ratio by 100 basis points (3%). This change will be rolled out in four phases from September through December. The measures come as inflation expectations remained subdued at 3.7%.

The central bank also stated that its monetary stance had shifted from accommodative to neutral. During a press conference following the policy announcement, Malhotra explained that the front-loading of rate cuts was necessitated by the need for certainty amidst prevailing uncertainty. He added that the committee now sees limited room for additional stimulus, having eased rates by a total of 100 basis points over a short span.

Rupee Dips Amid Growth and Inflation Projections

Financial markets reacted sharply to the rate reduction, as India’s benchmark 10-year government bond yield initially dropped by 10 basis points before settling at 6.19%. Equity benchmarks rose approximately 0.9%, led by bank stocks. Meanwhile, the rupee fluctuated and the USD/INR fell 0.07% to 85.740.

India’s Q1 GDP expanded by 7.4%, and the central bank maintains its projection of 6.5% growth for the fiscal year. Malhotra signaled aspirations for even stronger growth, saying that Friday’s policy decisions were designed to push growth onto a more ambitious path, targeting expansion in the 7% to 8% range.

The RBI now sees inflation averaging 3.7% for the year, down from its earlier estimate of 4%. Inflation fell to 3.16% in April, almost hitting a low unseen in six years. The MPC noted that price levels are trending lower across key sectors and indicated inflation could fall slightly below target.