Key Moments:Japan’s real wages dropped 2.3% year-over-year in April, extending their decline to a fourth consecutive month.GBP/JPY advanced by 0.5% and breached 194.00 on Thursday.UK exporters receive

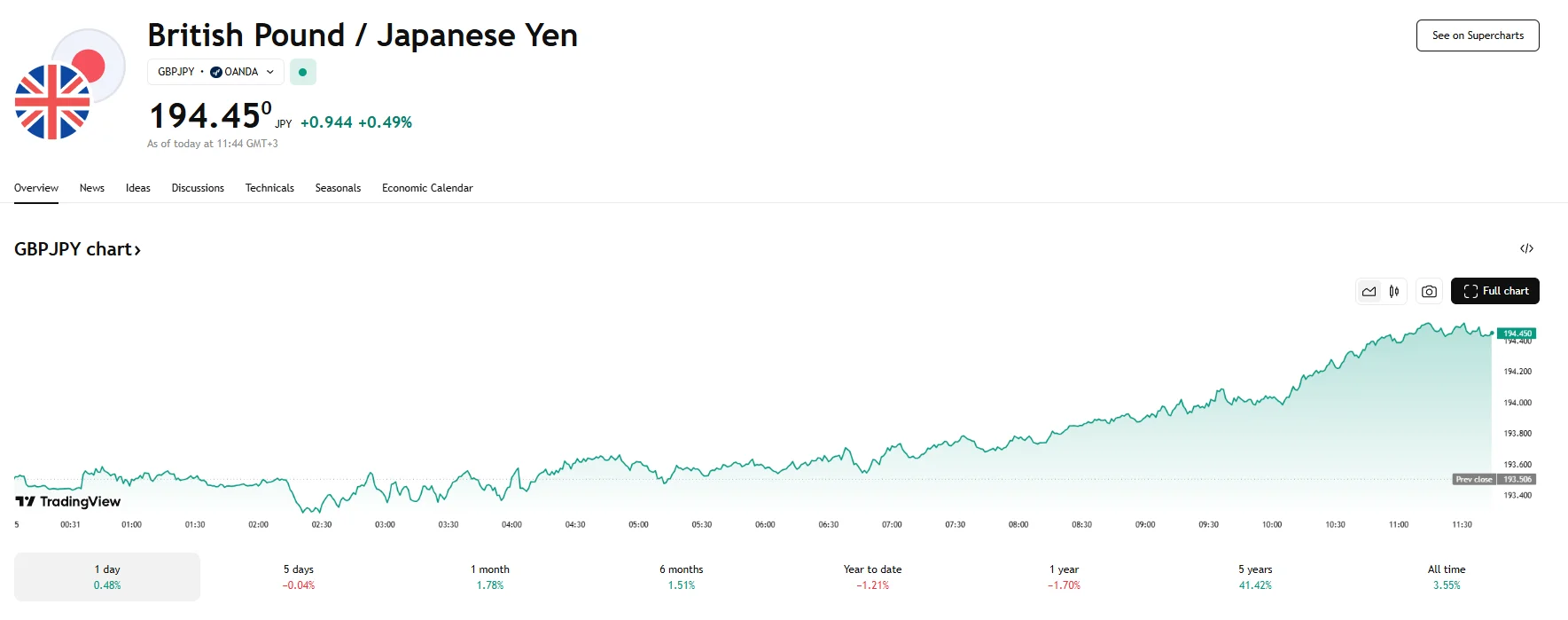

UK Exporters Enjoy Tariff Relief, GBP/JPY Climbs 0.5% to 194.45 as Weak Japanese Wage Data Pressures Yen UK Exporters Enjoy Tariff Relief, GBP/JPY Climbs 0.5% to 194.45 as Weak Japanese Wage Data Pressures Yen

Key Moments:

- Japan’s real wages dropped 2.3% year-over-year in April, extending their decline to a fourth consecutive month.

- GBP/JPY advanced by 0.5% and breached 194.00 on Thursday.

- UK exporters received a temporary exemption from the latest 25% hike to steel and aluminum tariffs.

Japanese Real Wages Disappoint as US Excludes UK From Recent Tariff

The Japanese yen weakened on Thursday as fresh labor market data showed real wages fell by 2.3% year-over-year in April, marking the fourth straight month of declines. While nominal wages rose 2.3% over the same period, the increase fell short of market expectations for a 2.6% gain, fueling concerns about the pace of wage growth amid ongoing inflationary pressures.

The wage data’s publication followed news that UK exporters have received a temporary reprieve from steep tariff hikes. Namely, UK steel and aluminum manufacturers will not be affected by the Trump administration’s recent tariff hike to 50%. Instead, they will only be subject to the already existing 25% duty.

GBP/JPY Rebounds

This underwhelming labor data further complicated the Bank of Japan’s policy trajectory. Investors have grown wary as inflation continues to exceed wage gains, casting doubt on the central bank’s ability to normalize policy in the near term. The soft wage figures also contributed to increased selling pressure on the yen in the currency markets.

As a result, the GBP/JPY soared by 0.5% on Thursday and managed to climb above the 190.40 mark. The surge toward 195.00 served as a rebound from earlier losses.

Further aiding the GBP was economic data from the United Kingdom. According to the latest figures published by S&P Global, the UK’s Composite Purchasing Managers’ Index rose to 50.3 last month, higher than the estimated 49.4. The PMI was also higher than April’s 48.5. Of particular note was the Services PMI, which ticked higher to 50.9.