Key Moments:April retail sales in the UK rose by 1.2%, exceeding forecasts of 0.3%.Ofgem is reducing the UK’s energy price cap by 7%.The sterling experienced a notable climb of 0.53% to 1.3489 on Frid

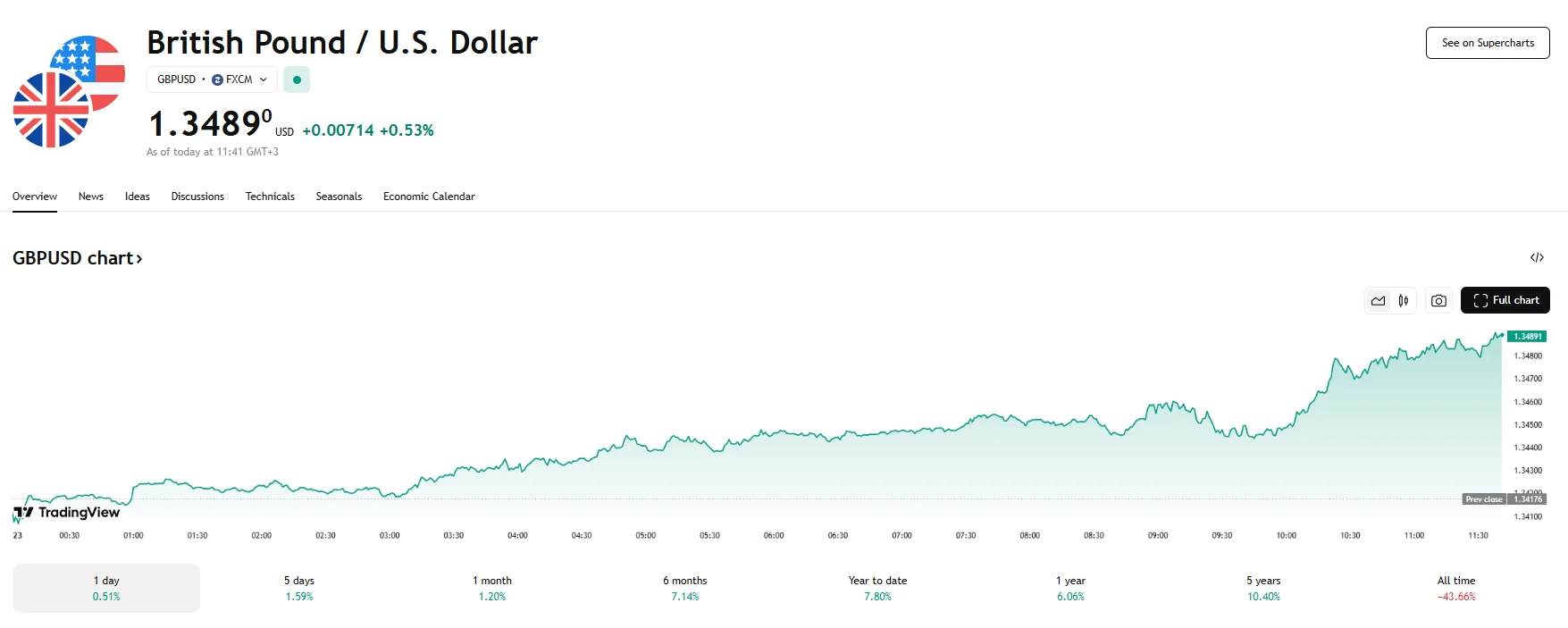

GBP/USD Hits 3-Year High of 1.3489, Energy Relief and 1.2% Retail Sales Surge Boost Sentiment GBP/USD Hits 3-Year High of 1.3489, Energy Relief and 1.2% Retail Sales Surge Boost Sentiment

Key Moments:

- April retail sales in the UK rose by 1.2%, exceeding forecasts of 0.3%.

- Ofgem is reducing the UK’s energy price cap by 7%.

- The sterling experienced a notable climb of 0.53% to 1.3489 on Friday

GBP/USD Breaches 1.3480

The sterling managed to reach its highest valuation in several years on Friday, with the GBP/USD soaring 0.53% to reach 1.3489. The surge followed a stronger-than-anticipated increase in retail sales, as well as improving consumer sentiment and renewed relief among UK households over an upcoming decrease in energy prices.

Retail Momentum Persists

As revealed by the Office for National Statistics (ONS) on Friday, retail sales volumes increased by 1.2% in April compared to March, beating economists’ forecasts of a 0.3% gain. This represents the fourth consecutive monthly rise, the first of its kind in around five years.

Over the quarter that ended in April, sales volumes climbed 1.8% from the previous three-month period. According to the ONS, this marked the sharpest jump since July 2021.

Food store sales saw a notable rebound, climbing 3.9% after consecutive declines in the preceding two months. However, clothing and footwear sales declined over the month despite gains in department stores, household goods outlets, and non-store retailers.

Household Confidence on the Rise

Consumer sentiment improved in May, driven by optimism around personal finances and an increased readiness to make larger purchases. Positive momentum was also supported by the United States’ decision to ease some of the import tariffs targeting UK exports to the US, alongside the recent slash of interest rates by the Bank of England.

Ofgem further relieved pressure on consumers by imposing a 7% decrease on the country’s energy price cap. Effective July, this cut follows a series of prior hikes.

Inflation and Policy Outlook

Despite the uplifting data, inflation remains a concern. Consumer prices rose 3.5% in April, higher than what market analysts had been anticipating. This tempered expectations of aggressive policy easing, though the probability of a cut in August still stands at around 50%, according to analysts.