Key Moments:BlackRock’s IBIT ETF reached $64.697 billion in assets on Thursday.The fund surpassed Strategy’s $59.146 billion gold ETF, signaling shifting institutional prioritiesBitcoin’s price apprec

BTC Recovers to $104,006, BlackRock’s Bitcoin ETF Hits $64.697B Milestone BTC Recovers to $104,006, BlackRock’s Bitcoin ETF Hits $64.697B Milestone

Key Moments:

- BlackRock’s IBIT ETF reached $64.697 billion in assets on Thursday.

- The fund surpassed Strategy’s $59.146 billion gold ETF, signaling shifting institutional priorities

- Bitcoin’s price appreciated on Friday, reaching $104,006.

Momentum in Crypto Markets

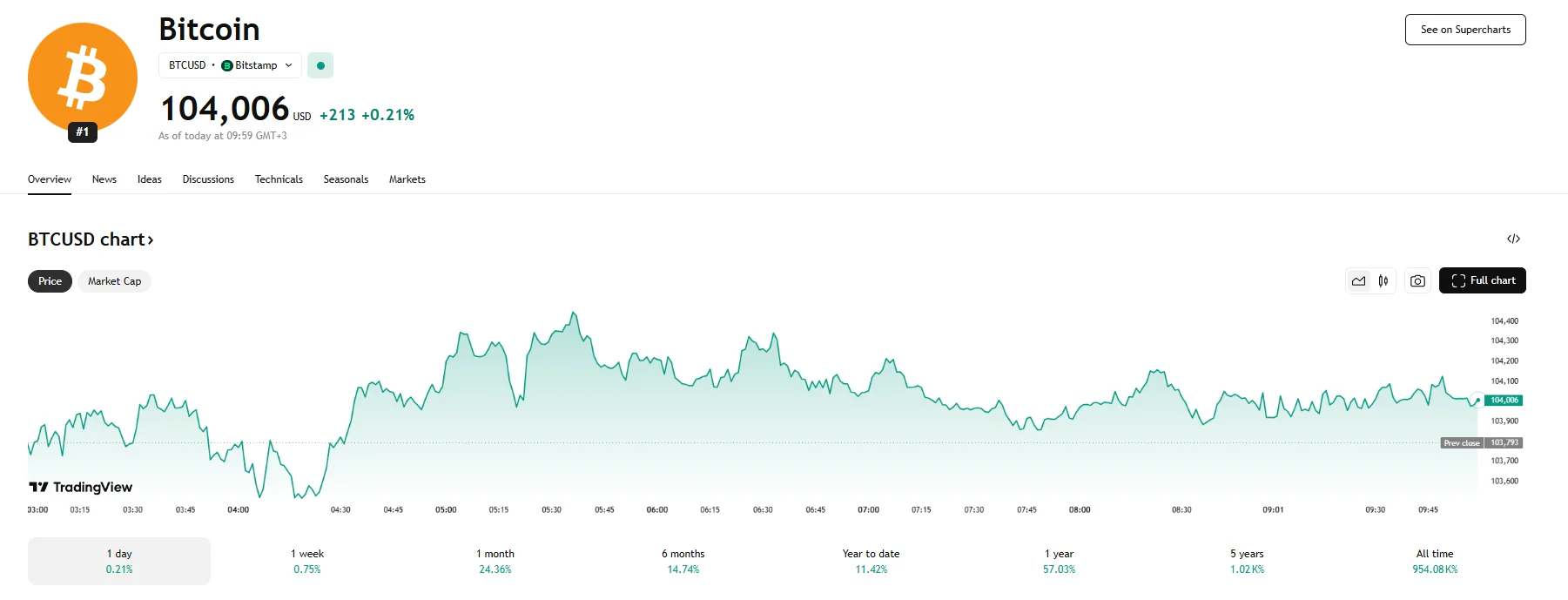

Friday saw Bitcoin regain momentum after recent depreciation, with the cryptocurrency’s price climbing 0.21% to $104,006. This surge of interest occurred following the release of US PPI and CPI data that, according to market participants, proved to further increase the chances of a Fed rate cut occurring in the near future. It also coincided with a PANews report regarding how the Bitcoin holdings of BlackRock’s iShares Bitcoin Trust ETF rose to $64.697 billion, eclipsing the $59.146 billion recorded by Strategy’s ETF. This development underscores increasing institutional investor preference for Bitcoin as a digital store of value versus traditional safe havens.

IBIT has experienced steady capital inflows recently, amassing $6.96 billion in net new investments since the beginning of the year. Major players such as Goldman Sachs boosted their stake in the fund by 28% during the first quarter, indicating elevated confidence in the long-term prospects of Bitcoin.

BlackRock’s Competitive Edge

Bloomberg’s Eric Balchunas pointed to IBIT’s 0.25% expense ratio and strong brand presence as key factors driving fund inflows. He further highlighted the stark disparity between IBIT’s inflows and those of its competitors, stating that IBIT was attracting considerably more capital than the others, while typically “there’s much more parity.” He proposed his theory that this could be attributed to the return of the hedge fund basis trade, along with substantial investors taking positions following the decoupling and the subsequent price increase.

Analysts at Coincu believe that IBIT’s momentum not only reinforces investor confidence in Bitcoin but could also accelerate broader cryptocurrency adoption. With ongoing regulatory adjustments concerning digital assets, these structural shifts are poised to impact both financial markets and innovation strategies. According to the Coincu research team, BlackRock’s dominant position may act as a catalyst in shaping the next phase of crypto-enabled financial ecosystems.