Key Moments:The EUR/USD pair dropped by 1.34% to 1.1095 on Monday.US and China agreed to a 115% reduction in tariffs for 90 days, bolstering the greenback.Additional rate cuts not recommended, accord

EUR/USD Down 1.34% as Tariff Relief Fuels Greenback, US Dollar Index Breaches 101.700 EUR/USD Down 1.34% as Tariff Relief Fuels Greenback, US Dollar Index Breaches 101.700

Key Moments:

- The EUR/USD pair dropped by 1.34% to 1.1095 on Monday.

- US and China agreed to a 115% reduction in tariffs for 90 days, bolstering the greenback.

- Additional rate cuts not recommended, according to the ECB’s Isabel Schnabel.

Euro Slips Sharply Amid US Dollar Surge

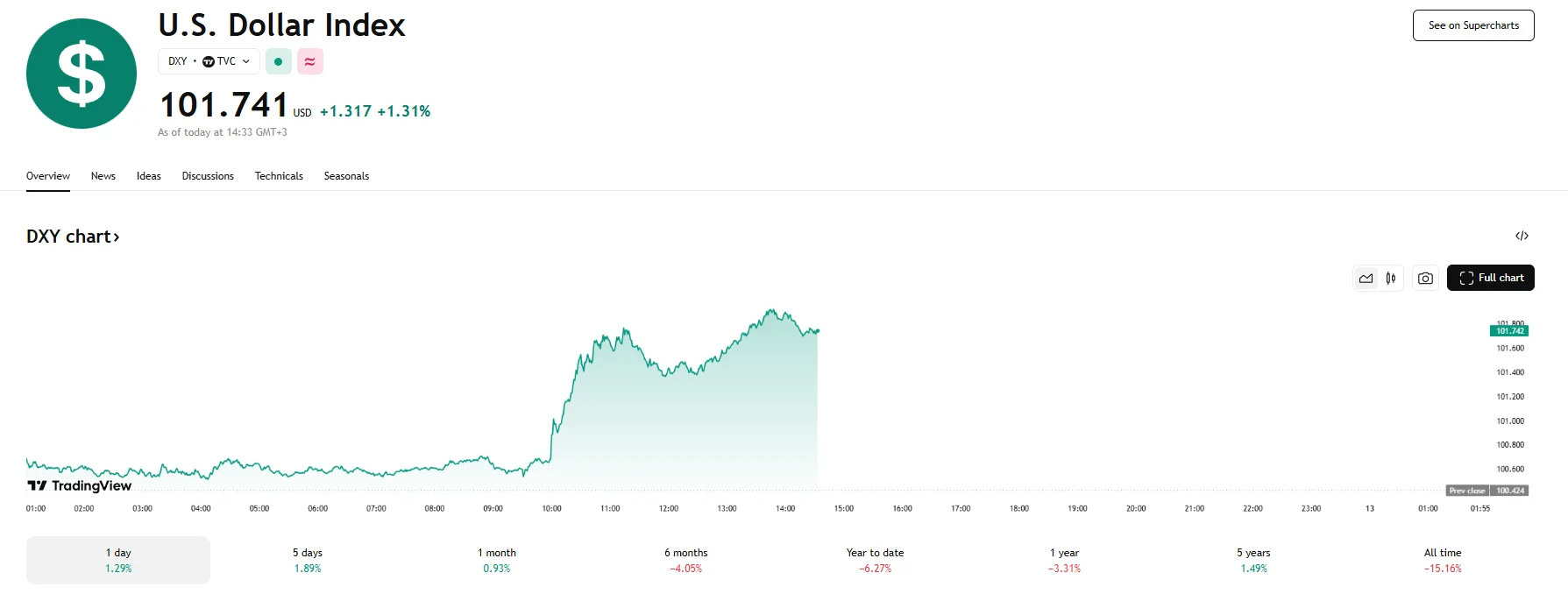

The EUR/USD currency pair dropped significantly on Monday, falling beneath the 1.1100 as A sharp rally in the US dollar followed news that the United States and China have agreed to implement a 115% tariff reduction for a period of 90 days. This move appears to be alleviating concerns around inflation and trade uncertainty, enabling the US Dollar Index (DXY) to surge above the 101.700 mark, reflecting the currency’s strengthened performance against a basket of six major currencies.

Tariff rates now stand at 10% for US goods and 30% for Chinese goods, with the latter including a 20% fentanyl-related duty. According to US Trade Representative Jamieson Greer, constructive discussions regarding the issue of fentanyl are underway. Markets are now watching for upcoming comments from Federal Reserve officials, which could shed light on potential changes to policy in response to the temporary easing of trade tensions. A reduction in inflation expectations could influence the Fed’s stance on interest rates going forward after its recent decision to keep them unchanged.

On the European side, mixed views within the European Central Bank (ECB) continue to shape monetary policy forecasts. Prospects of continued monetary easing by the ECB may curb upside potential for the euro, but while some officials support further cuts, ECB board member Isabel Schnabel took a more neutral stance during a Friday conference held at Stanford University. She argued that the most suitable approach was to maintain interest rates at levels similar to the present.