Key Moments:EUR/USD reached 1.1355 on Monday as renewed selling pressure pushed the US Dollar downwards.The US Dollar Index fell 0.52% to 99.518.Traders continued to anticipate further ECB rate cuts,

Euro Gains 0.51% Against Greenback Ahead of Fed Decision Euro Gains 0.51% Against Greenback Ahead of Fed Decision

Key Moments:

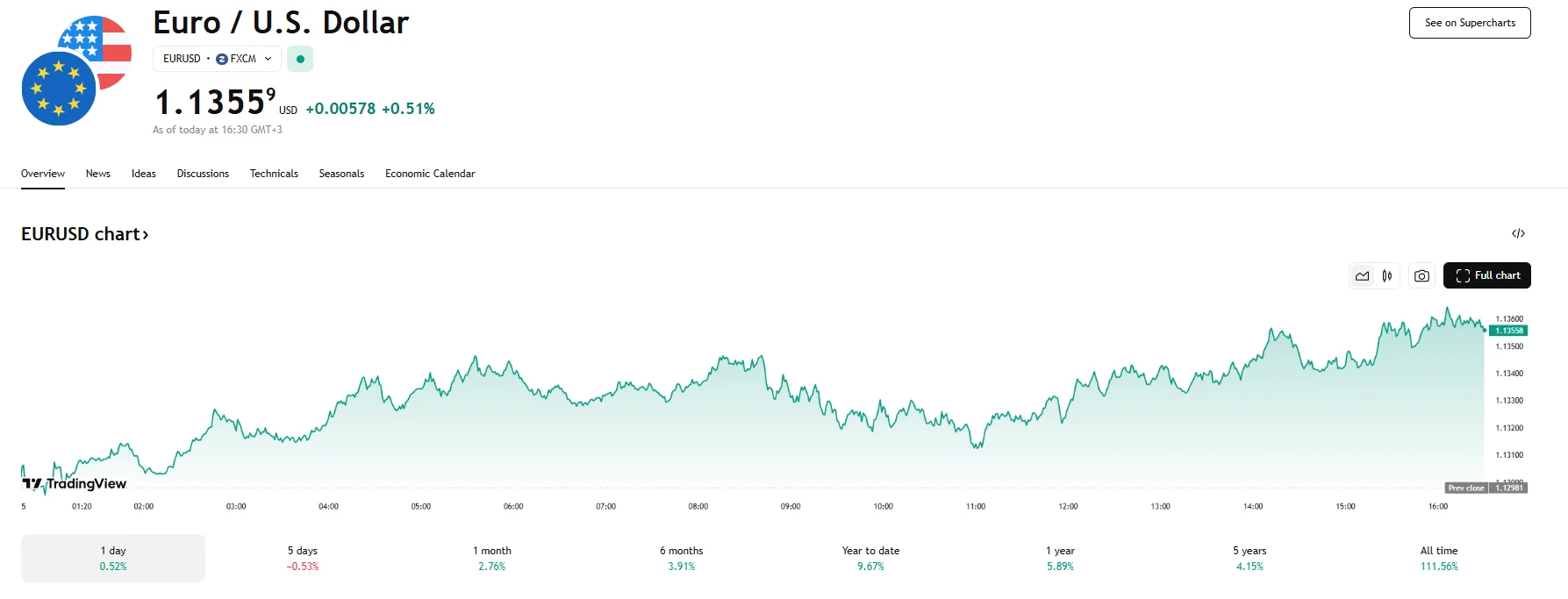

- EUR/USD reached 1.1355 on Monday as renewed selling pressure pushed the US Dollar downwards.

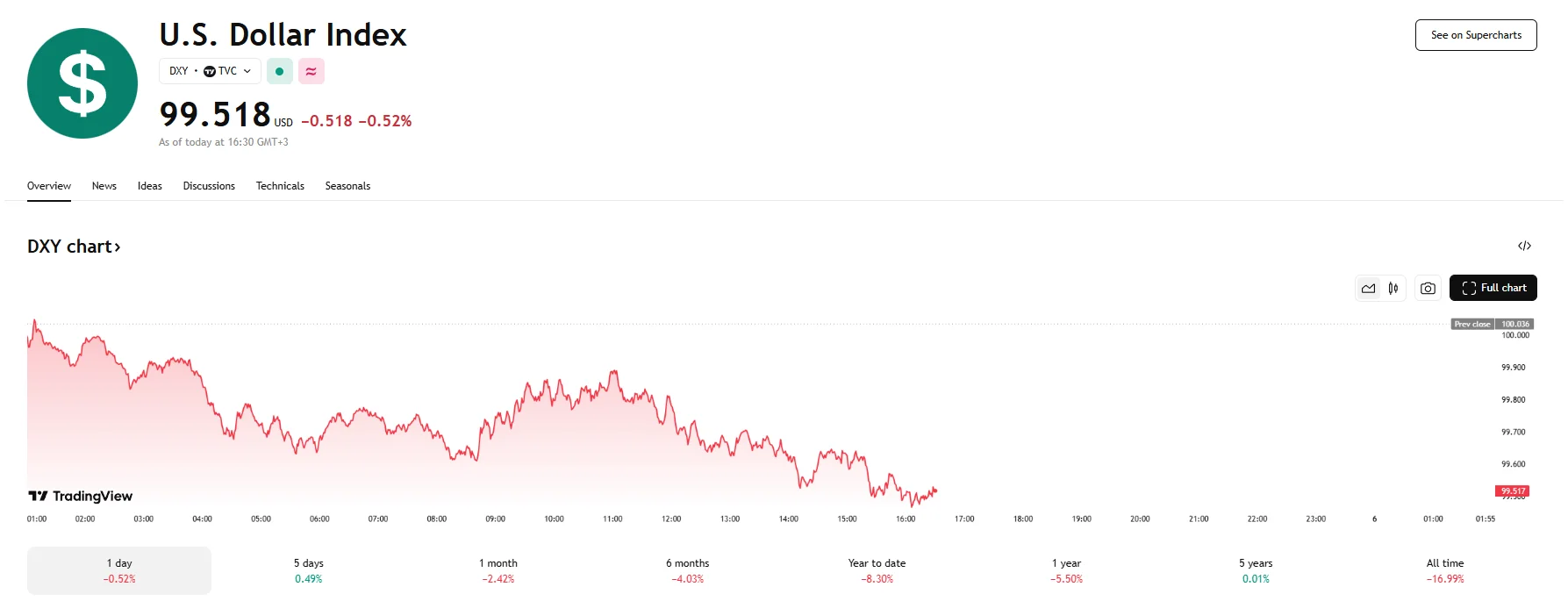

- The US Dollar Index fell 0.52% to 99.518.

- Traders continued to anticipate further ECB rate cuts, while expectations surrounding a potential rate decrease by the Federal Reserve remained low.

Euro Climbs as Dollar Slips on Trade Concerns and Fed Uncertainty

The EUR/USD pair edged higher Monday, building momentum after rebounding from last week’s low of 1.1265. The 0.51% uptick to 1.1355 came as weakness in the US Dollar persisted, driven by ongoing tensions between the Trump administration and Beijing.

President Donald Trump recently stated that he was hopeful about announcing new trade deals in the coming days. While some market participants were also reassured by his not ruling out talks with Chinese officials, concerns persisted, as he stated that no direct discussions with Chinese President Xi Jinping had taken place.

We should also note that the US Dollar Index declined to around 99.50 on Monday. This movement marked its latest downward slope and underscored the greenback’s struggle to reclaim the 100 mark.

Interest Rate Policies in Focus

Investor attention is now firmly on the Federal Reserve’s monetary policy meeting. At present, market participants expect the Wednesday meeting to conclude with the central bank leaving its benchmark interest rates within the 4.25%-4.50% thresholds. Monetary policy is likely to be affected by April’s stronger-than-anticipated Nonfarm Payrolls.

Across the Atlantic, sentiment surrounding the European Central Bank (ECB) remained dovish. Markets continued to anticipate another rate cut at June’s meeting, despite April’s Harmonized Index of Consumer Prices (HICP) showing stronger-than-expected gains. The core HICP rose 2.7% year-on-year, exceeding estimates of 2.5%. Headline inflation also came in higher, beating expectations by reaching 2.2%.