Key Moments:The Eurozone’s manufacturing output sub-index climbed to 51.5 in April, a figure unseen since March 2022.The HCOB Eurozone manufacturing PMI surpassed March’s 48.6 by hitting 49. New order

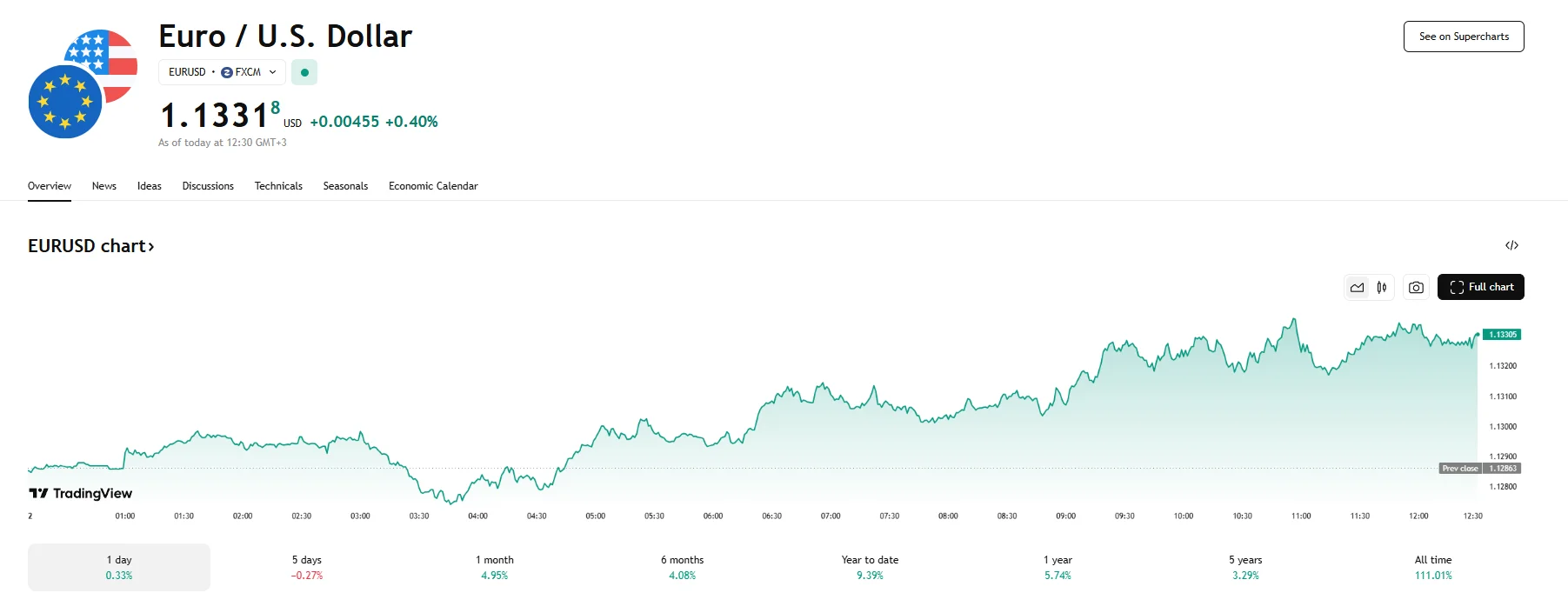

EUR/USD Up 0.4% as Eurozone Manufacturing PMI Reaches 49 EUR/USD Up 0.4% as Eurozone Manufacturing PMI Reaches 49

Key Moments:

- The Eurozone’s manufacturing output sub-index climbed to 51.5 in April, a figure unseen since March 2022.

- The HCOB Eurozone manufacturing PMI surpassed March’s 48.6 by hitting 49. New orders showed the smallest decline in three years, with the sub-index reaching 49.5.

- The news aided the euro, allowing it to appreciate 0.4% against the greenback.

Output Growth Strengthens Despite Ongoing Industry Contraction

Manufacturing activity in the Eurozone continued to show early signs of recovery in April, with production increasing at the fastest pace in around three years even as overall industry metrics remained in contraction territory. Following the data’s publication, the EUR/USD rose by 0.4%, reaching 1.331.

According to S&P Global and the Hamburg Commercial Bank, the final Eurozone manufacturing Purchasing Managers’ Index (PMI) reached 49 last month. This marks an increase from the 48.6 reported in the previous month, and the figure was the highest reported since March 2022. However, it still fell short of the 50-point threshold that, if hit, would have signaled growth.

Broad-Based Output Expansion Ignites Hopeful Sentiment

The manufacturing output sub-index rose by 1 point to 51.5 in April, extending the growth observed over the past several months. However, this recovery comes amid subdued demand conditions, as new orders continued to contract, albeit at their slowest pace in three years. The new orders sub-index improved to 49.5, signaling a near return to stability.

Hamburg Commercial Bank’s chief economist, Cyrus de la Rubia, commented that the fourth consecutive rise in the HCOB PMI could be interpreted as an indication that the manufacturing sector’s condition was finding stability. He further noted the unexpected nature of this development, considering the numerous uncertainties and disruptive events of the preceding months.

Mixed Country-Level Performance

Among individual Eurozone nations, Greece emerged as the leading with a PMI of 53.2, as highlighted by de la Rubia. Ireland, meanwhile, ranked second as its PMI hit 53.

At the other end of the spectrum, Austria posted a reading of 46.6. Germany rose slightly from the previous month’s 48.3, reaching 48.4. France’s figures were also muted, as its PMI gained by 0.2 points to 48.7. In contrast, Italy jumped from 46.6 to 49.3.

| Country | Manufacturing PMI (April) |

|---|---|

| Greece | 53.2 |

| Ireland | 53 |

| Italy | 49.3 |

| France | 48.7 |

| Germany | 48.4 |

| Austria | 46.6 |

De la Rubia commented the following: “The near stabilisation of the industrial economy was helped by a production pick-up in both Germany and France in April, and Italy is fighting its way back into expansion territory.”

Other figures painted a mixed picture. Foreign demand remained muted, with export orders declining more sharply than total new business. Meanwhile, the sector saw its 23rd straight month of job losses.

Profit margins expanded when it came to manufacturing, aided by lower input costs and higher output prices, the latter accelerating at a rate not seen since 2023. However, business confidence plummeted.