Key momentsBitcoin fell today, with its price reaching $92,650.Earlier, BTC briefly slipped below $92,000.The drop followed Wednesday’s $916.91 million in net inflows that bolstered US Bitcoin ETFs.Bi

Bitcoin Tumbles to $92,650 Despite ETF Inflows of $916.91M Bitcoin Tumbles to $92,650 Despite ETF Inflows of $916.91M

Key moments

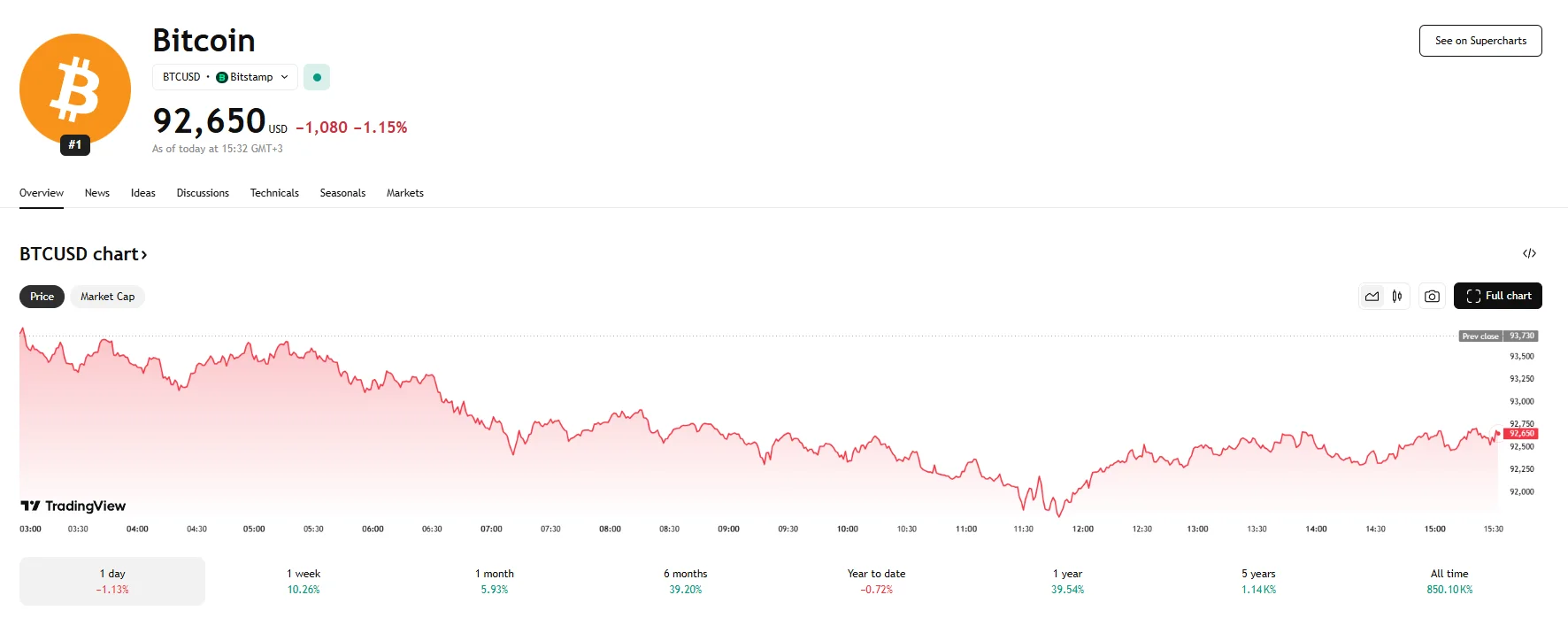

- Bitcoin fell today, with its price reaching $92,650.

- Earlier, BTC briefly slipped below $92,000.

- The drop followed Wednesday’s $916.91 million in net inflows that bolstered US Bitcoin ETFs.

Bitcoin Price Bucks High ETF Demand

Bitcoin retreated from recent highs on Thursday, with its value decreasing 1.15% to $92,650. Earlier in the day, the price even briefly dipped below the $92,000 mark. This decline in Bitcoin’s price mirrored a broader downturn across the crypto market. The total market capitalization of all cryptocurrencies collectively decreased by 1.5% to reach $2.89 trillion.

One likely element is profit-taking by existing holders. After a period of upward price movement, some investors may choose to sell a portion of their holdings to realize gains, increasing selling pressure on exchanges. Data indicating a net inflow of Bitcoin onto exchanges supports this idea, suggesting that some holders are moving assets to platforms where they can be sold.

Furthermore, while a general “risk-on” sentiment was noted in broader financial markets, influenced by developments such as a seemingly softer stance from the US administration on the Federal Reserve and trade tensions, this positive macroeconomic backdrop did not entirely insulate Bitcoin from a short-term correction. The crypto market, despite its growing maturity, can still be subject to its own internal dynamics, including cycles of accumulation and distribution.

Bitcoin’s price depreciation on Thursday served to contrast a notable trend of substantial inflows into US-based spot BTC Exchange-Traded Funds (ETFs) in the preceding days. According to Sosovalue data, these investment vehicles saw significant net inflows totaling $916.91 million on Wednesday alone. This marked a continuation of strong demand from institutional investors, which had fueled positive flows into Bitcoin ETFs for three consecutive days leading up to Thursday’s price dip.

The disconnect between strong institutional inflows via ETFs and a falling spot price on a given day can sometimes occur due to the complex nature of market dynamics. This may include timing differences between institutional purchasing and individual investor actions, as well as broader market sentiment shifts that might trigger profit-taking across different investor groups.