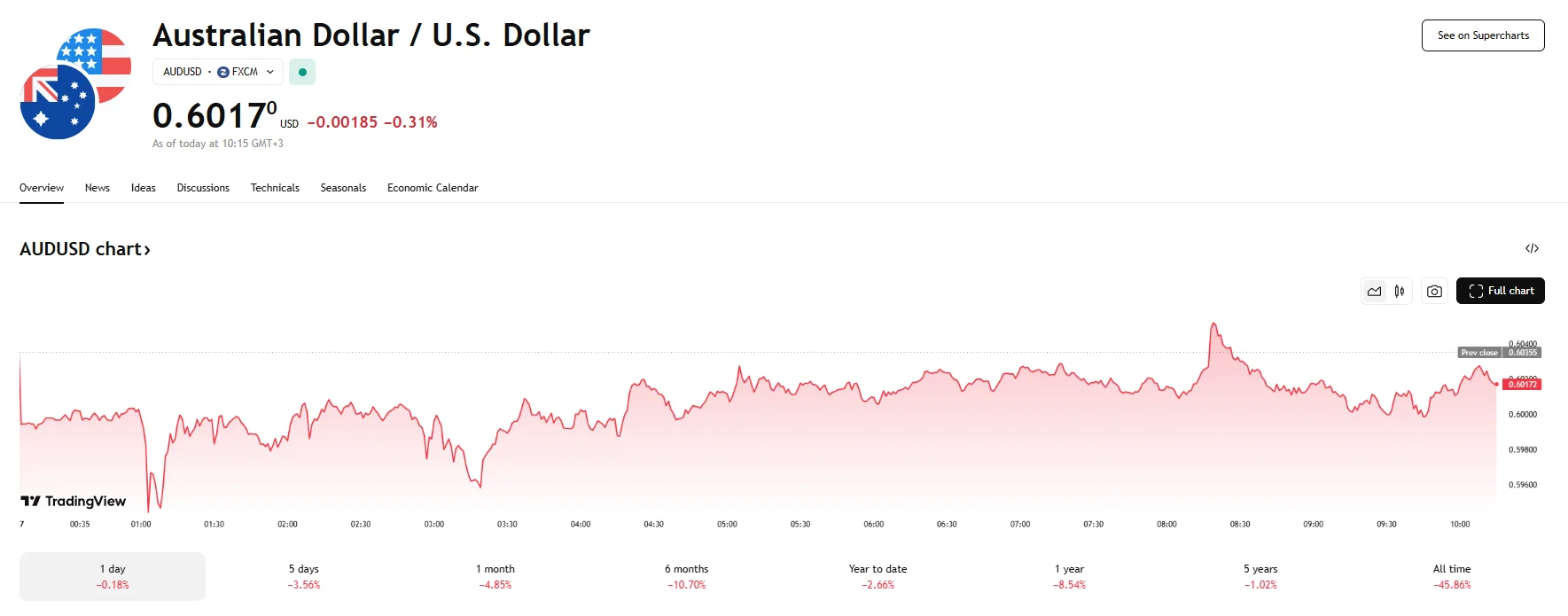

Key momentsThe AUD/USD pair sank to the 0.6017 mark.Monday’s trading session also saw the Aussie tumble below 0.6000 at one point.Growing apprehension regarding the increasing likelihood of a global t

AUD/USD Extends Losses, Slips to 0.6017 AUD/USD Extends Losses, Slips to 0.6017

Key moments

- The AUD/USD pair sank to the 0.6017 mark.

- Monday’s trading session also saw the Aussie tumble below 0.6000 at one point.

- Growing apprehension regarding the increasing likelihood of a global trade conflict weighs on the Aussie.

AUD Loses Ground on Tariff Anxiety

Monday saw the Australian Dollar’s exchange rate against the USD weaken considerably. The AUD/USD fell to 0.6017 during the trading session, experiencing a further 0.31% drop for a currency pairing that had already been demonstrating signs of fragility. Earlier in the day, the Aussie had breached the psychologically significant 0.6000 level, briefly touching a low of around 0.5940, a value depreciation not witnessed since the height of the COVID-19 pandemic.

This pronounced weakening of the Australian Dollar can be attributed to escalating anxieties surrounding the potential for a full-blown global trade war. These fears were ignited by recent trade policy announcements, most notably the United States’ decision to impose widespread tariffs targeting China and other key economic partners.

Concerns regarding the health and stability of the Chinese economy are playing a substantial role in the AUD’s decline. Given the robust trade relationship between Australia and China, the Aussie Dollar is often viewed by market participants as a proxy for Chinese economic sentiment. The imposition of a substantial 34% levy by China on all goods originating from the United States, which, when combined with earlier duties resulted in a total tariff of 54%, has amplified worries about the economic repercussions for both nations and their trading partners. In addition, the forceful nature of China’s response to the US trade actions is also thought to have heightened the perceived risk of a protracted and damaging trade conflict between the world’s two largest economies.

Furthermore, domestic factors within Australia are also contributing to the currency’s struggles. Although the Reserve Bank of Australia (RBA) opted to maintain current interest rates, its decision was accompanied by acknowledgments of prevailing global risks. The central bank indicated it would be closely monitoring incoming economic data to ascertain if inflation would sustainably remain within its target band of 2-3%. Lingering concerns about a robust labor market potentially fueling inflationary pressures also add a layer of complexity to the outlook for the Australian Dollar.