Key momentsThe EUR/USD’s momentum slowed on Friday, with the pair falling 0.45% to 1.1001.The US Dollar Index, on the other hand, is now back to levels of over 102.According to recent data, the ISM Se

ISM Services PMI Dips to 50.8, EUR/USD Down 0.45% as Dollar Index Climbs Above 102 ISM Services PMI Dips to 50.8, EUR/USD Down 0.45% as Dollar Index Climbs Above 102

Key moments

- The EUR/USD’s momentum slowed on Friday, with the pair falling 0.45% to 1.1001.

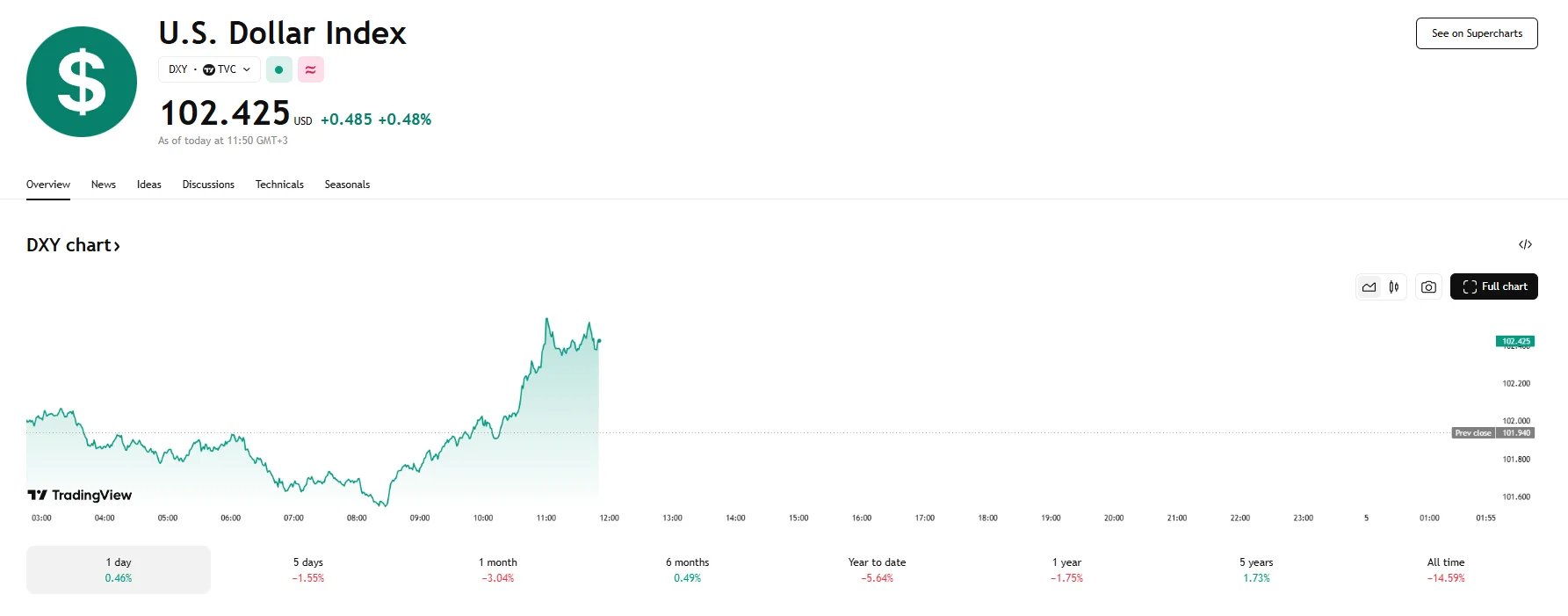

- The US Dollar Index, on the other hand, is now back to levels of over 102.

- According to recent data, the ISM Services PMI fell to 50.8 in March.

EUR/USD Drops Amid Dollar Index Recovery

Friday saw the EUR/USD pair experience a slight downturn, registering a 0.45% decrease and fluctuating around the 1.1000 mark. This movement occurred against a backdrop of a recovering US Dollar Index, which achieved a rebound.

Despite this daily dip, a report by the UOB’s Global Economics & Markets Research indicates that the EUR/USD is still on track for a weekly gain. Analyst Quek Ser Luang highlighted that the weekly close above the Ichimoku cloud would signal continued strength for the currency pair in the coming months.

As for the US Dollar Index, it faced significant pressure on Thursday and Friday, at some point falling below 101.600 during Friday’s trading session. This weakness was attributed to the market’s reaction to recent macroeconomic data and escalating trade tensions following President Trump’s latest tariff policies, which included a base tariff of 10% along with additional tariffs on goods from China, Japan, and select other countries.

Adding to the dollar’s woes was the release of the ISM Services PMI for March, which failed to meet market expectations and fell to 50.8, 2.2 below the forecasted 53.0. Other data in the report revealed a concerning contraction in the services sector’s labor market, with the employment index falling by 7.7 to hit 46.2. Although inflation pressures showed some signs of easing, the ISM Prices Paid Index declined to 60.9.

Friday did witness a degree of market adjustment, however. The US Dollar Index managed to stage a recovery of over 0.40%, which allowed it to breach the 102 threshold again and even reach figures higher than 102.400.