Key momentsMonday saw the EUR/USD pair reaching 1.0844The Dollar Index fell 0.17%, dropping under 104.Heightened market unease concerning upcoming trade policies has affected the performance of the U.

EUR/USD Climbs 0.30%, Dollar Index Dips Under 104 EUR/USD Climbs 0.30%, Dollar Index Dips Under 104

Key moments

- Monday saw the EUR/USD pair reaching 1.0844

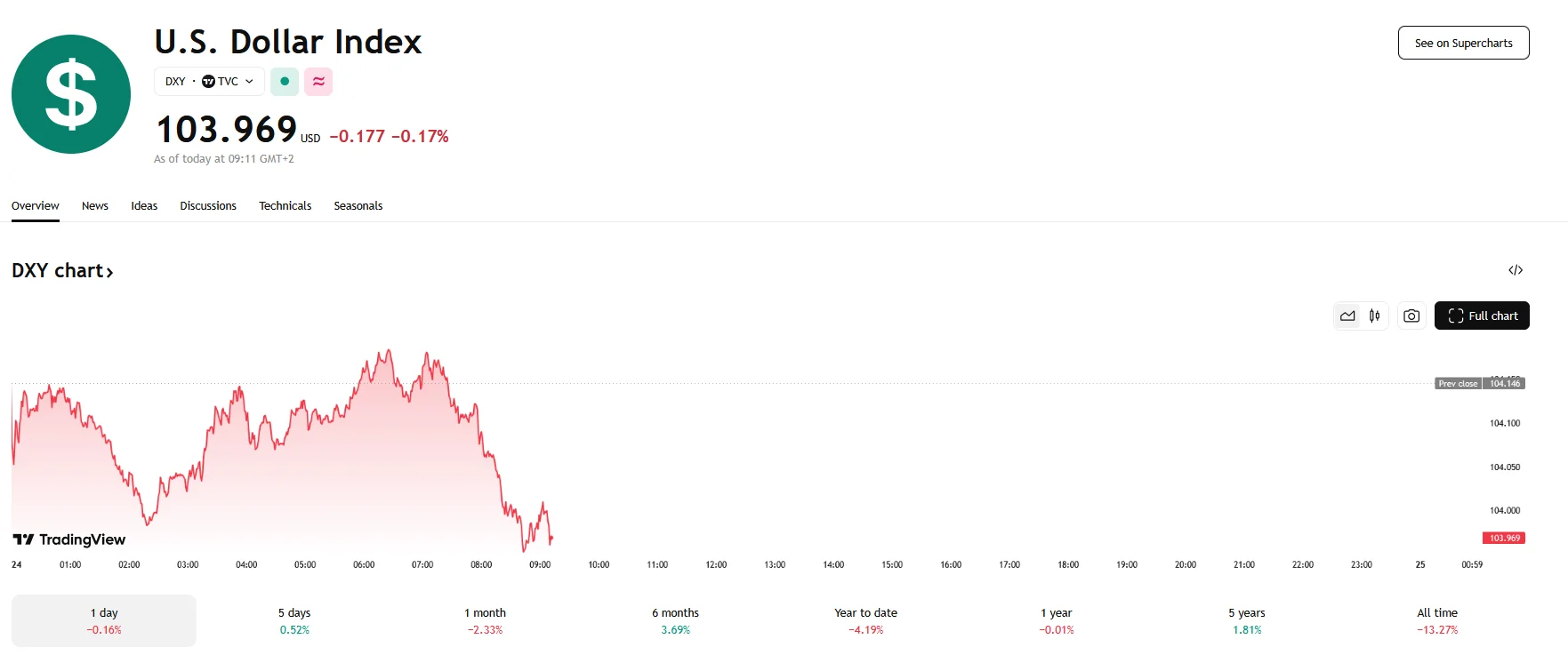

- The Dollar Index fell 0.17%, dropping under 104.

- Heightened market unease concerning upcoming trade policies has affected the performance of the U.S. dollar.

USD Under Pressure, Struggles Against Euro as Dollar Index Drops 0.17%

The foreign exchange market witnessed notable shifts on Monday as the Euro climbed against the U.S. dollar. The EUR/USD pair registered a 0.30% increase to a level of 1.0844. Simultaneously, the Dollar Index, a metric focusing on the dollar’s value against other major currencies, retreated below the 104 threshold, reaching 103.969 after a 0.17% decrease.

These movements occurred amidst increasing anxiety stemming from impending trade measures slated to commence on April 2nd. Concerns related to the potential economic implications of these actions are influencing investor sentiment. The euro’s ascent followed three successive sessions of downward pressure.

Market participants are keenly anticipating the release of the preliminary March Purchasing Managers Index (PMI) data. These metrics, encompassing data from the Eurozone, Germany, and the United States, are anticipated to provide crucial insights into the health of these economies.

Analyzing the EUR/USD’s technical configuration, a bullish bias is indicated, as the pair maintains a position above a key moving average. The relative strength indicator, positioned above the neutral line, reinforces this view, showing bullish momentum. Furthermore, a resistance level is pinpointed at approximately 1.0955. On the opposing side, a support level exists near 1.0775, and a breach beneath that could lead to further depreciation.

In the broader context, the dollar’s performance is being scrutinized as past optimism regarding growth-oriented policies has given way to apprehensions regarding the potential for an economic slowdown in the U.S. The prospect of counter-tariffs has further increased market sensitivity to the potential economic effects of trade tensions.

Analysts have altered their projections to reflect these shifting market realities. In a research note, Goldman Sachs analysts stated they anticipated the dollar to recover to a certain extent from the current levels despite last week’s downgraded dollar forecasts. They added that their economists downgraded U.S. growth evaluation due to expectations that tariffs would rise to a greater extent.