Key momentsThe U.S. dollar index (DXY) experienced a significant decline, falling below the 105 mark.The ADP National Employment Change report significantly missed expectations, and new U.S. tariffs h

ADP Miss and Tariff Concerns Push Dollar Index Below 105 Mark

Key moments

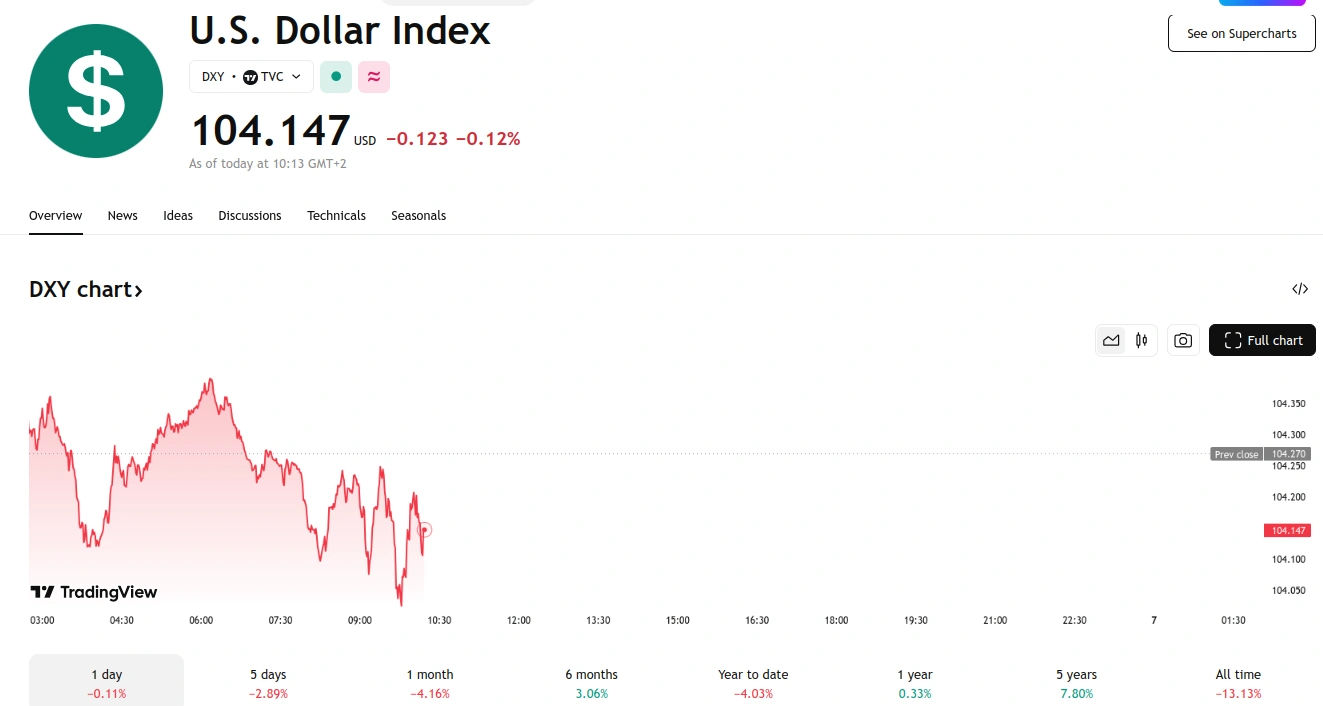

- The U.S. dollar index (DXY) experienced a significant decline, falling below the 105 mark.

- The ADP National Employment Change report significantly missed expectations, and new U.S. tariffs have raised concerns about retaliatory measures and potential economic growth impediments.

- Traders are closely monitoring the upcoming European Central Bank (ECB) rate decision and the U.S. Nonfarm Payrolls report.

Weak Jobs Data & Trade Fears Pressure Greenback to Multi-Month Low

The U.S. dollar faced continued downward pressure Thursday, with the dollar index slipping to a four-month low, breaching the 105 level. This decline was fueled by disappointing U.S. labor market data and escalating trade tensions, as new U.S. tariffs on Canada, Mexico, and China prompted retaliatory actions, raising fears of a broader trade conflict that could hamper U.S. economic expansion.

Specifically, the U.S. ADP National Employment Change report revealed a significant shortfall in private sector hiring for February, with a gain of only 77,000 jobs, far below the anticipated 140,000 and the previous month’s 186,000. Market participants are now keenly focused on Friday’s release of the crucial February Nonfarm Payrolls report. The dollar index, which measures the dollar against a basket of major currencies, stood at 104.13, down 0.12% for the day. Within this basket, the EUR/USD and GBP/USD pairs maintained positions near four-month highs, trading around $1.0821 and $1.2907, respectively.

The U.S. Dollar Index (DXY) struggled to rebound, extending its losses in a volatile week. The persistent downward trend reflects traders’ ongoing reduction of dollar exposure, driven by growing concerns that U.S. economic exceptionalism may be waning, particularly in light of potential negative impacts from President Trump’s tariffs. This shift in sentiment precedes the European Central Bank (ECB) rate decision and the U.S. Nonfarm Payrolls report.

On the economic data front, the Institute for Supply Management (ISM) services report offered a minor positive note, exceeding expectations across various indicators, especially after the ADP private payrolls miss. However, the stronger ISM data, particularly the “Prices Paid” component, could potentially reignite inflation concerns, adding another layer of complexity to the currency markets.