Key Moments:AUD/USD climbed to a weekly high of 0.6513 during Thursdays trading session.The US Dollar Index remained stuck below 99.00.Weak economic data and renewed tariff tensions weighed on the USD

AUD/USD Rallies Past 0.6500 on Disappointing US Services Data AUD/USD Rallies Past 0.6500 on Disappointing US Services Data

Key Moments:

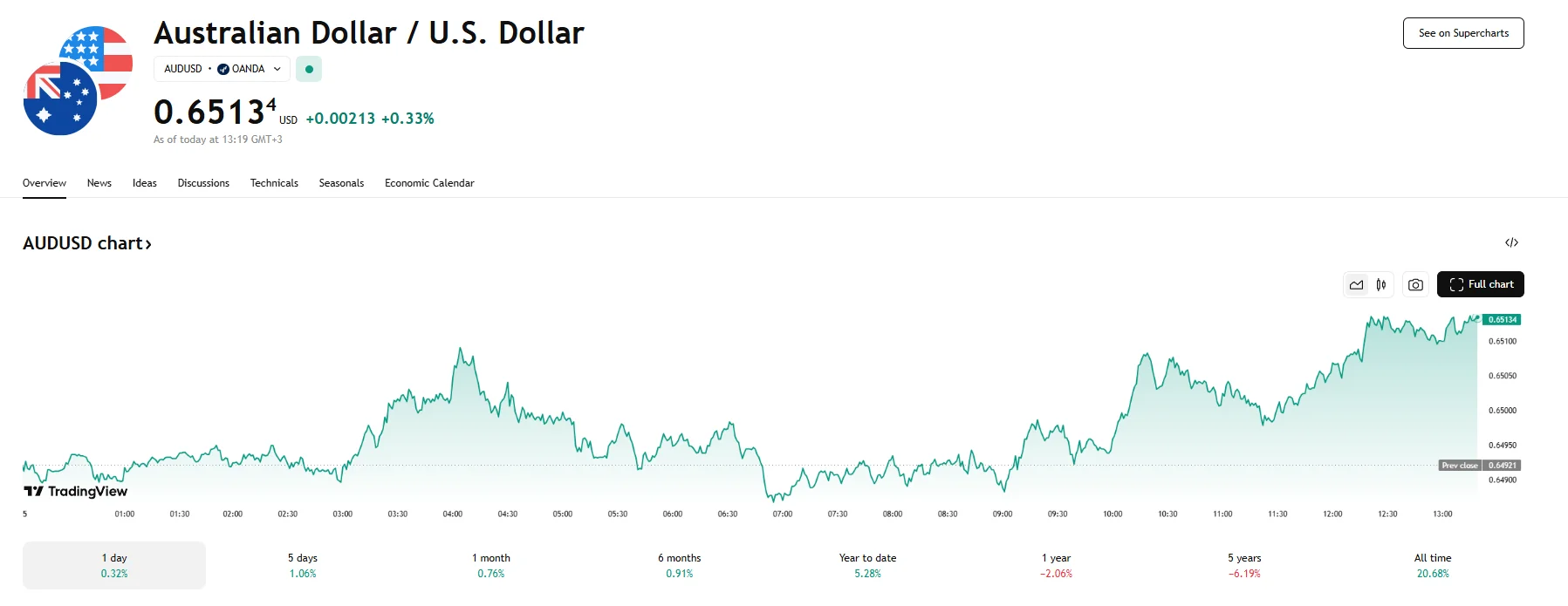

- AUD/USD climbed to a weekly high of 0.6513 during Thursday’s trading session.

- The US Dollar Index remained stuck below 99.00.

- Weak economic data and renewed tariff tensions weighed on the USD.

Greenback Slips Amid Weak Data and Trade Tensions

A climb of 0.33% saw the AUD/USD breach the 0.6500 level on June 5th, extending the gains achieved during yesterday’s trading session. The jump was primarily attributed to a struggling US dollar, which faced pressure from an ISM PMI index report that revealed a sharp drop in domestic service-sector activity.

That release, combined with a smaller-than-expected increase in ADP payrolls, served to spread uncertainty over the upcoming Nonfarm Payrolls report. It also fueled fears of a recession hitting the US economy.

Aussie Holds Firm Despite Domestic Headwinds

Australia’s GDP rose by just 0.2% during Q1 2025, indicating that growth has slowed substantially from the 0.6% reported in 2024’s fourth quarter. The figure also failed to meet expectations of a 0.4% jump. Moreover, it was recently revealed that RBA officials appear willing to implement further interest cuts in 2025 should global trade conditions deteriorate, which could cap AUD appreciation.

However, the lackluster performance of the US economy, along with rising US debt, served to help the Aussie stay afloat as traders gravitated toward non-greenback currencies. The US Dollar Index did not manage to breach 99.00 on Thursday.

Markets also responded negatively to escalating trade tensions, further diminishing the US dollar’s appeal. US tariffs on steel and aluminum imports were increased to 50% on Wednesday, twice the previous 25% imposed by the Trump administration. Moreover, investors also grappled with new commentary from US President Donald Trump regarding Chinese Premier Xi as he described discussions to be “extremely hard.” Trump also claimed that negotiations with other trade partners have generally stalled.