Key momentsAustralia reports a significant and unexpected drop in employment figures for February, contrasting with market expectations.Following the employment datas release, the market began to spec

AUD Weakens as Job Data Shocks Market, RBA Speculation Grows

Key moments

- Australia reports a significant and unexpected drop in employment figures for February, contrasting with market expectations.

- Following the employment data’s release, the market began to speculate more strongly about a possible May interest rate reduction by the RBA.

- Despite the immediate market reaction, economists suggest that underlying labor market fundamentals remain strong, and the RBA is unlikely to overreact to the single data point.

Australian Dollar Under Pressure as Job Data Shocks Market, RBA Speculation Grows

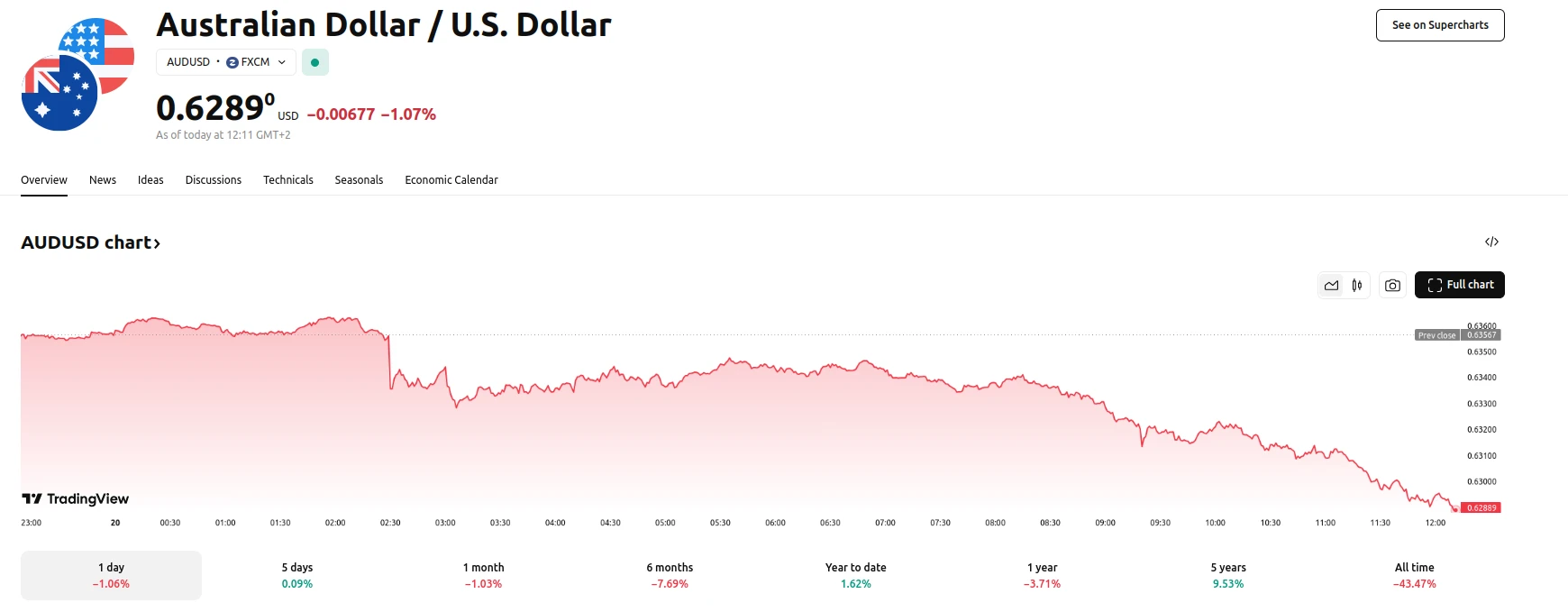

The Australian dollar (AUD) experienced a decline following the release of February’s employment data, which revealed a surprising drop of 52,800 jobs, significantly deviating from the anticipated increase of 30,000. This unexpected downturn prompted investors to reassess the likelihood of an interest rate cut by the Reserve Bank of Australia (RBA), with market probabilities for a May cut rising sharply. The data also showed a decrease in the participation rate, further contributing to the negative market sentiment.

The immediate reaction to the employment data was a surge in market expectations for an RBA rate cut, accompanied by a decline in Australian bond yields. This shift in market sentiment placed downward pressure on the AUD, as investors anticipated a potential easing of monetary policy. However, economists have cautioned against overreacting to the single data point, emphasizing that the underlying labor market fundamentals remain robust.

Analysis of the data reveals that the employment decline was largely attributed to older workers, aged 55 and over, choosing not to return to work. The Australian Bureau of Statistics (ABS) also noted an increase in retirement levels, contributing to the lower participation rate. Economists suggest that moderating cost-of-living pressures may have reduced the incentive for marginal workers to remain in the labor force. Despite the market volatility, economists believe the RBA will likely consider the broader economic trends and not place undue weight on this singular data release. The focus for the AUD is expected to shift to upcoming U.S. tariff announcements, which pose significant downside risks for trade-sensitive currencies.