Key Moments:The Aussie fell to 0.6481 on Tuesday after climbing to a six-month high yesterday.According to market expectations, the probability of another RBA cut in July stands at 65%.The USD rose fo

Australian Dollar Slips From 6-Months High, AUD/USD Hits 0.6481 Australian Dollar Slips From 6-Months High, AUD/USD Hits 0.6481

Key Moments:

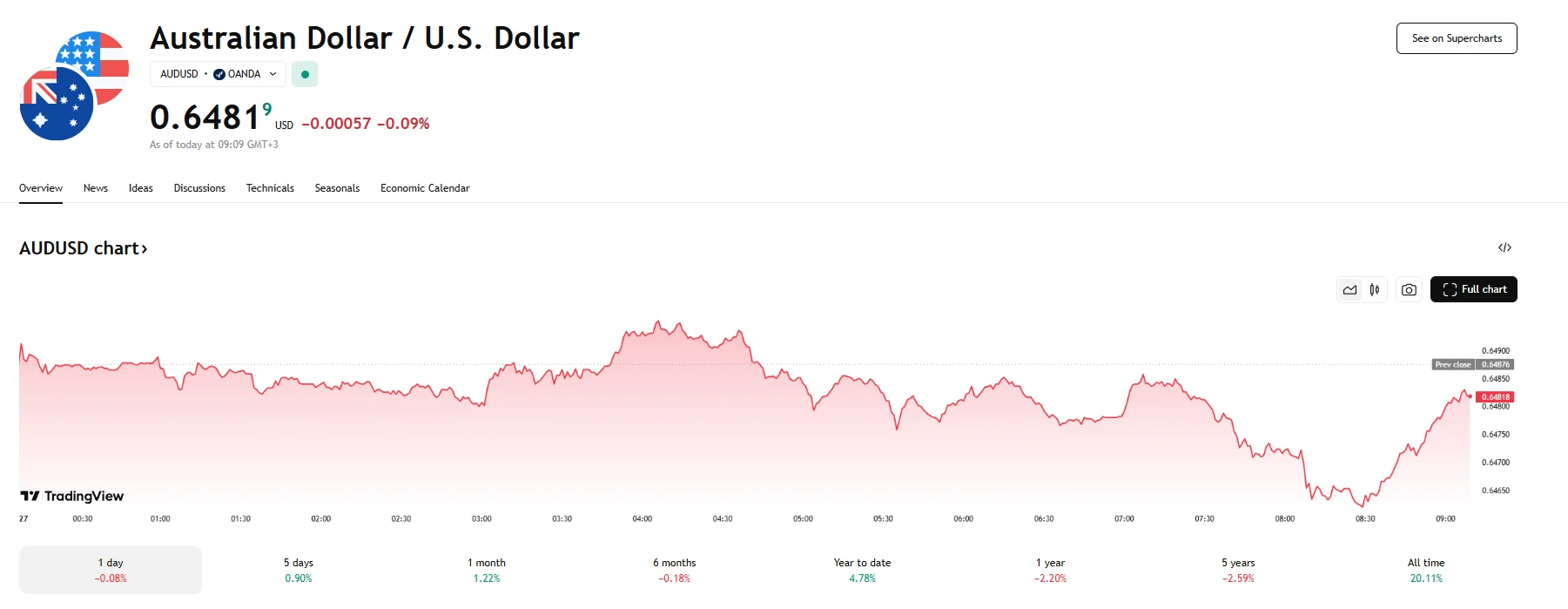

- The Aussie fell to 0.6481 on Tuesday after climbing to a six-month high yesterday.

- According to market expectations, the probability of another RBA cut in July stands at 65%.

- The USD rose following news of a temporary suspension of Trump’s 50% tariffs on the European Union.

Australian Dollar Under Pressure Amid Rising USD

The Australian dollar retreated 0,1% to 0.6481 on Tuesday, giving up gains after touching a six-month peak just a day earlier. Earlier in the session, the AUD/USD pair fell to 0.6462. The decline came amid increased market caution as global economic instability and trade-related tensions weighed on investor confidence.

A primary catalyst for the Australian dollar’s recent strength has been a sustained softening of the greenback and a more positive sentiment towards currencies sensitive to global risk appetite. However, the AUD/USD pair has found it challenging to firmly establish itself above the significant 0.6500 mark.

Adding a nuanced layer to the currency dynamic, the US dollar received a slight uplift after the Trump administration decided to postpone its 50% tariffs on European goods. This development helped alleviate some immediate anxieties surrounding ongoing trade disputes.

RBA Guidance Spurs Interest Rate Speculation

The Reserve Bank of Australia recently lowered its benchmark interest rate to 3.85%, a move that was anticipated by the market. The central bank also kept the door open to additional easing steps should it prove necessary amid economic challenges. As a result, forecasts now suggest a 65% chance for the RBA to cut rates further during the meeting scheduled for July. By early 2026, the bank is expected to ease rates by a total of 75 basis points.

With key domestic inflation data scheduled for release later this week, traders also positioned themselves cautiously. The figures are expected to play a pivotal role in further shaping the RBA’s forward-looking monetary policy.