Key Moments:Australia’s consumer prices rose 2.4% year-over-year in April, slightly above the expected 2.3%.The Reserve Bank of Australia may continue easing monetary policy in the months ahead.The Au

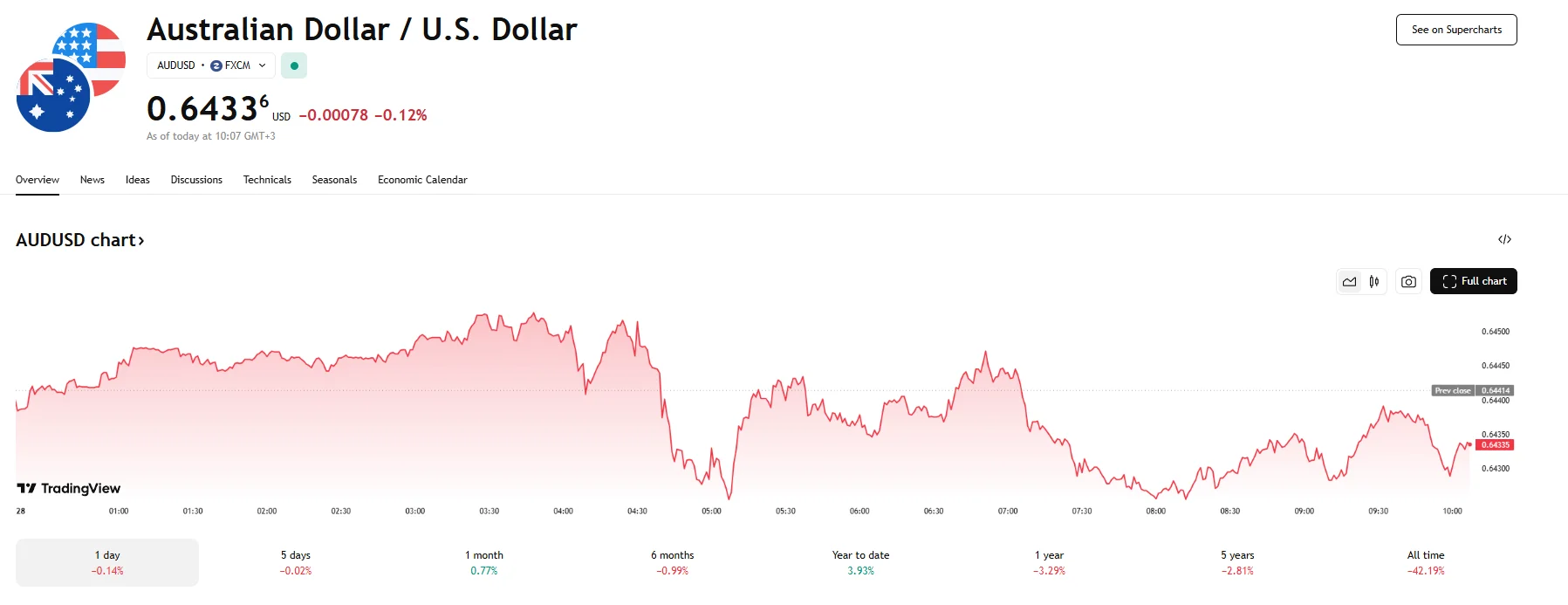

Australian Inflation Steady at 2.4%, AUD/USD Stuck Below 0.6440 as Aussie Equities Fall From 3-Month High Australian Inflation Steady at 2.4%, AUD/USD Stuck Below 0.6440 as Aussie Equities Fall From 3-Month High

Key Moments:

- Australia’s consumer prices rose 2.4% year-over-year in April, slightly above the expected 2.3%.

- The Reserve Bank of Australia may continue easing monetary policy in the months ahead.

- The Australian dollar weakened 0.12% to 0.6433 while the S&P/ASX 200 slipped by 0.13%.

Currency Weakness Persists Despite Inflation Beat

The Australian dollar fell 0.12% to 0.6433 on Wednesday, continuing its recent downward trend in the face of unexpectedly strong inflation data. The monthly Consumer Price Index (CPI) stayed at 2.4% in April, and it exceeded the 2.3% increase forecast by market participants.

According to the Australian Bureau of Statistics, the CPI also remained within the RBA’s 2% to 3% inflation target for the ninth consecutive month. Core CPI, which excludes volatile items and travel costs, hit 2.8%, achieving a 0.2% climb from March’s figures. The trimmed mean inflation measure also ticked up slightly to 2.8% from the previous month’s 2.7% reading.

The data failed to offer the AUD/USD support, however, as the US dollar extended its ascent amid growing confidence in the US economy, and investor sentiment was anchored by the Reserve Bank of Australia’s latest monetary policies. The RBA slashed its key interest rate by 25 basis points last week, which bolstered market expectations regarding further cuts in the summer. According to RBA officials, the trade dispute between Washington and Beijing has been pressuring economic growth, and inflation has also eased.

Growth Data and Equities

In contrast to the robust inflation print, data on total construction work done in Australia showed an unchanged reading at A$74.43 billion in 2025’s first quarter. This result followed a revised 0.9% expansion in the fourth quarter and came in below the 0.5% growth forecasted by analysts.

Meanwhile, Australia’s equity markets did not fare much better than the AUD. The S&P/ASX 200 Index closed with a loss of 0.13% and hit 8,396.9, down from the three-month peak of 8,450 achieved earlier in the session. The stock that enjoyed the most robust gains was Web Travel Group, as it soared by 12.4%, while ALS Limited sank to the bottom of the index due to a decline of 7.6%.