Key momentsBitcoin prices have fallen by more than 23% to $83,740 since its January high.Bitcoin ETF outflows reached a record $1.1 billion on Tuesday.A $1.5 billion hack, policy disappointments, and

Bitcoin Enters Bear Market as Prices Suffer Dramatic 23% Drop to $83,740 Bitcoin Enters Bear Market as Prices Suffer Dramatic 23% Drop to $83,740

Key moments

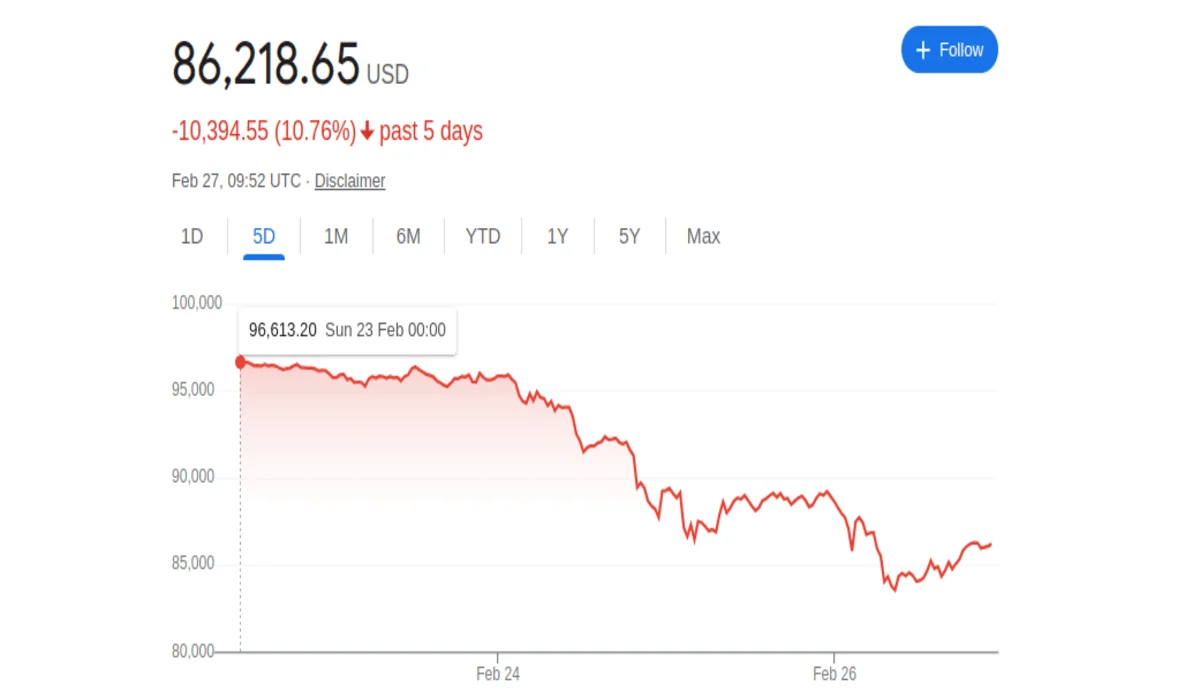

- Bitcoin prices have fallen by more than 23% to $83,740 since its January high.

- Bitcoin ETF outflows reached a record $1.1 billion on Tuesday.

- A $1.5 billion hack, policy disappointments, and a broader risk-off sentiment have contributed to the downturn.

Bitcoin has entered bear-market territory, with its value declining by 23.4% on Wednesday when the cryptocurrency fell to an intraday low of $83,740. This marks a significant downturn from its January highs when the leading cryptocoin’s prices stood at $109,350, indicating a reversal from its recent bullish momentum. The downturn has been fueled by a combination of factors, including recent crypto scandals, policy changes under the Trump administration, and a broader risk-off sentiment among investors.

Investor confidence has been further shaken by a massive $1.1 billion outflow from Bitcoin exchange−traded funds (ETFs) on Tuesday, the largest single−day withdrawal on record. Analysts attribute this exodus to growing skepticism about the cryptosector’s stability, exacerbated by last week’s $1.5 billion hack of the Bybit exchange. Additionally, the Trump administration’s policies, despite its pro-crypto campaign promises, have left some traders disillusioned.

Geoff Kendrick, head of digital assets research at Standard Chartered, had previously cautioned that Bitcoin’s price could fall to $0,000, while some analysts predict an even steeper decline to $71,000. Bitcoin’s drop has also impacted altcoins, with the total market capitalization of cryptocurrencies (excluding Bitcoin, Ethereum, and stablecoins) plummeting from $1 trillion in December to $600 billion. The cryptocurrency Fear and Greed Index has dropped to 21, signaling “extreme fear” among investors.

Despite the current slump, some analysts remain optimistic about Bitcoin’s long-term prospects. On-chain indicators suggest the market is still in the early-to-mid stages of a bull cycle, with Bitcoin’s dominance rising to 62% as altcoins underperform. However, the immediate future remains uncertain, as investors gauge whether to re-enter the market amid ongoing volatility and regulatory uncertainties.

The recent downturn underscores the challenges the crypto sector is facing, as it grapples with external pressures and internal vulnerabilities. Whether Bitcoin can regain its footing will depend on broader market sentiment and the ability of policymakers to restore confidence in the digital asset space.