Key momentsBitcoin and major altcoins experienced a sharp decline, erasing weekend gains triggered by the U.S. strategic crypto reserve announcement.The announcement of 25% tariffs on imports from Can

Bitcoin’s Price Drops 10% to $85,000, Reversing Crypto Reserve Momentum

Key moments

- Bitcoin and major altcoins experienced a sharp decline, erasing weekend gains triggered by the U.S. strategic crypto reserve announcement.

- The announcement of 25% tariffs on imports from Canada and Mexico significantly impacted the crypto market.

- Bitcoin’s price has significantly dropped from its January high, and its three-month performance shows a decline.

Crypto Market Plummets as Trump Tariff News Overwhelms Strategic Reserve Hype

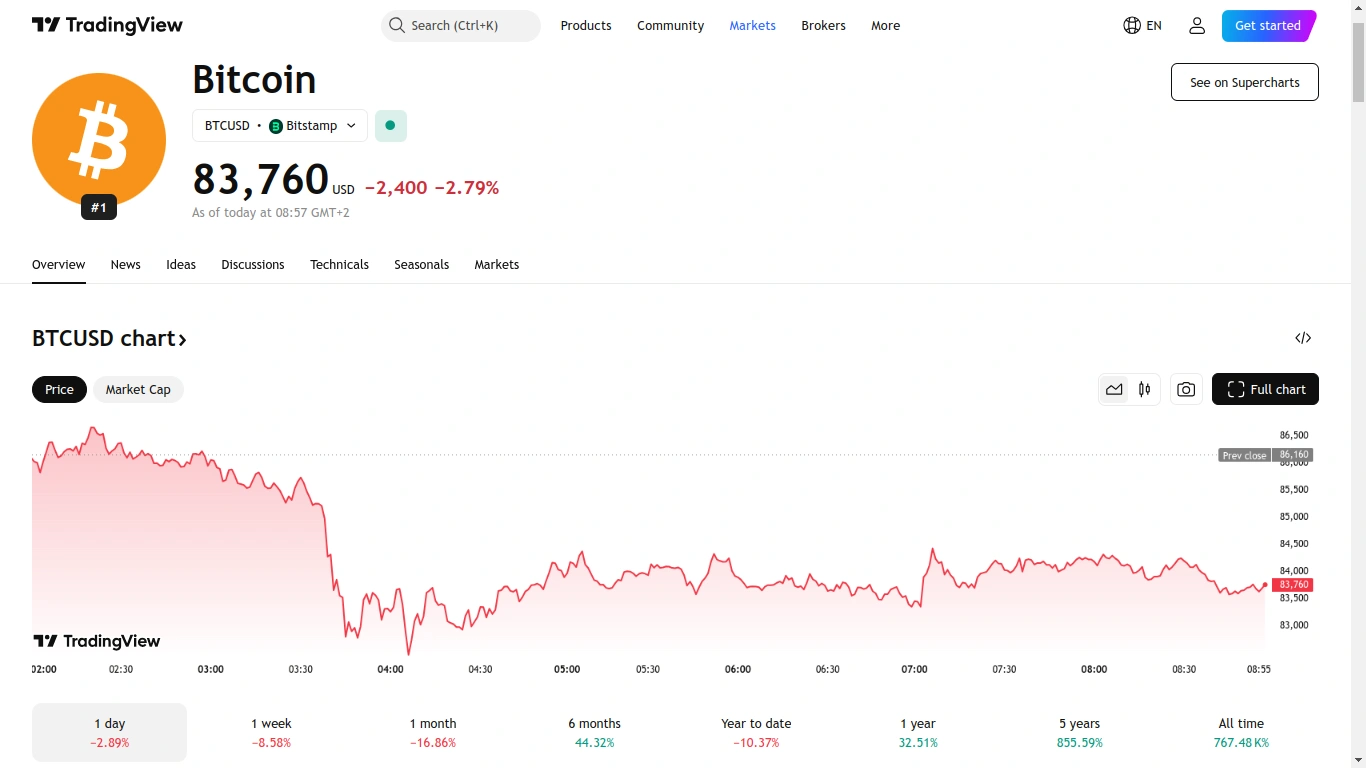

Bitcoin’s (BTC) weekend surge abruptly reversed on Monday, March 3rd, with the cryptocurrency tumbling nearly 10% to $85,000, erasing gains fueled by President Trump’s strategic crypto reserve announcement. The initial rally to $93,000 quickly evaporated as market sentiment shifted.

Altcoins suffered even steeper declines. Ethereum (ETH) dropped 15% to $2,135, and Solana (SOL) plummeted 18% to $143.05, turning the entire major cryptocurrency market red.

Crypto-related stocks mirrored the downturn. Coinbase Global (COIN) and Robinhood (HOOD) reversed early gains, closing down 5% and 6%, respectively. MicroStrategy (MSTR) also flipped from a 14% rise to a 2% loss.

The strategic crypto reserve news was overshadowed by the Trump administration’s announcement of 25% tariffs on Canadian and Mexican imports, effective March 4th. This trade war threat triggered a flight from riskier assets, including cryptocurrencies.

Bitcoin is now down over 20% from its January all-time high of $109,000, reached on Trump’s inauguration day.

With limited Wall Street analyst coverage, Bitcoin’s three-month performance reveals a 4.66% decline, highlighting its inherent volatility. The market’s reaction to geopolitical events and regulatory announcements underscores the importance of risk management for crypto investors.