Key Moments:The USD/JPY dropped 0.25% on Wednesday.Expectations for continued policy tightening by the Bank of Japan have supported the JPY.April’s US CPI data showed that inflation has slowed, which

Diverging Policy Paths Push USD/JPY 0.25% Lower Diverging Policy Paths Push USD/JPY 0.25% Lower

Key Moments:

- The USD/JPY dropped 0.25% on Wednesday.

- Expectations for continued policy tightening by the Bank of Japan have supported the JPY.

- April’s US CPI data showed that inflation has slowed, which reinforced projections that the Federal Reserve will lower interest rates in 2025.

Yen Strengthens as BoJ Signals More Tightening Ahead

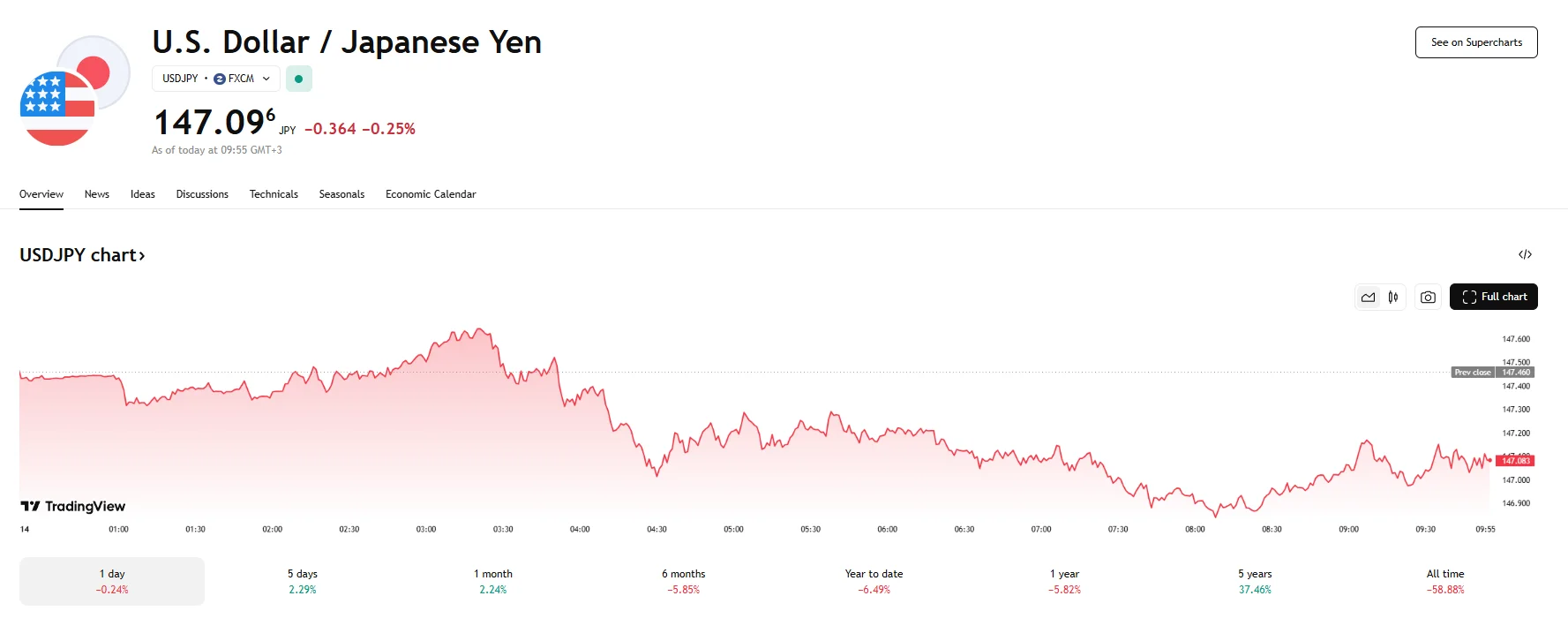

The USD/JPY fell on Wednesday, with its rate slipping 0.25% to 147.09 as the yen extended its gains against the greenback for a second day. Investor sentiment continued to favor the yen amid signs of policy divergence between the BoJ and the Fed.

Although Japan’s Producer Price Index (PPI) data, which was published today, showed a 0.2% monthly gain and an annual rise of 4%, which indicated a slight easing from the previous month’s 4.2%, the currency saw little reaction. The broader narrative remained focused on the Bank of Japan’s outlook, as Deputy Governor Shinichi Uchida affirmed that the BoJ would proceed with further rate increases if macroeconomic conditions and price trends align with forecasts.

Meanwhile, investor positioning reflects a mixed view of the Federal Reserve’s stance on monetary policy. While expectations for more aggressive easing have diminished, markets still expect that rate cuts would total 56 basis points by the end of 2025. This outlook was further solidified by the latest Consumer Price Index figures from the Bureau of Labor Statistics. Headline CPI fell to 2.3% year-over-year, while core CPI jumped 2.8%.

While sentiment around equities has been supported by developments in global trade, the boost to risk appetite has not significantly altered the appeal of the yen. Continued optimism over a 90-day pause in US-China tariffs has improved market tone, but has done little to offset the intraday strength of the safe-haven currency.

As the USD/JPY pair remains weighed down by prevailing monetary policy signals, investors are now awaiting upcoming speeches from key Federal Open Market Committee (FOMC) members. These comments are expected to influence USD movement.