Key Moments:The US dollar index declined 0.5% to 98.959 on Monday amid renewed tariff concerns.EUR/USD hovered near 1.1400 as it rose 0.48%.President Trump announced plans to increase the duties on st

Dollar Index Sinks to 98.959, EUR/USD Hits 1.1401 as Trump Doubles Tariffs on Steel, Aluminum Dollar Index Sinks to 98.959, EUR/USD Hits 1.1401 as Trump Doubles Tariffs on Steel, Aluminum

Key Moments:

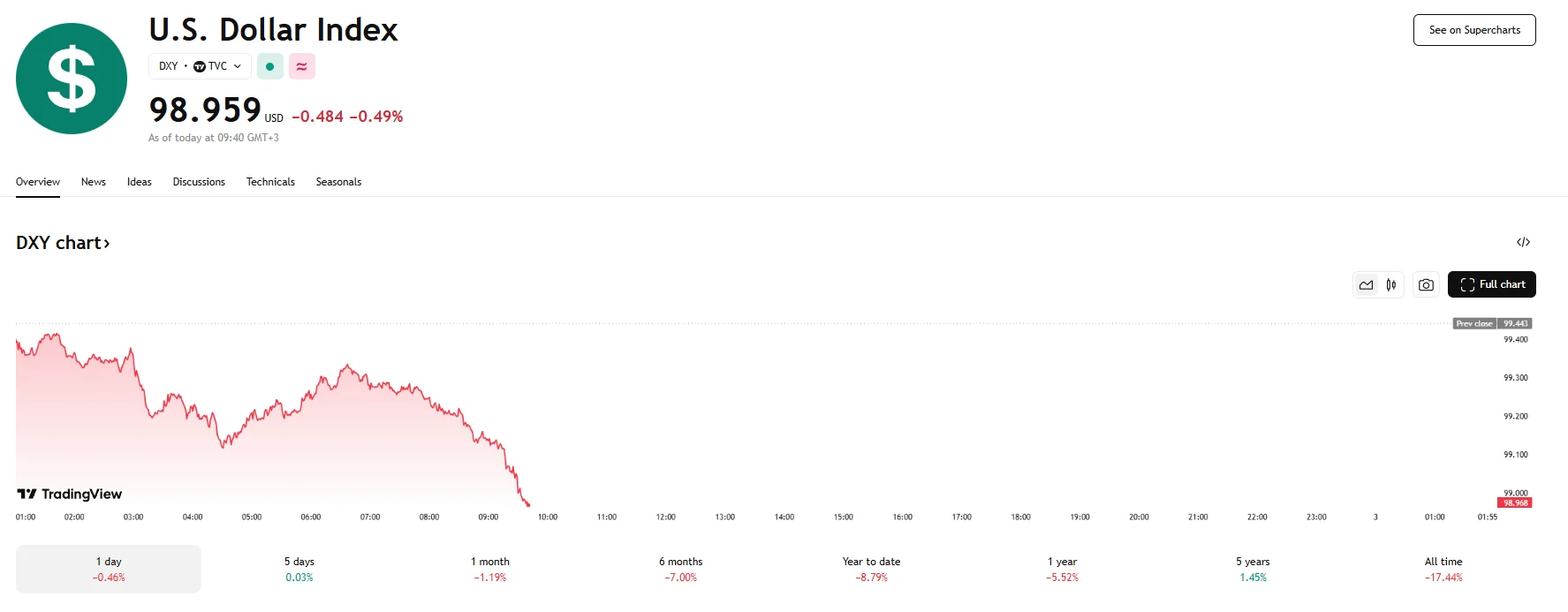

- The US dollar index declined 0.5% to 98.959 on Monday amid renewed tariff concerns.

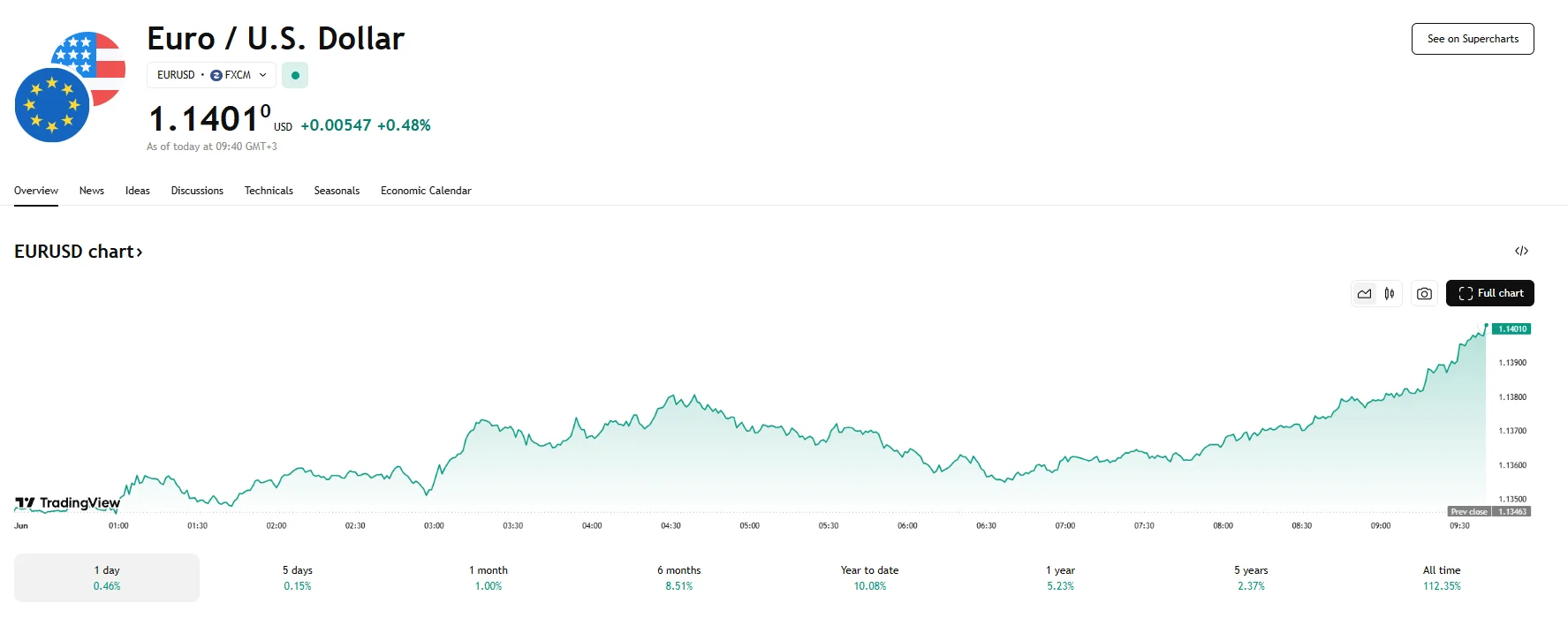

- EUR/USD hovered near 1.1400 as it rose 0.48%.

- President Trump announced plans to increase the duties on steel and aluminum imports to 50% starting Wednesday.

Dollar Slides as Trade Frictions Intensify

The US dollar fell on Monday as investors reacted to escalating trade tensions and the potential economic fallout from President Donald Trump’s latest tariff decisions. The dollar index, which tracks the greenback’s performance compared to six major currencies, slid 0.5% to 98.959.

This decline was particularly pronounced against the euro, as the EUR/USD managed to breach the 1.1400 level. Today’s currency movements followed Trump’s late-Friday remarks confirming plans to raise existing tariffs on steel and aluminum imports to 50%, effective Wednesday.

Market Sentiment Remains Fragile

Jonas Goltermann, Deputy Chief Markets Economist at Capital Economics, stated that the dollar was still near the bottom of its post-2022 trading range and significantly weaker than interest rate differentials suggested. He added that market sentiment towards the dollar remained negative, leaving it susceptible to further adverse fiscal and trade policy news.

After suffering earlier declines from Trump’s Liberation Day tariffs and another retreat several weeks ago linked to a 50% tariff threat on European goods, the dollar has continued to struggle.

Talks of renewed EU negotiations aided the dollar by around 0.3% last week, and news of a Federal court striking down Trump’s tariffs was also well received. However, an appeals court later reinstated the tariffs, and the case is pending further review.

According to JPMorgan Chief Economist Bruce Kasman, the court ruling could impact future trade strategies, though the administration retains many policy tools to pursue its objectives. Kasman projected a baseline tariff rate of 10% and anticipated rising sector-based duties. He also pointed to a probable targeting of Association of Southeast Asian Nations (ASEAN) members to curb tariff circumvention and noted that upward pressure remains on transatlantic trade levies.