Key Moments:Bitcoin and Ethereum ETFs attracted a total of $1.05 billion in net inflows on Thursday.Ethereum ETFs saw $110.5 million in net inflows, their best since February 4The figures failed to ai

Ethereum, Bitcoin Prices Drop Over 1% Despite Combined ETF Inflows of $1.05B Ethereum, Bitcoin Prices Drop Over 1% Despite Combined ETF Inflows of $1.05B

Key Moments:

- Bitcoin and Ethereum ETFs attracted a total of $1.05 billion in net inflows on Thursday.

- Ethereum ETFs saw $110.5 million in net inflows, their best since February 4

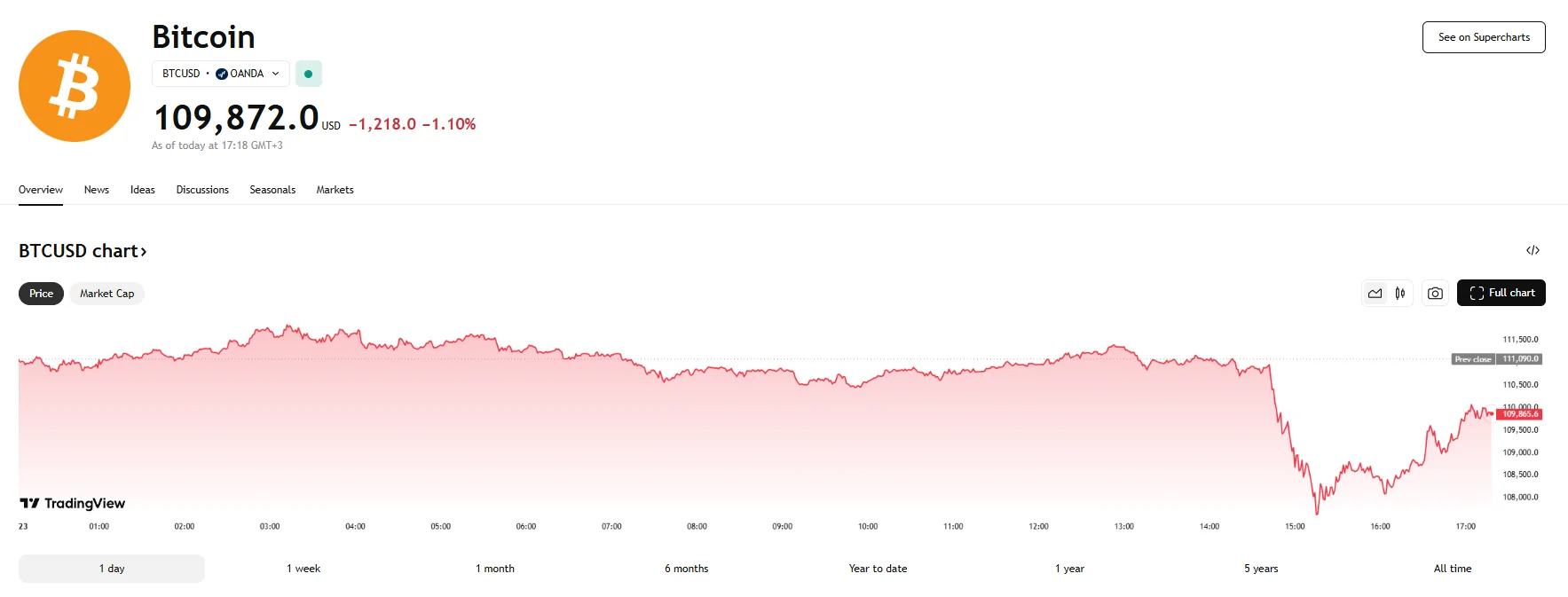

- The figures failed to aid prices on Friday, as Bitcoin dropped 1.1% to 109,872, while Ethereum fell 3.19% to 2,579.37.

Bitcoin ETFs Attract Highest Daily Inflows Since January

US spot Bitcoin and Ethereum exchange-traded funds pulled in a combined total of $1.05 billion in net inflows on Thursday, marking the largest daily intake since January. The surge coincided with Bitcoin reaching a new all-time high and Ethereum enjoying its most positive market trend in months.

Data from The Block revealed that Bitcoin ETFs alone drew $934.8 million in inflows on May 22nd, and BlackRock’s IBIT led the charge with $877.2 million in net inflows. This also placed IBIT among the top five ETFs by year-to-date inflows. Fidelity’s FBTC, meanwhile, enjoyed an inflow of $48.7 million, while Ark Invest’s ARKB contributed $8.9 million.

Ethereum ETFs Log Best Daily Flows in Over Three Months

US spot Ethereum ETFs brought in $110.5 million in net inflows on Thursday, their largest one-day increase since February 4th. Grayscale’s ETHE was at the top with $43.7 million, followed by Fidelity’s FETH with $42.2 million. ETH, also tied to Grayscale, saw $18.9 million, and Bitwise’s ETHW added $5.7 million.

The Ethereum ETF category is now on a five-day winning streak, accumulating $211.8 million in net flows during that time. Year-to-date net inflows stand at $61.9 million, while cumulative inflows since inception total $2.7 billion.

Spot Prices Fall

While news of robust ETF inflows may often aid the spot prices of Ethereum and Bitcoin alike, such a surge did not come to fruition on Friday.

Bitcoin fell by 1.1%, down from yesterday’s record-high valuation above the $111,000 mark.

Ethereum’s own decline was even sharper, as it lost 3.19% of its value and hit $2.579.37. It should be noted that Ethereum is up when it comes to its five-day performance, however.