Key momentsEthereum gained a modest amount on Monday, reaching $1,904.The cryptocurrency was unable to reach $2,000 as 21Shares made the decision to pull the plug on the ARK 21Shares Active Bitcoin Et

Ethereum Gains Stall Below $2,000, 21Shares Liquidates Two Bitcoin and Ethereum ETFs Ethereum Gains Stall Below $2,000, 21Shares Liquidates Two Bitcoin and Ethereum ETFs

Key moments

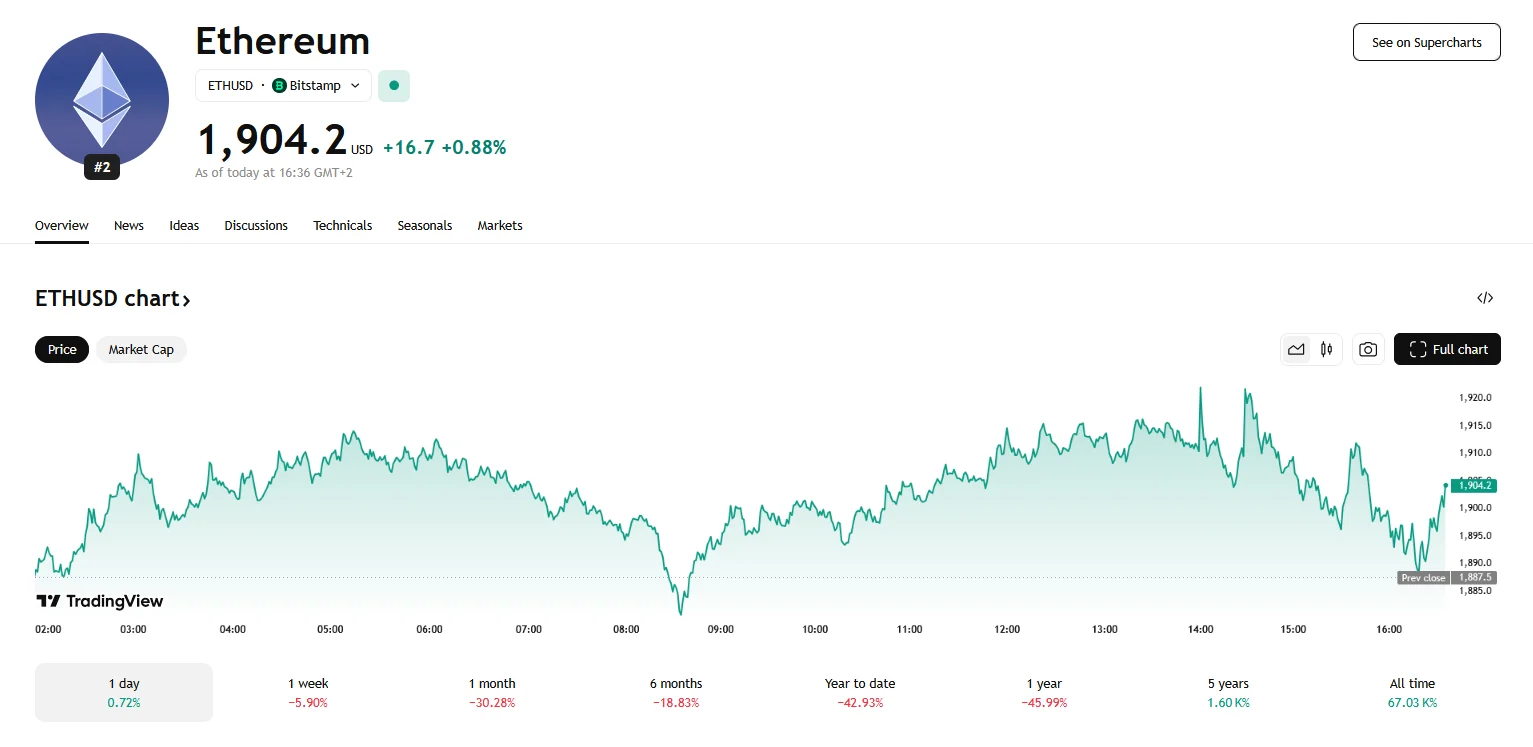

- Ethereum gained a modest amount on Monday, reaching $1,904.

- The cryptocurrency was unable to reach $2,000 as 21Shares made the decision to pull the plug on the ARK 21Shares Active Bitcoin Ethereum Strategy ETF (ARKY).

- Ethereum’s struggle to breach the $2,000 mark is compounded by a combination of weak on-chain activity and ETF outflows.

Ethereum’s Price Hurdles: $2,000 Untouched, 21Shares Announces Closures of ARKC and ARKY

Ethereum’s price trajectory is currently facing significant hurdles, as it struggles to break through the $2,000 resistance barrier, despite the modest 0.88% increase to $1,904 it experienced on Monday. This persistent inability to surpass the threshold of $2,000 raises concerns about the cryptocurrency’s near-term potential, particularly given the broader market dynamics and recent developments in the exchange-traded fund (ETF) sector.

Recent data indicates that Ethereum has been consolidating within a tight trading range, oscillating between $1,810 and $1,960 over the past week. This consolidation phase is attributed to a confluence of factors, including declining network activity, reduced total value locked (TVL), persistent outflows from spot Ethereum ETFs, and bearish technical indicators.

The underperformance of Ethereum’s price is notably linked to investors’ risk-averse behavior, evident in the sustained outflows from spot Ethereum ETFs. These investment products have experienced consecutive days of outflows, totaling substantial amounts in recent weeks.

This appears to be an ongoing trend, as 21Shares has announced the liquidation of two ETFs linked to Bitcoin and Ethereum futures. The substantial outflows from Bitcoin ETFs, coupled with the overall decline in cryptocurrency prices, have prompted 21Shares to reassess its investment strategies. The ARK 21Shares Active On-Chain Bitcoin Strategy ETF (ARKC) and the ARK 21Shares Active Bitcoin Ethereum Strategy ETF (ARKY) will be the ETFs affected by 21Shares’ decision.

Furthermore, a decline in Ethereum’s on-chain metrics is exacerbating the price stagnation. The network’s decentralized exchange (DEX) volume has reached $16.8 billion, marking a decrease of 30%. This reflects a slowdown in overall activity.