Key Moments:EUR/GBP climbed past 0.8470, hitting a one-month peak on Wednesday.Weaker UK jobs data and rising BoE rate-cut expectations continued to weigh on the British poundMarket participants await

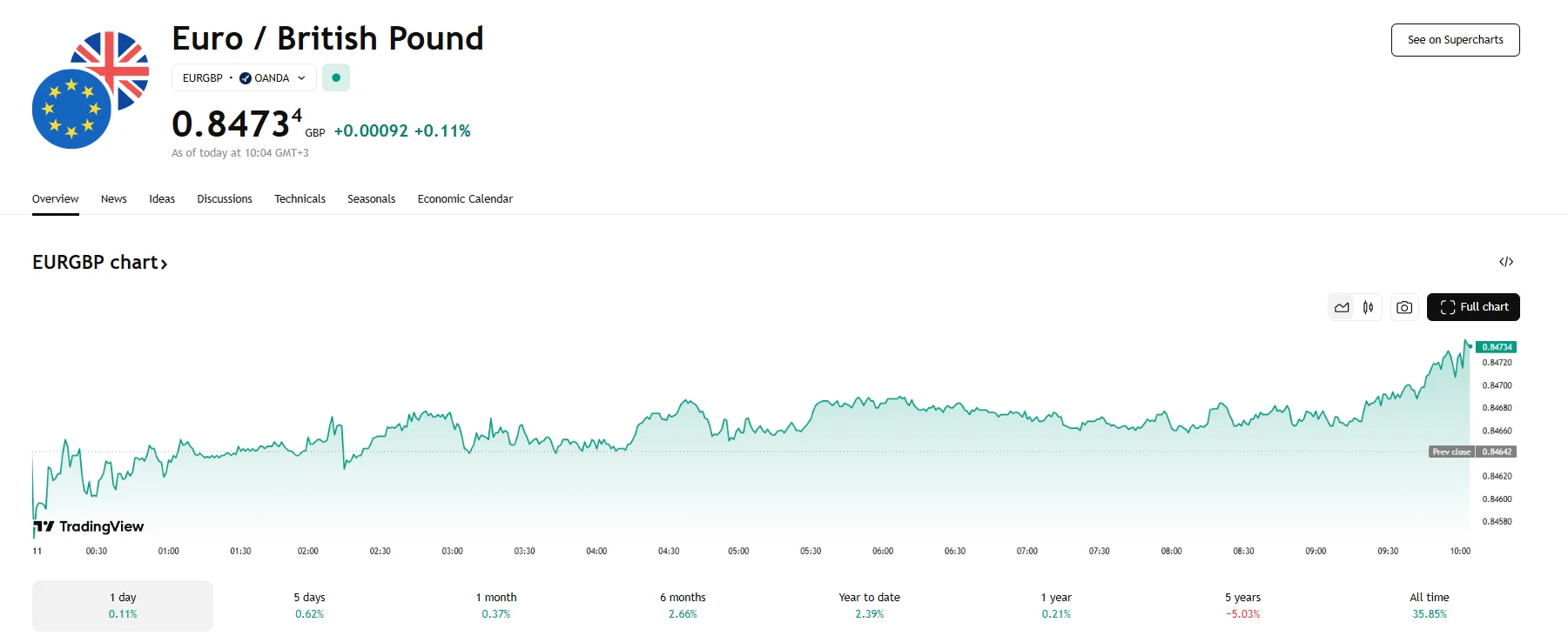

EUR/GBP Hits 1-Month High Above 0.8470 as Diverging Central Bank Outlooks Favor Euro EUR/GBP Hits 1-Month High Above 0.8470 as Diverging Central Bank Outlooks Favor Euro

Key Moments:

- EUR/GBP climbed past 0.8470, hitting a one-month peak on Wednesday.

- Weaker UK jobs data and rising BoE rate-cut expectations continued to weigh on the British pound

- Market participants awaited the US inflation report before initiating new positions.

EUR/GBP Enjoys Gains

Wednesday saw the euro extend its rally against the British pound, with the EUR/GBP pair experiencing a surge above the 0.8470 level. Although the initial strength was followed by fading momentum with limited follow-through buying, the pair is still trading above yesterday’s figures.

Diverging Monetary Policy Expectations Support Euro

The sterling continued to underperform after the publication of lackluster UK employment data released on Tuesday. The figures fueled speculation of further interest rate cuts being implemented by the Bank of England (BoE) before the end of 2025.

Meanwhile, recent commentary by European Central Bank (ECB) officials signaled that the current phase of monetary easing might be approaching its end. This served to provide additional support to the euro, and the contrasting central bank outlooks have reinforced the EUR/GBP cross’s upward bias.

Global market sentiment also turned positive following reports of US and Chinese officials reaching a deal following their two-day meetings in London. While details, especially particulars surrounding a potential long-term truce, are yet to be released, it has been established that China will be removing the restrictions that impacted rare earth trade.

Technical Breakout and Market Sentiment

A recent breakout above a short-term consolidation phase strengthened the near-term bullish case for EUR/GBP. However, market participants have shown caution, opting to wait for the upcoming US Consumer Price Index report before committing to new positions. The data is anticipated to introduce fresh volatility later in the session.

Meanwhile, no major economic data expected from either the Eurozone or the UK is expected to be published today. Technical and sentiment-driven factors, therefore, may continue to guide EUR/GBP in the near term, and any minor pullbacks are likely to find support.