Key Moments:The EUR/USD pair hovers near 1.1100 as weak Eurozone trade prospects and ECB rate cut expectations impede climb.The ZEW economic sentiment index for Germany jumped to 25.2 in May, beating

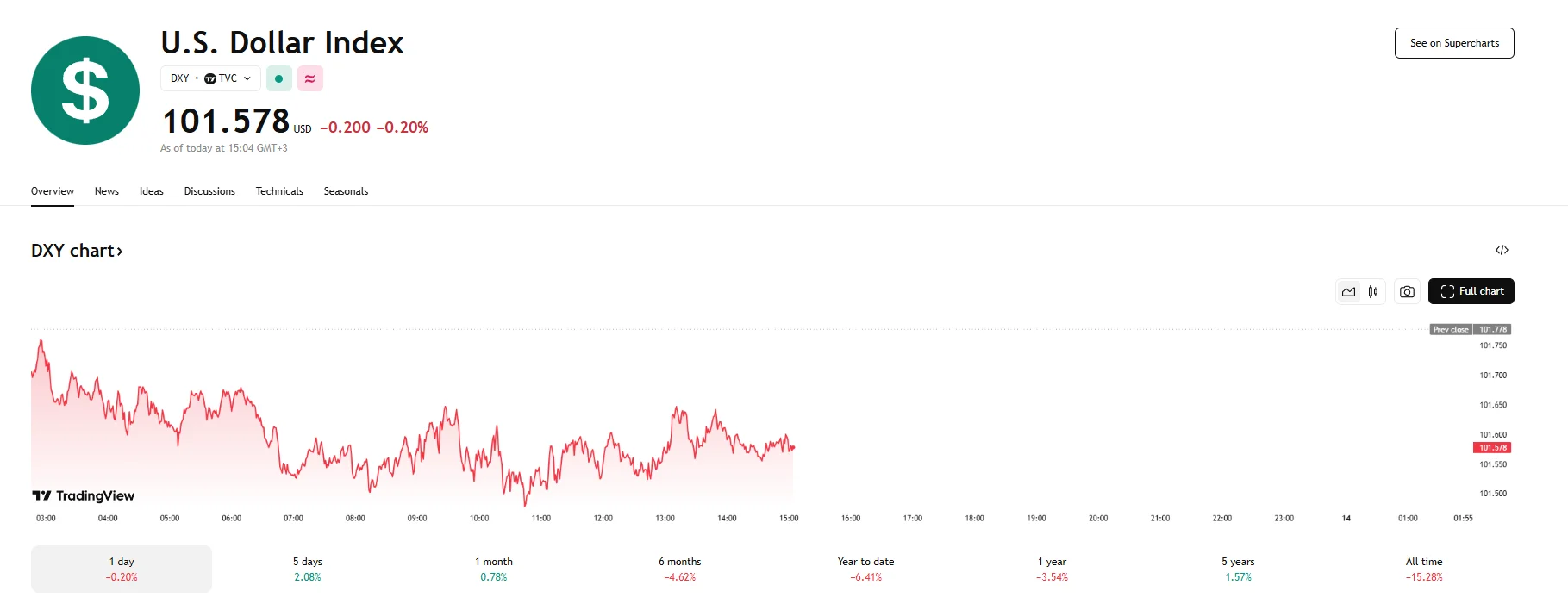

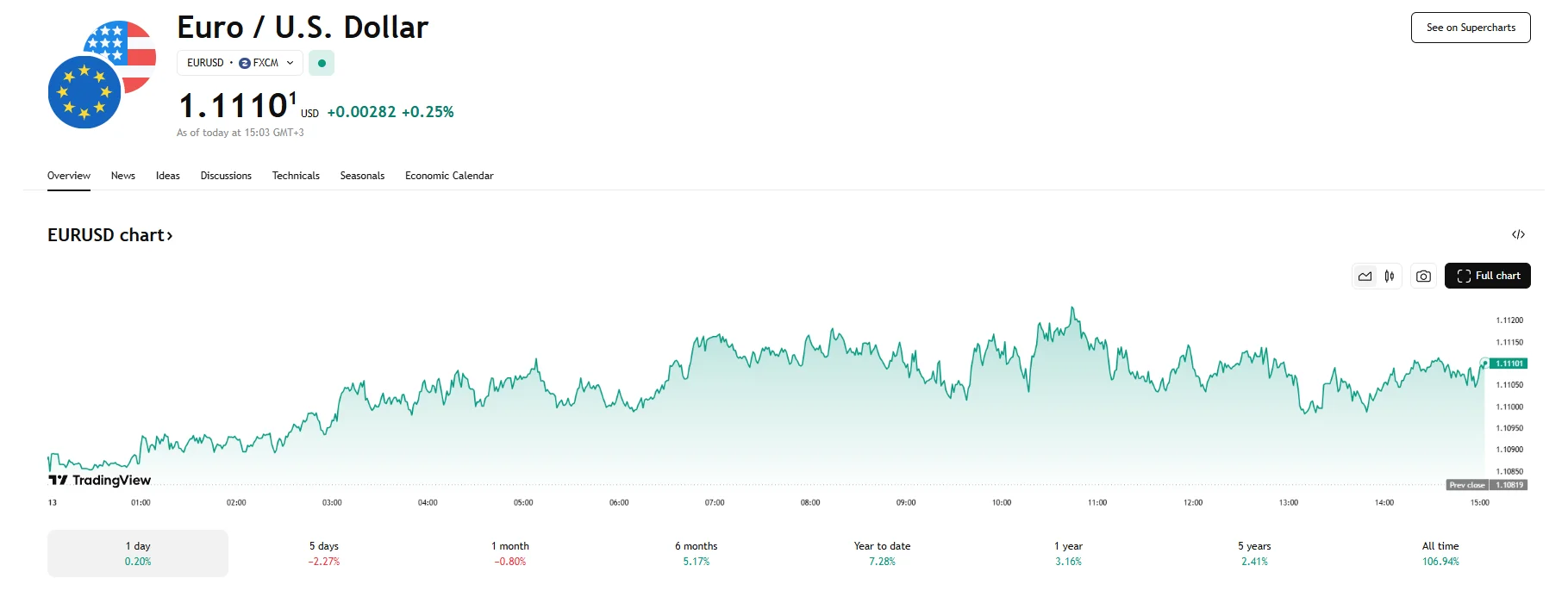

EUR/USD Rises 0.25% to 1.1110, Dollar Index Slips 0.2% EUR/USD Rises 0.25% to 1.1110, Dollar Index Slips 0.2%

Key Moments:

- The EUR/USD pair hovers near 1.1100 as weak Eurozone trade prospects and ECB rate cut expectations impede climb.

- The ZEW economic sentiment index for Germany jumped to 25.2 in May, beating forecasts and aiding a mild euro.

- A temporary US-China trade truce and lack of EU-US trade progress supported near-term upside in the US Dollar.

Mixed Forces Keep EUR/USD Under Pressure

The euro edged slightly higher against the US dollar on Tuesday, trading just above the 1.1100 mark amid a 0.25% increase. However, gains remained limited as investors weighed weak Eurozone trade dynamics and a broader backdrop of stalled EU-US trade negotiations.

The European Union has been one of the few major economies not to make headway in resolving trade tensions with the United States following President Donald Trump’s announcement of retaliatory tariffs. In response, the European Commission launched a public consultation on countermeasures that could affect up to €95 billion worth of US imports if talks fail to progress meaningfully.

Investor sentiment around the euro continued to sour as markets leaned more heavily into expectations for further easing by the European Central Bank, with the next cut expected to happen as early as June. Further fueling speculation were ECB officials’ reassurances that inflation is slowing and that price growth is projected to hit the 2% target in 2025.

However, the euro did receive a modest lift following the release of stronger-than-expected ZEW survey data from Germany. The May economic sentiment index rose sharply to 25.2 points, a notable recovery from April’s reading of -14.0 and well above the projected 16.4. However, the assessment of current conditions deteriorated slightly, falling from -81.2 to -82.0.

On the other side of the EUR/USD pair, the US dollar retained some support on Tuesday after a temporary truce between Washington and Beijing helped reinstate investor confidence in the US economy. The US and China agreed over the weekend to reduce tariffs by 115% for 90 days.

Even as risk sentiment improved somewhat, Federal Reserve official Austan Goolsbee maintained a cautious tone, warning that the US economy continues to face headwinds including persistent inflation pressures. This tempered some of the bullish sentiment around the dollar. The US Dollar Index eventually suffered a decline, dropping 0.20% to 101.578.