Key Moments:The EUR/USD struggled to find its footing on Wednesday after sliding below 1.1300.Sentiment favored the US dollar after President Trump delayed tariffs on imports sourced from the EU.The e

EUR/USD Trades Near 1.1330 as Dollar Benefits from Strong US Data and Easing Trade Concerns EUR/USD Trades Near 1.1330 as Dollar Benefits from Strong US Data and Easing Trade Concerns

Key Moments:

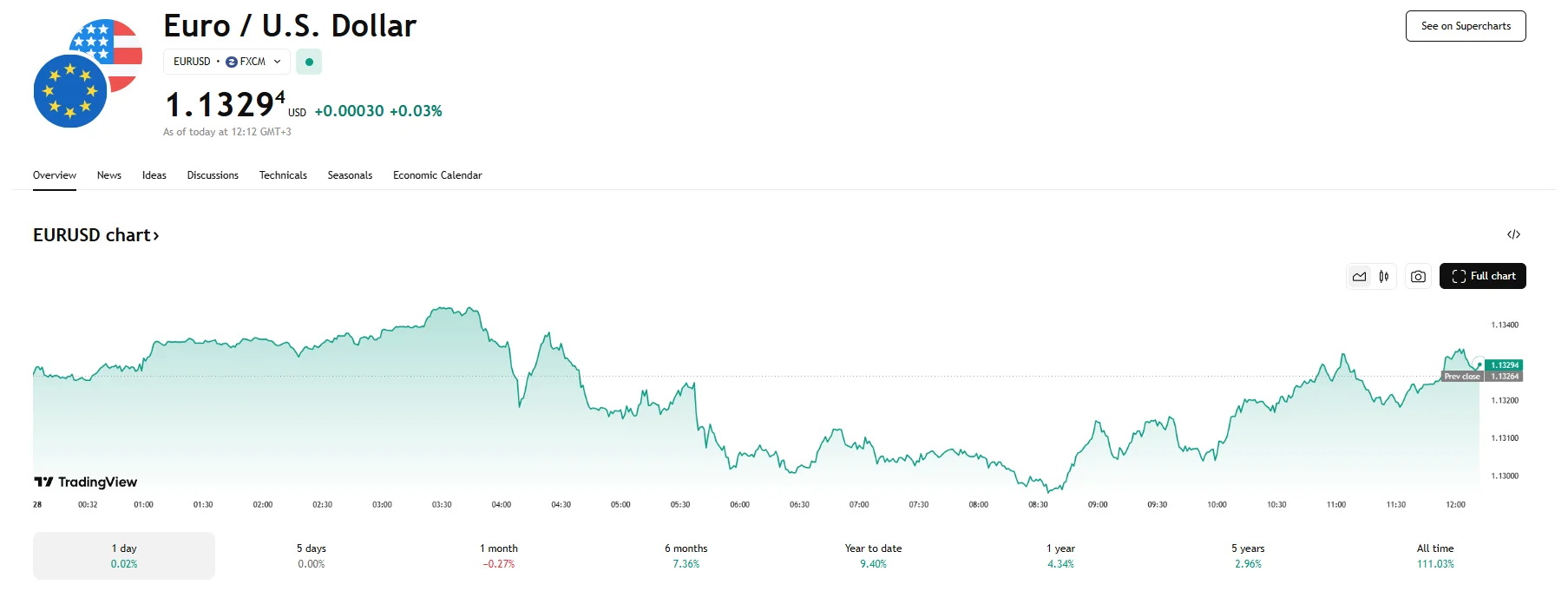

- The EUR/USD struggled to find its footing on Wednesday after sliding below 1.1300.

- Sentiment favored the US dollar after President Trump delayed tariffs on imports sourced from the EU.

- The euro was pressured by solid US data and weak Eurozone confidence figures.

Euro Remains Under Pressure

The EUR/USD pair declined for the second session in a row on Wednesday before managing a tentative rebound. The pair slipped below the 1.1300 mark earlier before climbing slightly above flat levels near 1.1330.

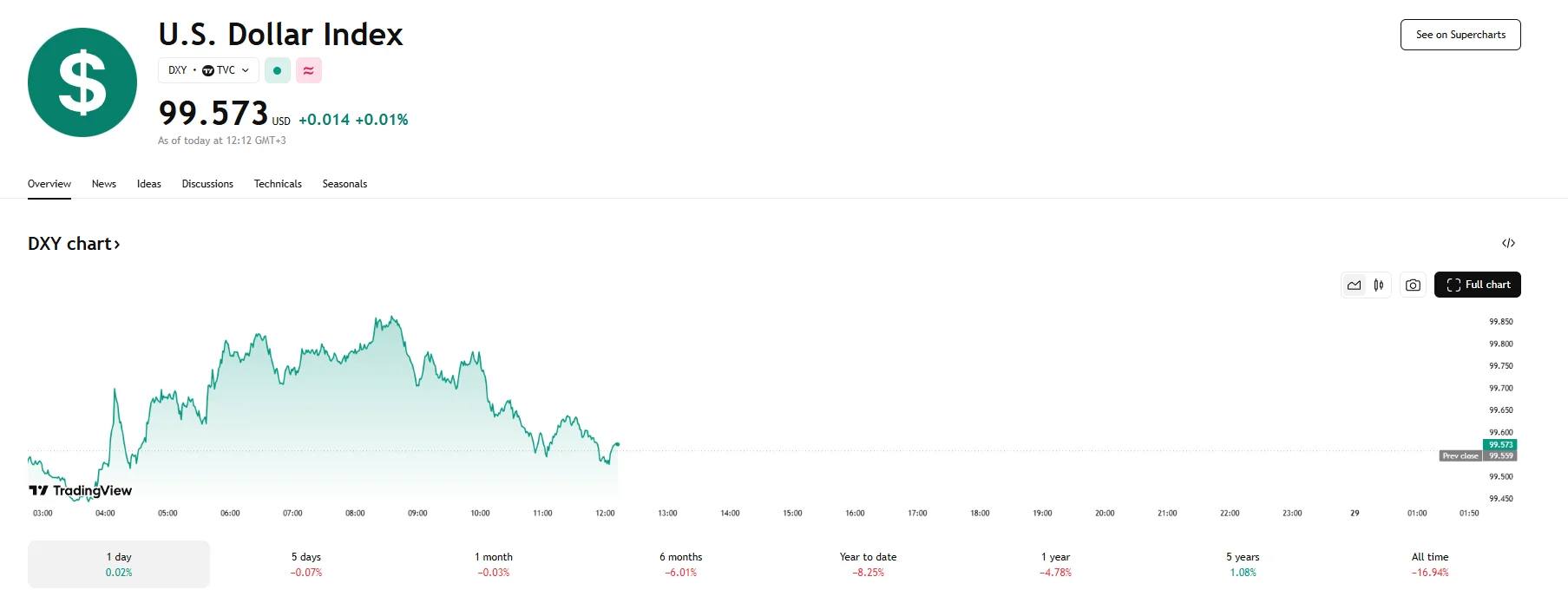

The US Dollar Index, meanwhile, stayed above 99.500, as a strong rebound in the US Consumer Confidence Index to 98.0 supported the greenback and prevented major declines. The survey revealed a notable improvement in Americans’ expectations for income, employment, and business conditions while recession fears subsided. Although the US Durable Goods Orders in April showed a 6.3% decline, the figure was slightly better than the expected 7.9% drop.

Risk appetite improved following President Donald Trump’s postponement of the imposition of 50% tariffs on European goods. This alleviated some pressure from global markets, easing anxiety over a possible escalation in the trade conflict.

Eurozone indicators offered little support for the euro. The German GfK Consumer Confidence stood at -19.9, only slightly up from the former -20.8, while the broader Eurozone Consumer Confidence metric was stagnant at -15.2. Although there were limited gains in economic sentiment and industrial confidence, they could not trigger significant support for the euro.

Additionally, comments from ECB policymaker François Villeroy, who highlighted the bank’s remaining scope to reduce rates further, amplified bearish sentiment.