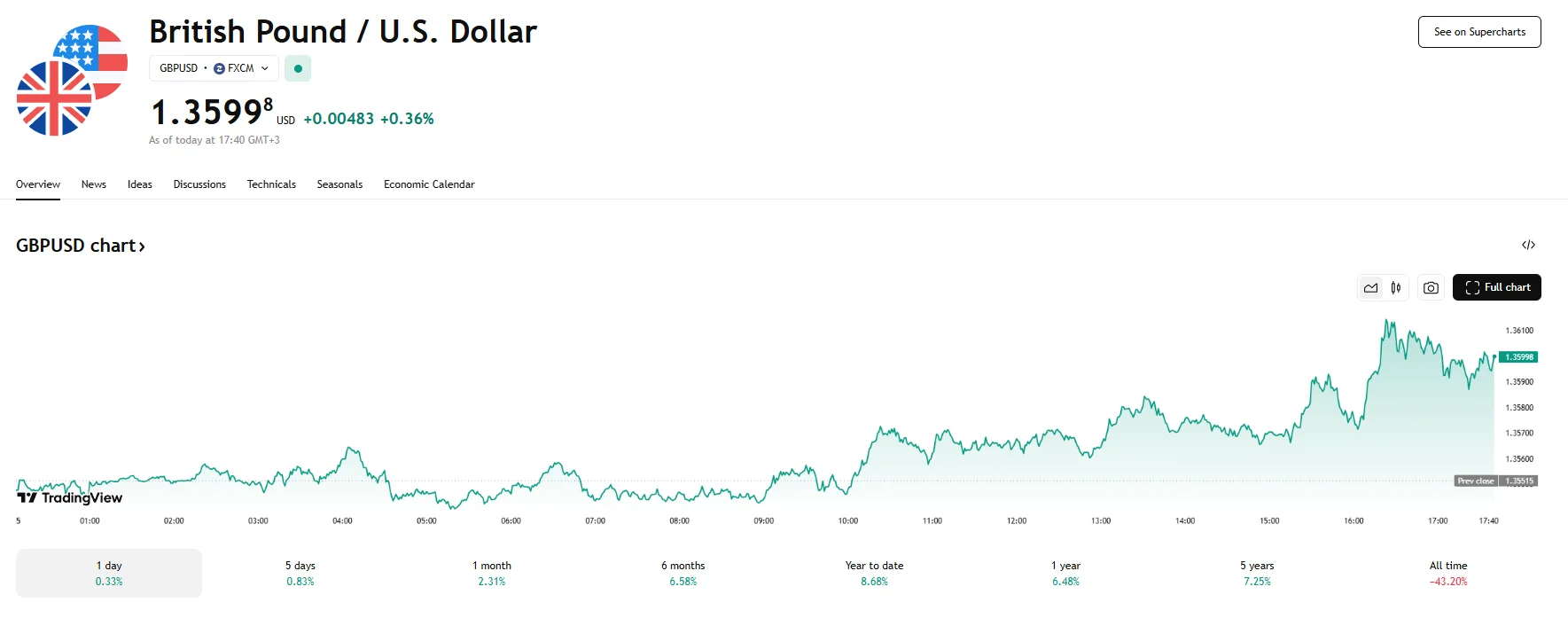

Key Moments:GBP/USD soared above 1.3600 on Thursday amid a climb of over 0.35%.The US dollar Index remains under pressure below $99.00.US jobless claims unexpectedly rose to 247,000, surpassing foreca

GBP/USD Rallies to 3-Year Peak Near 1.3600 GBP/USD Rallies to 3-Year Peak Near 1.3600

Key Moments:

- GBP/USD soared above 1.3600 on Thursday amid a climb of over 0.35%.

- The US dollar Index remains under pressure below $99.00.

- US jobless claims unexpectedly rose to 247,000, surpassing forecasts and weakening the US dollar.

Softening Greenback Fuels Sterling’s Climb

The British pound continued its upward trajectory on Thursday, supported by broad-based pressure on the US dollar. The GBP/USD pair climbed beyond the 1.3600 mark, reaching levels last seen in February 2022.

The latest weekly report from the US Department of Labor revealed that initial jobless claims increased to 247,000 last week, a figure that failed to reach the 235,000 forecast by market participants. The news served to further push an already struggling greenback, as the Dollar Index has been trading below the 99.00 threshold on June 5th.

ECB Decision Accelerates USD Outflows

Further straining the dollar, the European Central Bank decided to implement an interest rate cut of 25 basis points today. What is more, comments from ECB President Christine Lagarde pointed to a cautious but optimistic outlook. According to Lagarde, the bank is now “in a good place” and is potentially approaching the end of the current policy cycle. These remarks prompted even greater capital outflows from the USD.

Investors Eye Fed Outlook and US Jobs Report

In tandem with the developments in Europe, the greenback faced pressure from recent labor data that traders broadly deemed disappointing. Jobless claims advanced to 247,000 during May’s final week, while Q1 labor costs surged by 6.6%. Productivity, in contrast, fell by 1.5%.

Now, market participants are awaiting speeches from multiple Federal Reserve officials set for Thursday, ahead of the US Bureau of Labor Statistics’ upcoming employment data for May. According to the CME FedWatch Tool, the chances of a rate cut of 25 basis points being implemented in July currently stand at 30% based on market expectations.