Key momentsGBP/USD reaches a four-month peak of 1.2989, driven by weakened US Dollar.US inflation data fuels speculation of Federal Reserve rate cuts, impacting Dollar value.UK housing market shows si

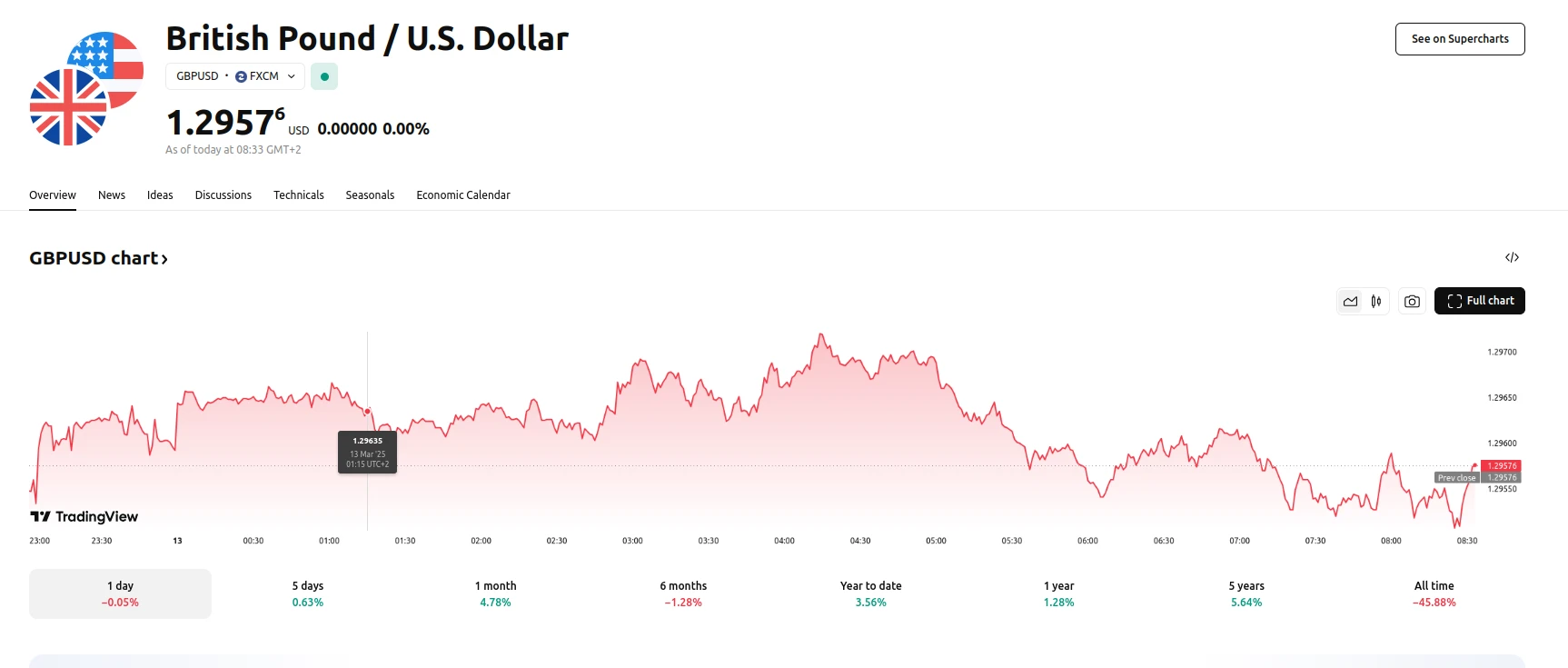

GBPUSD Stays Firm Above 1.2950, Near 4-Month Peak

Key moments

- GBP/USD reaches a four-month peak of 1.2989, driven by weakened US Dollar.

- US inflation data fuels speculation of Federal Reserve rate cuts, impacting Dollar value.

- UK housing market shows signs of cooling, with RICS Housing Price Balance declining.

GBP/USD Maintains Strong Position Amid Diverging Economic Signals

The GBP/USD currency pair has demonstrated sustained strength, holding above the 1.2950 threshold and approaching a four-month high. This upward trend is primarily attributed to the weakening US Dollar, influenced by recent inflation data that suggests a potential shift in the Federal Reserve’s monetary policy. The observed cooling of US inflation, with both headline and core figures falling below expectations, has increased speculation that the Fed may implement rate cuts sooner than previously anticipated. This development has placed downward pressure on the Greenback, contributing to the GBP/USD pair’s ascent.

Concurrently, the UK’s economic landscape presents a mixed picture. While the Pound benefits from the Dollar’s weakness, domestic data reveals signs of a moderating housing market. The Royal Institution of Chartered Surveyors (RICS) Residential Market Survey reported a decline in the Housing Price Balance to 11% in February, marking a second consecutive monthly decrease. This figure fell short of market projections, indicating a potential slowdown in the UK’s housing sector. However, the UK gilt yields are rising (4.68%), indicating that the market expects the Bank of England to hold rates higher for longer.

Furthermore, the UK government’s approach to trade negotiations with the US, particularly regarding potential tariffs, is being closely monitored. Prime Minister Keir Starmer expressed optimism about avoiding US tariffs on steel and aluminum while maintaining a pragmatic approach, which adds a layer of economic and political context to the currency pair’s performance. Market participants are now awaiting further economic indicators, including US Producer Price Index (PPI) data, weekly jobless claims, and UK GDP figures, to better understand the factors influencing the GBP/USD exchange rate.