Key momentsThe New Zealand Dollar fell to around $0.57 on Wednesday, briefly dipping below that level.Trumps unpredictable tariffs have increased risk aversion and negatively impacted the NZD.New Zeal

NZD Hits $0.57 Amid Global Economic Fears NZD Hits $0.57 Amid Global Economic Fears

Key moments

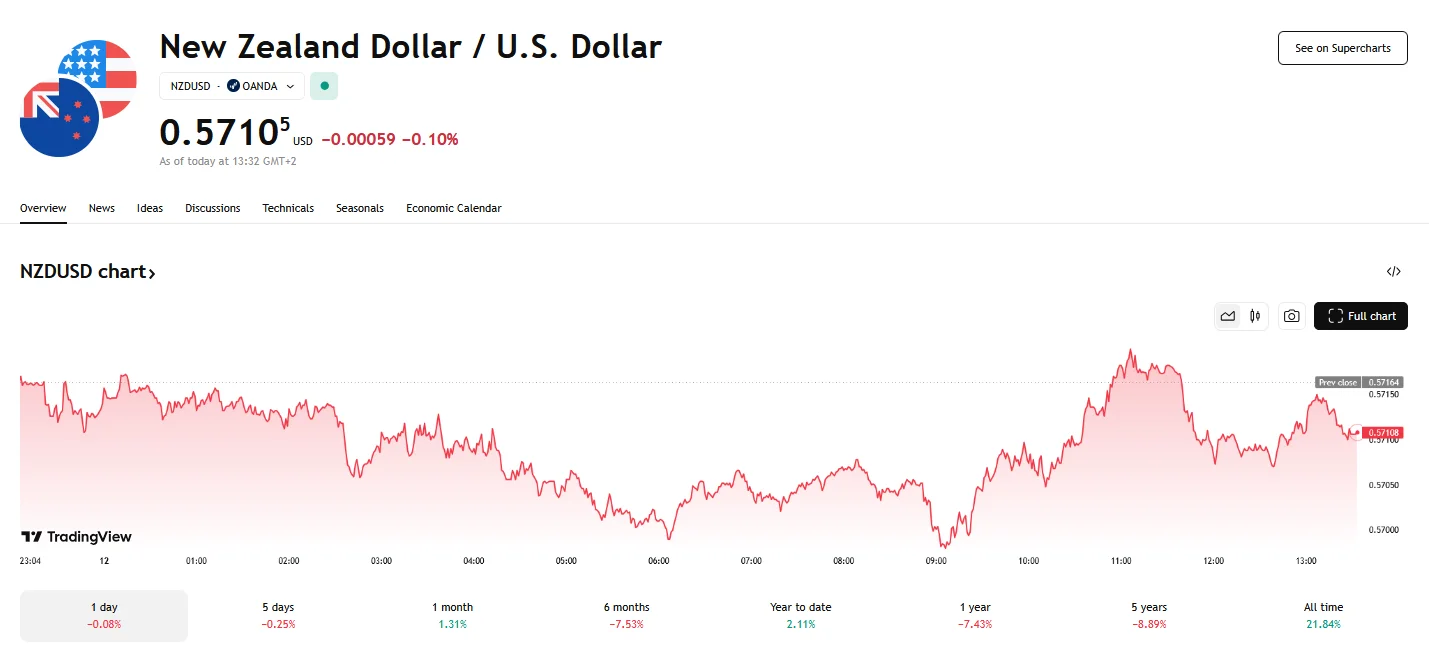

- The New Zealand Dollar fell to around $0.57 on Wednesday, briefly dipping below that level.

- Trump’s unpredictable tariffs have increased risk aversion and negatively impacted the NZD.

- New Zealand’s electronic card transactions rose 0.3% to NZD 6,528 million in February.

New Zealand Dollar Struggles as Market Sentiment Turns Sour

The New Zealand Dollar experienced a noticeable decline on Wednesday, dropping to approximately $0.57, as global economic uncertainties cast a shadow over market sentiment. Earlier, the price dipped below the $0.57 threshold. This downward trend is attributed to a combination of factors, including the potential impact of U.S. trade policies, the anticipation of crucial U.S. inflation data, and persistent deflationary pressures in China, New Zealand’s primary export market.

Unpredictable trade policies from U.S. President Donald Trump, particularly the imposition of tariffs, have created significant investor apprehension. This has resulted in heightened risk aversion and consequently impacted the New Zealand Dollar’s value, as fears of a prolonged trade war grow. Simultaneously, the U.S. Consumer Price Index (CPI) report is eagerly anticipated by financial markets, as it will provide crucial insights for evaluating the Federal Reserve’s upcoming interest rate decisions.

Further exacerbating the New Zealand Dollar’s challenges are growing concerns regarding deflationary pressures in China. Market sentiment has been significantly weakened by recent Chinese economic data. February saw consumer prices in China plummet to their lowest point in 13 months, and factory-gate prices have now declined for 29 consecutive months. This is particularly concerning given China’s status as New Zealand’s largest trading partner. However, despite the prevailing downward pressure on the New Zealand Dollar, its decline may be tempered by concerns regarding a potential economic slowdown in the United States.

On the domestic front, February 2025 saw a 0.3% increase in New Zealand’s electronic card transactions, reaching NZD 6,528 million on a seasonally adjusted basis. This modest growth was driven by a 0.6% rise in consumables and a 1% increase in apparel purchases, while fuel transactions remained static.