Key momentsThe euro experienced a 0.10% increase yesterday, trading at 82.53 pence, recovering from a recent low of 82.40 pence.The pound sterling demonstrated a 0.30% gain against the U.S. dollar, re

Pound Rises 0.30% Against Dollar to $1.26, Struggles to Maintain Ground against Euro Pound Rises 0.30% Against Dollar to $1.26, Struggles to Maintain Ground against Euro

Key moments

- The euro experienced a 0.10% increase yesterday, trading at 82.53 pence, recovering from a recent low of 82.40 pence.

- The pound sterling demonstrated a 0.30% gain against the U.S. dollar, reaching $1.2614.

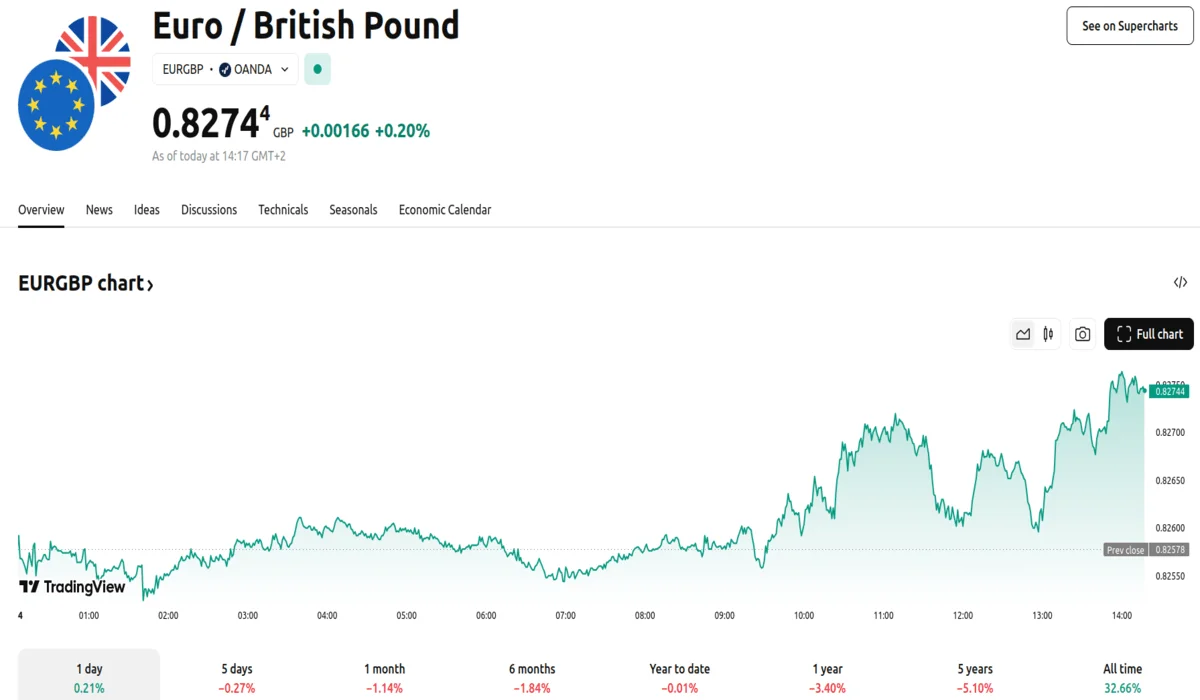

- The British currency currently trades at 82.74 pence against the euro, showing a 0.20% increase at the time of publication.

Pound Sterling Records First Monthly Increase against the Dollar since Last September

The British pound exhibited mixed performance in Monday’s trading, influenced by both geopolitical developments and economic factors. The pound experienced a slight decline against the euro, while strengthening against the U.S. dollar. The euro climbed to 82.53 pence for a 0.10% increase on Monday after descending to 82.40 pence the previous week, which was its lowest point since mid-December.

Conversely, the sterling rose 0.30% against the dollar, reaching $1.2614 last Friday. This rise marked the pound’s first monthly increase against the greenback since September, primarily driven by expectations that the Bank of England would maintain higher interest rates for a longer period compared to other central banks. The sterling currently trades at 82.74 pence against the euro, marking a 0.20% gain since yesterday.

The European leaders’ agreement to formulate a Ukraine peace plan to present to the United States has impacted currency values. The euro is anticipated to be the primary beneficiary of any peace agreement in the region, particularly as Germany considers significant fiscal spending increases.

However, the euro has faced broader pressures due to U.S. President Trump’s threats of imposing 25% tariffs on European Union exports. Economists anticipate that these potential protectionist measures would exert downward pressure on European currencies, though to a lesser extent on the pound.

The dollar experienced a decline as investors focused on the possibility of a peace deal and increased fiscal spending within the Eurozone. In the UK, wage pressures have raised concerns about inflation remaining above the Bank of England’s target. However, the Bank’s Deputy Governor Dave Ramsden indicated that interest rate cuts might not necessarily be slow.

Analysts have noted that the UK’s economic data calendar is relatively quiet this week. The Treasury Committee’s questioning of Bank of England Governor Andrew Bailey and other monetary policy committee members on Wednesday is the most significant domestic event at the moment.