Key momentsSignificant Whale Accumulation Amid Initial Price SurgeSubsequent Price Decline Despite Large-Scale PurchasesMarket Uncertainty Fueled by External Economic Factors and Regulatory DelaysXRP

Ripple Whales Scoop Up 1 Billion XRP, Price Action Diverges

Key moments

- Significant Whale Accumulation Amid Initial Price Surge

- Subsequent Price Decline Despite Large-Scale Purchases

- Market Uncertainty Fueled by External Economic Factors and Regulatory Delays

XRP Market Sees Conflicting Signals: Whale Activity Contrasts with Price Correction

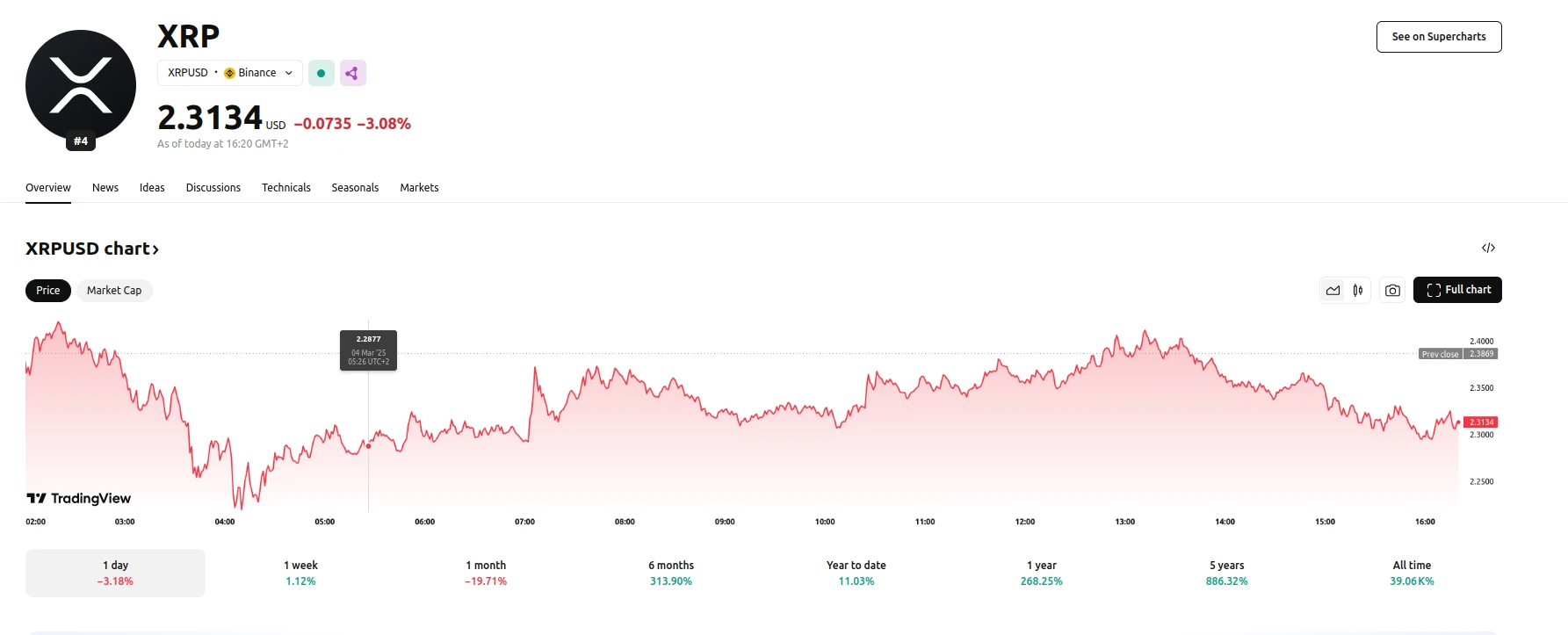

Recent market activity surrounding Ripple’s XRP has presented a notable divergence between large-scale accumulation and price movement. Data indicates that significant XRP holders, often referred to as “whales,” amassed approximately 1 billion XRP tokens following a substantial price surge. However, despite this influx of capital, the price of XRP subsequently experienced a downward trend, raising questions about the underlying market dynamics.

The initial price surge, which saw XRP approach the $3 mark, attracted considerable attention and prompted the large-scale purchases by whales. However, the momentum proved short-lived, with XRP experiencing a subsequent price correction. This decline occurred amidst a broader sell-off within the cryptocurrency market, with over $1 billion in capital being withdrawn. Factors contributing to this market downturn include concerns related to potential economic policies, such as proposed tariffs, and general economic uncertainty.

Furthermore, the ongoing legal proceedings between Ripple and the U.S. Securities and Exchange Commission (SEC) continue to weigh on market sentiment. Delays in the resolution of this case have contributed to investor anxiety and may be influencing price volatility. While recent statements regarding the potential inclusion of XRP in a U.S. crypto reserve initially generated positive market reaction, the long-term impact of these statements remains uncertain. Technical analysis suggests that key support levels, such as $2.40 and $2.20, will be crucial in determining XRP’s near-term trajectory. Should the price fall below these levels, further declines could occur. Conversely, maintaining these support levels could pave the way for a potential recovery. The crypto market as a whole remains volatile, and XRP is no exception.