Key Moments:USD/KRW slid closer to 1,350 on Monday, with the South Korean won nearing an eight-month high.It has been confirmed that Washington and Seoul will engage in trade negotiations surrounding

South Korean Won Approaches 8-Month High, USD/KRW Drops 0.51% on Confirmation of Washington-Seoul Tariff Talks South Korean Won Approaches 8-Month High, USD/KRW Drops 0.51% on Confirmation of Washington-Seoul Tariff Talks

Key Moments:

- USD/KRW slid closer to 1,350 on Monday, with the South Korean won nearing an eight-month high.

- It has been confirmed that Washington and Seoul will engage in trade negotiations surrounding the revision of tariff rules.

- South Korean stocks also enjoyed gains amid improving sentiment surrounding tariffs.

Won Strengthens as Trader Enthusiasm Grows

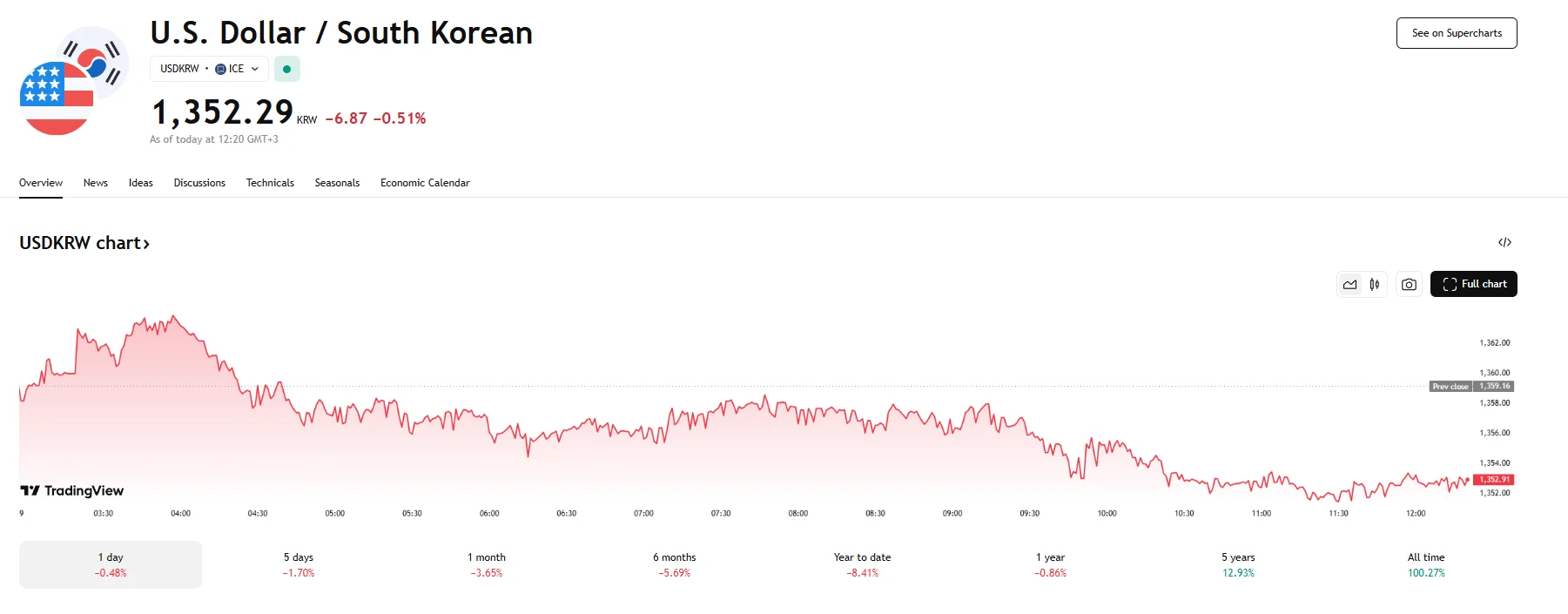

The USD/KRW forex pair sank by 0.51% on Monday and reached 1,352.29. This marked a steady climb towards the South Korean won’s strongest level in nearly eight months.

Gains were attributed to market enthusiasm, as investors welcomed news that Donald Trump and Lee Jae-myung, South Korea’s president, have reached a consensus to launch discussions on a revamped tariff network. A meeting between the two leaders may occur as early as the G7 summit scheduled later this month.

Deal Prospects Aids Forex and Equity Markets Alike

The new rules, should they come into effect, are expected to ease the tariff burden on Korea and promote trade relations marked by fairness. The talks may also reduce friction from earlier disputes and provide greater clarity for critical South Korean export industries, including the semiconductor sector, steel, and autos. The potential of an updated agreement raised hopes of more stable trade conditions for these sectors. Sentiment also rose in anticipation of an upcoming tariff-related meeting between US and Chinese officials.

Rising trade hopes surrounding US trade relations also served to aid South Korea’s equity markets. Monday witnessed the benchmark KOSPI jump by 1.55% and hit 2,855.78 amid a broader rally across Asian nations. Shinsung Tongsang and financial giant KakaoPay towered over other components by rallying almost 30% by the time Monday’s trading session ended. E Investment & Development, meanwhile, rose by 20.52%, while Pyung HWA Holding and Daidong Electronics jumped by 16.63% and 16.05%, respectively.