Key momentsThe Dollar Index managed to increase by 0.46%, going above 103.900.The EUR/USD pair is trading around 1.0840.During this week’s meeting, the Federal Reserve did not cut interest rates. Acco

U.S. Dollar Index Surges Past 103.900, EUR/USD Falls Below 1.0900 U.S. Dollar Index Surges Past 103.900, EUR/USD Falls Below 1.0900

Key moments

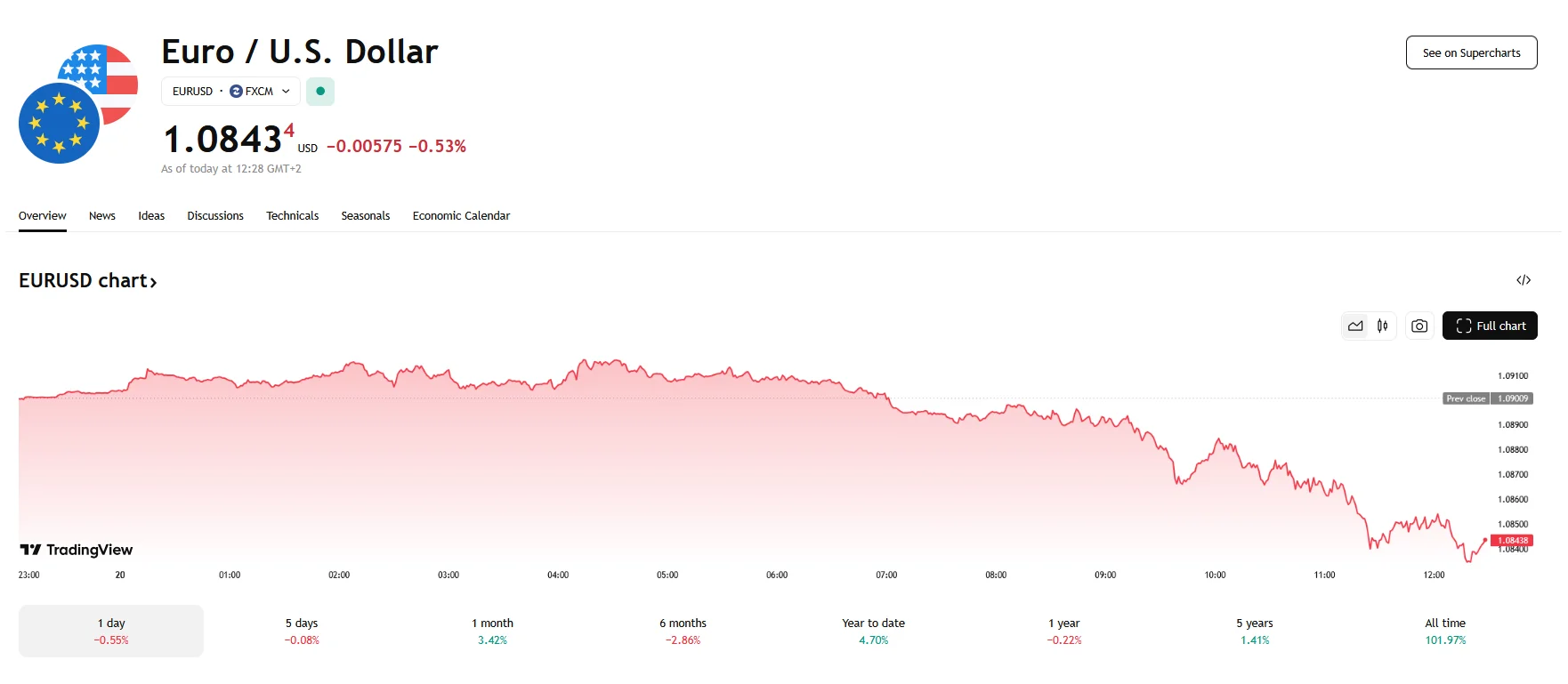

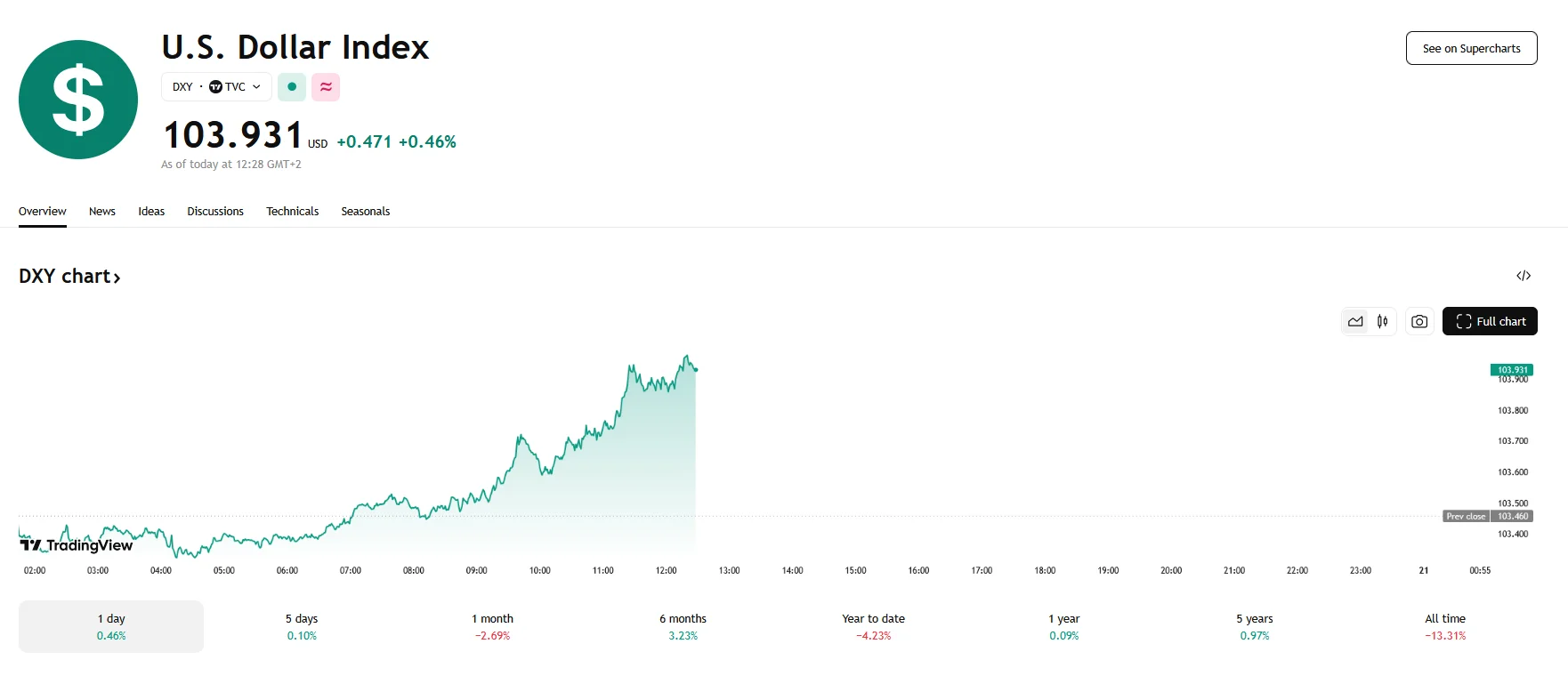

- The Dollar Index managed to increase by 0.46%, going above 103.900.

- The EUR/USD pair is trading around 1.0840.

- During this week’s meeting, the Federal Reserve did not cut interest rates. According to projections, however, rates could be reduced later this year.

U.S. Dollar Regains Strength, Climbs Above 103.900 Amidst Market Uncertainty

The global currency markets have recently witnessed significant shifts, with the U.S. Dollar Index (DXY) experiencing a notable surge of 0.46% and the EUR/USD pair dipping below the 1.0900 mark. These movements are heavily influenced by the Federal Reserve’s (Fed) monetary policy decisions and evolving market expectations regarding interest rates.

The Dollar Index gained upward momentum on Thursday and climbed above the 103.900 threshold. This trend is indicative of the dollar’s renewed strength in the face of various economic and geopolitical factors. However, the dollar’s performance is also being weighed down by shifting market sentiment regarding the Fed’s future actions.

Central to these market dynamics is the Fed’s stance on interest rates. While the Fed has maintained its benchmark interest rate within the 4.25%-4.50% range, there are projections of potential rate cuts in the coming years. These forecasts, coupled with acknowledgments of slowing economic growth and persistent inflation, have fueled speculation about monetary easing.

Market expectations for a July rate cut have solidified, with traders pricing in a substantial degree of monetary easing for the year. This anticipation of lower interest rates has exerted downward pressure on the dollar, as reduced yields make it less attractive to investors. Moreover, the decline in U.S. Treasury yields, particularly the 2-year and 10-year yields, has further contributed to the dollar’s weakening.

Concurrently, the EUR/USD pair has experienced a decline of 0.53%, falling below the 1.0900 level as the dollar strengthened. The pair will be further influenced by the European Central Bank’s (ECB) policy outlook, as well as the outcomes of the upcoming EU summit.

Geopolitical factors, such as the ongoing tensions between Russia and Ukraine, as well as potential trade policy changes by the U.S., are also contributing to market uncertainty and continue to exert influence on both currencies. These developments can significantly impact investor sentiment and currency valuations.