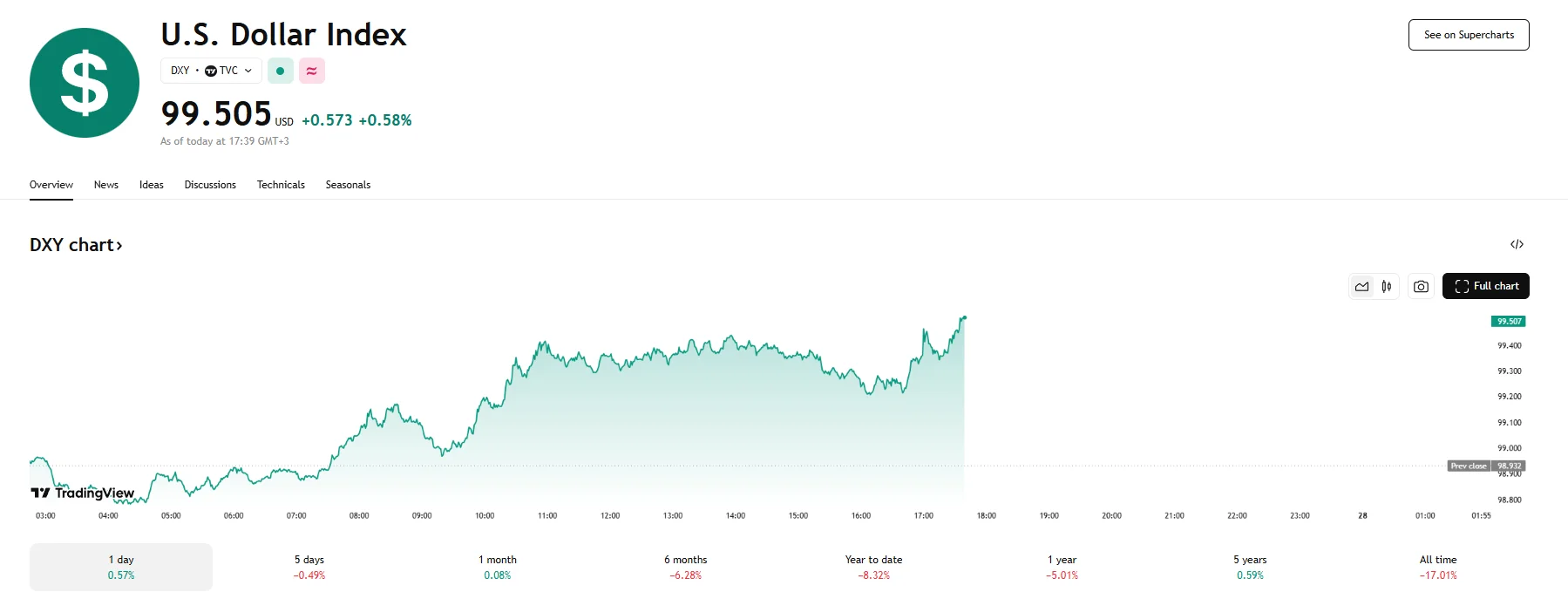

Key Moments:The US Consumer Confidence Index rose sharply to 98.0 in May, up from the reading of 86.0 observed in April.The Expectations Index jumped 17.4 points to 72.8.The US Dollar Index rose to 99

US Consumer Confidence Surges to 98.0, Dollar Index Climbs 0.58% to 99.505 US Consumer Confidence Surges to 98.0, Dollar Index Climbs 0.58% to 99.505

Key Moments:

- The US Consumer Confidence Index rose sharply to 98.0 in May, up from the reading of 86.0 observed in April.

- The Expectations Index jumped 17.4 points to 72.8.

- The US Dollar Index rose to 99.505, while the EUR/USD extended earlier losses and fell to 1.1339.

US Consumer Sentiment Rebounds in May, Dollar Climbs

Consumer sentiment in the United States climbed in May, with the Conference Board’s Consumer Confidence Index advancing to 98.0 compared to April’s 86.0, marking a notable recovery.

Optimism among consumers showed signs of strengthening as perceptions of both present conditions and future expectations turned more positive. The Present Situation Index gained 4.8 points, reaching 135.9 and reflecting better ratings of ongoing business and labor market conditions.

The Expectations Index, which captures consumers’ views on short-term income prospects and employment, showed even stronger momentum by surging 17.4 points to 72.8. While this remains below 80 points, a level commonly viewed as a threshold for recession concerns, the improvement nonetheless highlights growing consumer confidence in the near-term economic outlook.

According to Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board, the economic rebound was already noticeable prior to the May 12th US-China trade deal, yet it accelerated significantly thereafter. She added that consumer expectations primarily drove the monthly improvement, with future outlooks on business, employment, and income all rebounding from April lows. However, despite improved views on current business, consumers’ assessment of present job availability declined for the fifth consecutive month.

The US Dollar remained broadly supported, with the US Dollar Index trading managing to rise 0.58% to 99.505 and the EUR/USD continuing to trade lower at 1.1339. This came even as US yields experienced a slight pullback across the curve, suggesting that the improved consumer sentiment helped underpin interest in the greenback.