Key Moments:On Monday, the US Dollar Index hovered near 99.100 after earlier declines as attention shifted to the US-China discussions in London.The greenback traded lower against the yen, euro, and t

US Dollar Index Stabilizes Near 99.100 Amid Trade Talks US Dollar Index Stabilizes Near 99.100 Amid Trade Talks

Key Moments:

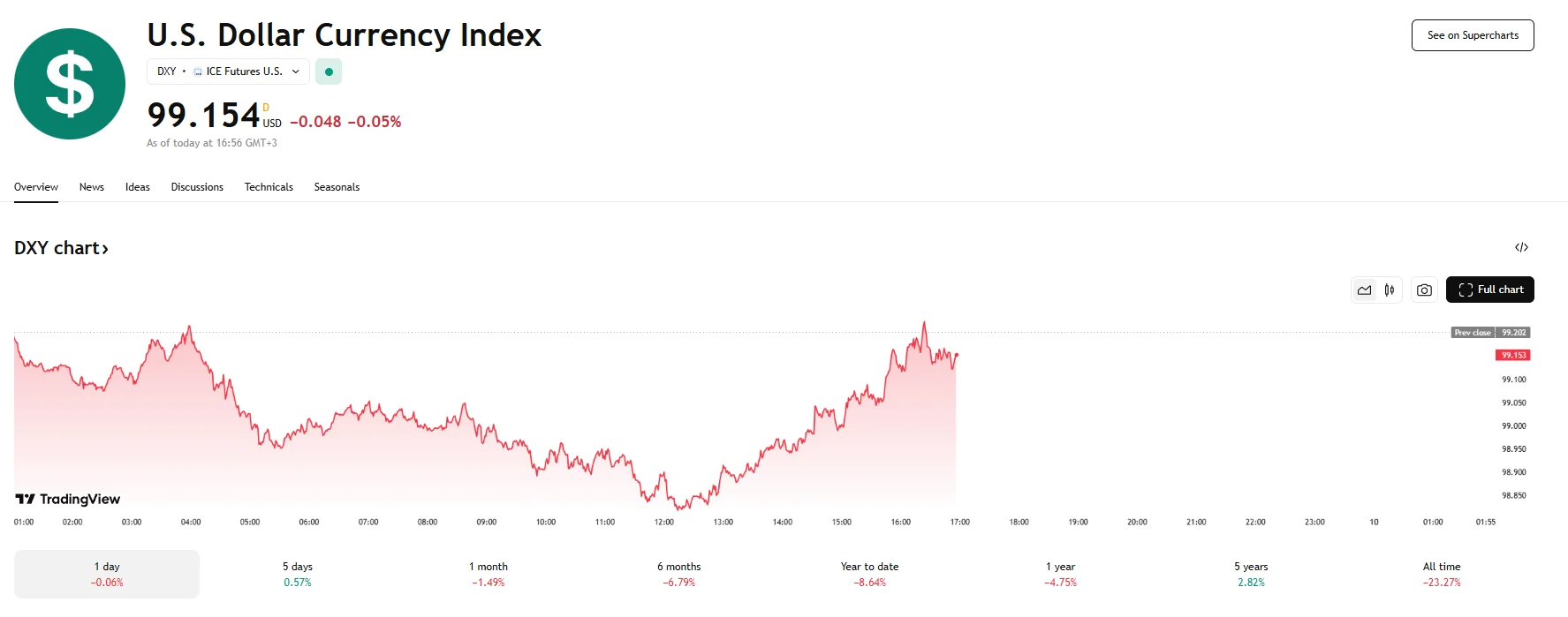

- On Monday, the US Dollar Index hovered near 99.100 after earlier declines as attention shifted to the US-China discussions in London.

- The greenback traded lower against the yen, euro, and the pound.

- Investors are looking forward to key inflation data that should be published later in the week as it could shape expectations for monetary policy.

Markets Focus on US-China Relations

The US Dollar Index trimmed earlier losses and traded mostly flat near the 99.100 mark during US trading hours on Monday while investors tracked developments from in-person talks in London between US and Chinese trade representatives. This diplomatic engagement followed renewed hopes of progress in easing trade tensions that were ignited by a recent phone call between Trump and President Xi.

The dollar continues to linger near its weakest point in over three years, however, as the currency has been weighed down by growing unease over the economic implications of the Trump administration’s trade and fiscal policies. These concerns drove investors to reduce exposure to US assets.

Today’s upward momentum also failed to push the dollar toward gains, as at press time, it is still trading lower than major peers like the yen, euro, and British pound. The USD/JPY fell the sharpest by 0.15% to around 144.601.

Trade and Supply Chain Developments as Key Reports Loom

While this week’s economic calendar remains relatively sparse, attention is turning to critical data points. The US Consumer Price Index (CPI) is scheduled for release on Wednesday, while on June 12th, the United Kingdom will publish its Gross Domestic Product (GDP) figures. In addition, the US is set to report on initial jobless claims later this week, which have recently shown an upward trend.

Market participants are also closely watching updates on trade supply chains. Officials from the US and China are holding talks on Monday that may lead to a handshake agreement on expanding rare earth exports. They may also potentially resolve other key points of contention when it comes to the trade relations between the two countries.