Key Moments:The US Producer Price Index declined 0.5% in April, marking its first monthly drop in over a year. Core wholesale prices (excluding food and energy) slipped 0.4% from March and rose 3.1% y

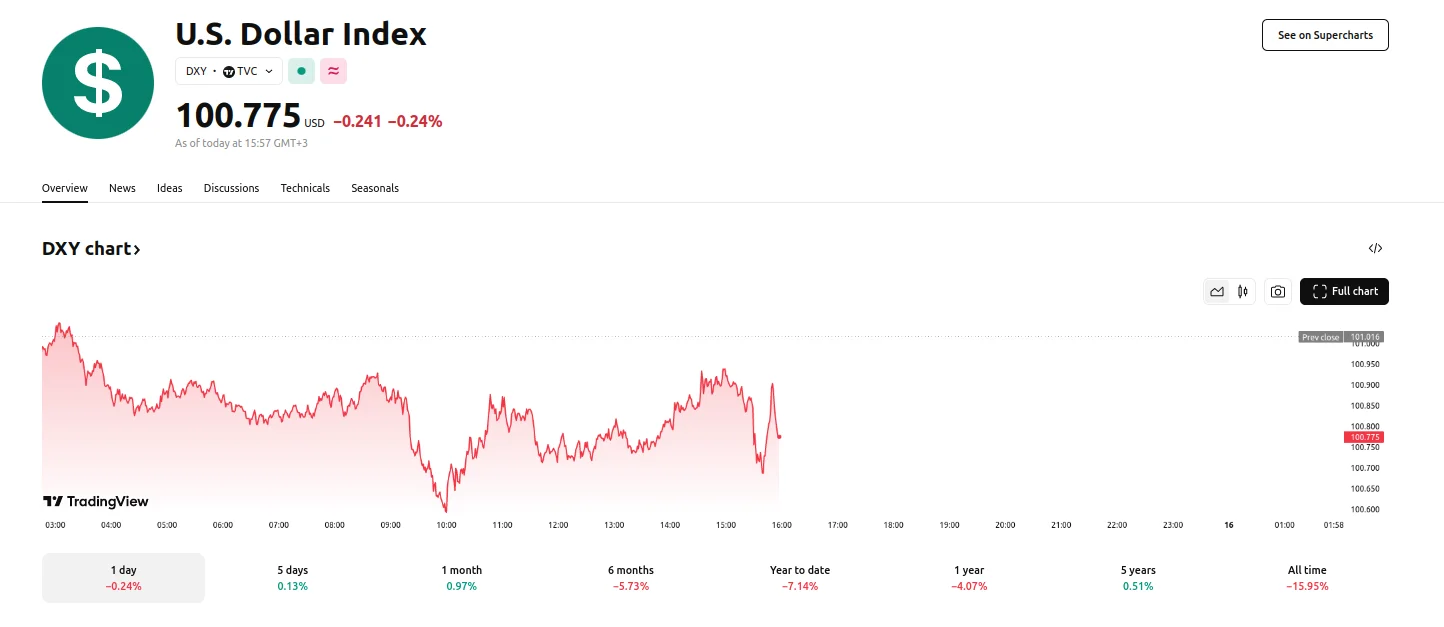

US Dollar Index Weakens to 100,775 Amid April Wholesale Price Decline and Boost to Retail Sales US Dollar Index Weakens to 100,775 Amid April Wholesale Price Decline and Boost to Retail Sales

Key Moments:

- The US Producer Price Index declined 0.5% in April, marking its first monthly drop in over a year. Core wholesale prices (excluding food and energy) slipped 0.4% from March and rose 3.1% year-over-year.

- Retail sales in the US edged up 0.1% in April to $724.1 billion, slightly ahead of expectations.

- The US Dollar Index extended its decline, dropping 0.24% to 100.775.

Wholesale Inflation Drops

US wholesale prices registered an unexpected decline in April, marking the first monthly decrease in more than 12 months. According to data released Thursday by the US Labor Department, the Producer Price Index (PPI) dropped 0.5% from March. However, compared to April 2024, the PPI climbed 2.4%.

The report showed that core wholesale prices, which do not include the typically volatile food and energy categories, also saw a downturn, falling 0.4% from the previous month. On a 12-month basis, core prices were up 3.1%.

Analysts had anticipated a mild uptick in wholesale prices for the month, but it ultimately failed to come to fruition. A key driver of the decline was a 0.7% drop in services prices, which exerted downward pressure on the overall index.

It is widely expected that the effects of President Donald Trump’s tariff measures may begin to surface in June or July. However, the volatile nature of trade policies has made the impact harder to forecast.

Retail Sales Edge Up

In a separate report released Thursday, the US Census Bureau disclosed that retail sales in April climbed 0.1% to $724.1 billion, adding onto the previous month’s 1.5% gains and beating market expectations. In terms of yearly performance, retail sales experienced a jump of 5.2%.

Over the February-April 2025 timeframe, total sales increased by 4.8% year-over-year, according to the report. In contrast, retail trade sales saw a marginal 0.1% decrease from March 2025, while still registering a 4.7% rise compared to the same time last year.

Following the release of both inflation and retail sales data, the US Dollar Index remained under pressure. It dropped by 0.24%, continuing to sink further away from the 101.00 threshold.