Key Moments:The Canadian dollar hovered close to 1.3700 per USD on Friday.Canada added only 8,800 jobs in May, pushing unemployment up to 7%.US tariffs and economic uncertainty have slowed hiring and

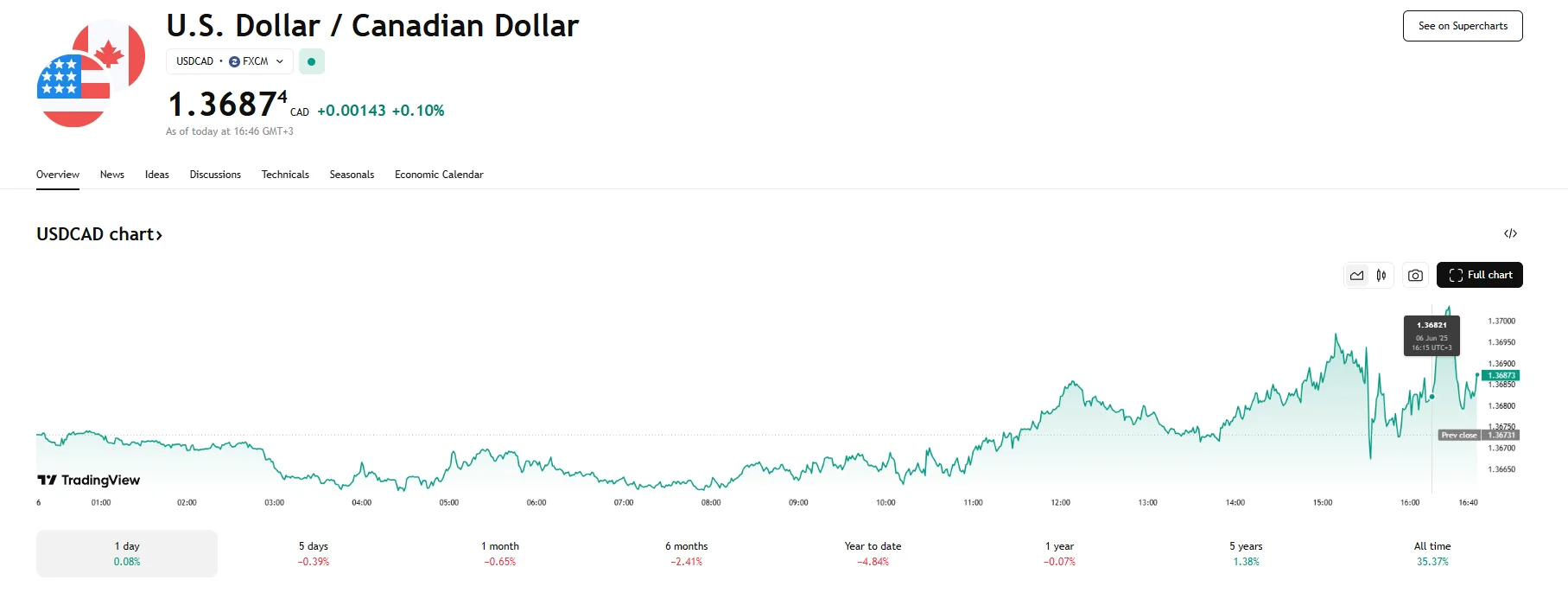

USD/CAD Drifts 0.1% Higher Near 1.370 as Canada’s Labor Market Loses Steam USD/CAD Drifts 0.1% Higher Near 1.370 as Canada’s Labor Market Loses Steam

Key Moments:

- The Canadian dollar hovered close to 1.3700 per USD on Friday.

- Canada added only 8,800 jobs in May, pushing unemployment up to 7%.

- US tariffs and economic uncertainty have slowed hiring and investment, according to the Bank of Canada.

USD/CAD Climbs to 1.3687

The Canadian dollar depreciated by 0.1% against the greenback on Friday, with the USD/CAD pair trading near 1.3700. The decline followed news of Canada’s labor market suffering a setback in May.

The country’s employment gains in May were modest, with just 8,800 positions added. The unemployment rate rose to 7%, a high unseen in around four years. As per Statscan estimates, the figure also marks the highest level of joblessness since 2016 when not including the rates reported during the Covid-19 pandemic.

According to Statistique Canada, the increase was not fueled by mass layoffs but rather a combination of stagnant job creation and population growth. One notable factor has been a lengthening in the duration of unemployment, as job seekers spent an average of 21.8 weeks searching for work last month, up from 18.4 weeks a year earlier.

Tariffs and Uncertainty Damp Business Outlook

Industries dependent on exports have begun to feel pressure from existing US tariffs. The unclear scope and impact of these duties have generated business uncertainty, as stated by the Bank of Canada, which served to discourage both hiring and investment. The bank believes that these effects will persist and contribute to further labor market challenges.

Earlier indicators, including a 2.2% GDP expansion in the first quarter and an extended period of retail sales growth, had painted a more optimistic picture that allowed the Bank of Canada to maintain its policy rate at 2.75%. However, concerns over broader trade disruption continue to weigh on markets despite ongoing trade talks between the US and the Canadian Government that have been described as “intensive” by officials.

Meanwhile, wage growth among permanent employees stayed flat at 3.5%. This is a key metric that the Bank of Canada monitors to assess inflation pressures.