Key Moments:USD/CAD dropped below the 1.3800 threshold on Monday before edging higher.The greenback is facing pressure amid mounting trade concerns.Trump is enforcing a 100% duty on movies made abroad

USD/CAD Reclaims 1.3800, Trump Announces 100% Tariff on Non-US Movies USD/CAD Reclaims 1.3800, Trump Announces 100% Tariff on Non-US Movies

Key Moments:

- USD/CAD dropped below the 1.3800 threshold on Monday before edging higher.

- The greenback is facing pressure amid mounting trade concerns.

- Trump is enforcing a 100% duty on movies made abroad.

USD/CAD Struggles for Traction

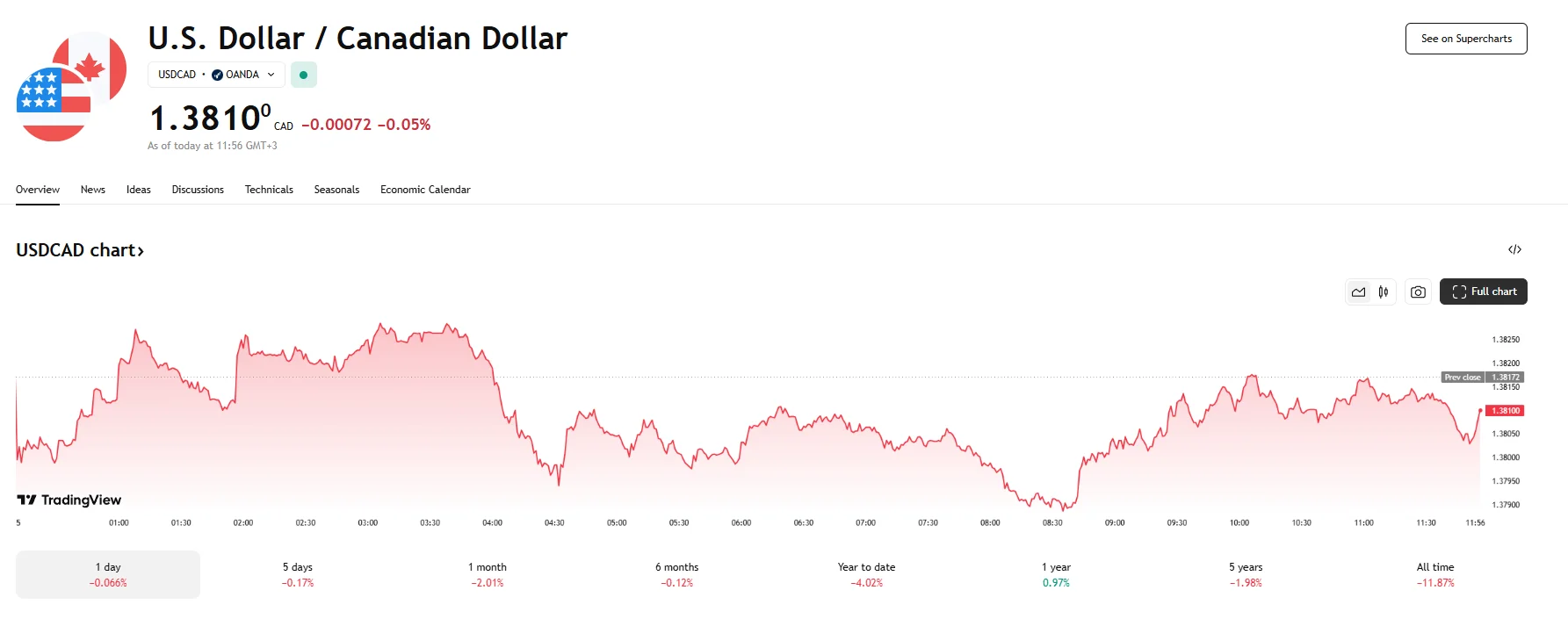

The USD/CAD currency pair saw little movement on Monday, hovering around 1.3810 after an earlier tumble saw the pair drop to 1.3788. On the technical side, daily chart patterns suggest a potential shift toward bullish sentiment, as the pair continues to stay above a descending channel formation.

However, the potential for further gains may encounter challenges. The US Dollar is currently facing headwinds, which may intensify due to another spike in trade concerns. Specifically, US President Donald Trump unveiled his plan to begin implementing a substantial 100% levy on films produced outside the US. This announcement has injected further uncertainty into the country’s economic outlook and could weigh on the Dollar’s overall strength.

Conversely, the Canadian Dollar has gained some traction against its peers as fears concerning an imminent economic downturn in Canada have receded somewhat. Recent figures on Canada’s Gross Domestic Product indicated a modest expansion during the month of March. This positive data emerged despite challenges, such as declining prices for key commodities and anxieties surrounding a possible escalation of trade tensions.

On the technical front, analysts have noted that the 14-day Relative Strength Index (RSI) stood near 30, signaling continued bearish bias but stopping short of oversold conditions. The 1.3800 level is now under scrutiny by the pair, representing a significant psychological floor. On the upside, the immediate hurdle lies at the nine-day EMA of 1.3839. A break above this level could strengthen bullish momentum in the short term.