Key Moments:USD/CAD slid 0.13% to 1.3678 on Monday.The US Dollar Index slipped below 99.00.US May unemployment stood at 4.2%, while Canada’s unemployment rate rose to 7%.Dollar Retreats After Initial

USD/CAD Softens 0.13% to 1.3678 While Markets Await US-China Trade Talks USD/CAD Softens 0.13% to 1.3678 While Markets Await US-China Trade Talks

Key Moments:

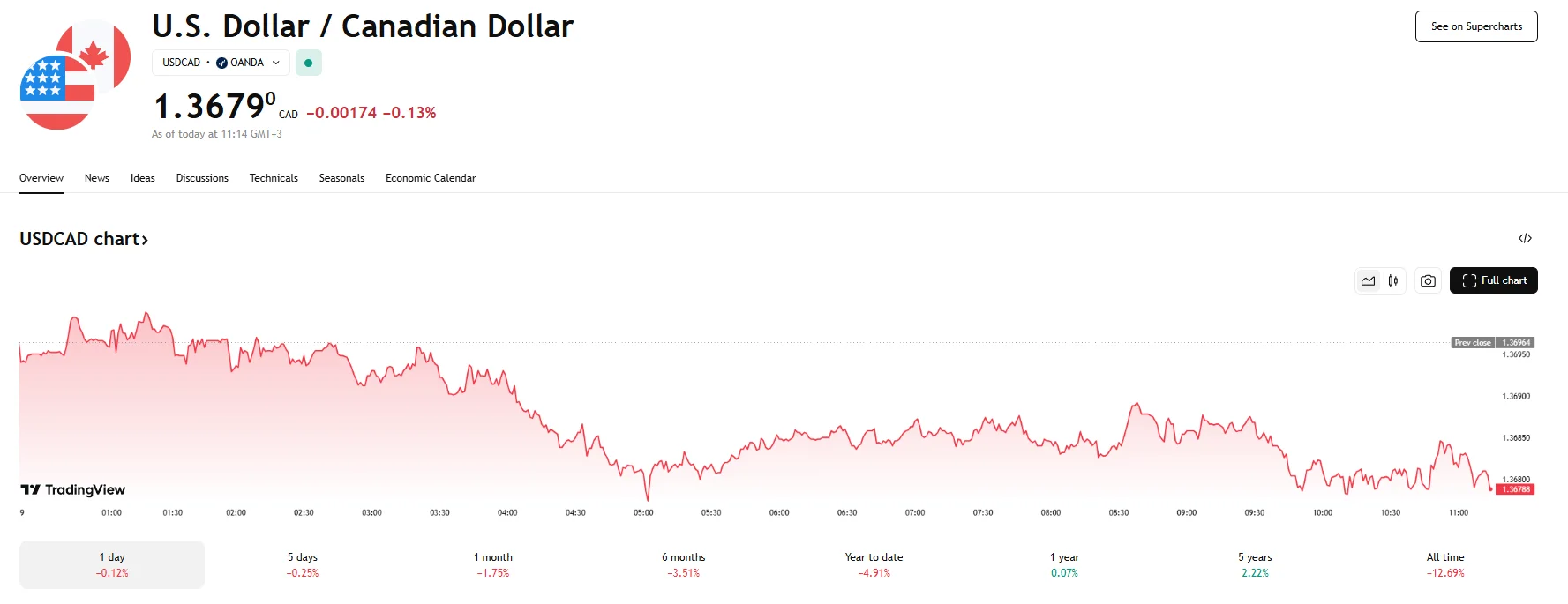

- USD/CAD slid 0.13% to 1.3678 on Monday.

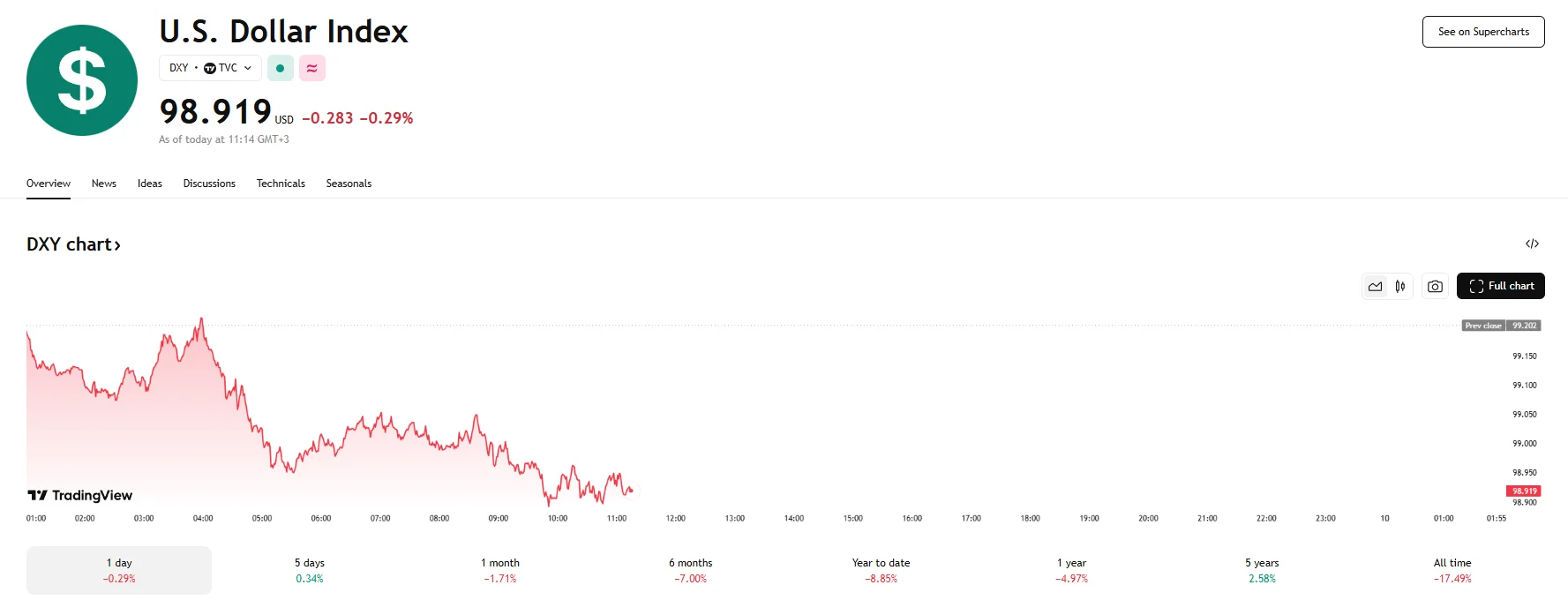

- The US Dollar Index slipped below 99.00.

- US May unemployment stood at 4.2%, while Canada’s unemployment rate rose to 7%.

Dollar Retreats After Initial Gains on Jobs Report

USD/CAD suffered declines on Monday as the greenback eased from earlier advances sparked by Friday’s robust Nonfarm Payrolls report. The pair fell by 0.13% and hit 1.3678.

Market sentiment turned cautiously upbeat as attention shifted toward the trade discussions between Beijing and Washington, scheduled to take place in London sometime today. With representatives from both nations reconvening to continue efforts initiated in Geneva in May, investors appeared hopeful for progress. The prior talks led to a notable easing of tariffs, lifting market spirits.

However, optimism around these negotiations coincided with traders scaling back on US dollar holdings. The US Dollar Index, which tracks its performance against major peers, fell 30% and reached 98.915.

Labor Market Data Backs Fed’s Steady Policy Stance

The greenback had rallied on Friday following unexpectedly strong employment data, according to which 139,000 jobs were created last month. The figure surpassed forecasts of 130,000, which helped to alleviate concerns stemming from sluggish business activity readings and a disappointing ADP Employment report. Meanwhile, the unemployment rate held firm at 4.2%, and wage growth remained at 3.7%.

These indicators pointed to continued tightness in the labor market, supporting the Federal Reserve’s current approach and suggesting no urgent need for additional interest rate cuts.

Mixed Picture from Canada’s Employment Report

As for Canada’s recent employment figures, job growth showed a modest rebound, with 8,000 positions being added in May, far exceeding the expectations of analysts who had expected a decline of 15,000. It also served to reverse April’s 7,600 drop, providing some relief.

However, the positive sentiment was short-lived, as the unemployment rate climbed to 7% from the previous 6.9%, reaching territory last seen during the COVID-19 pandemic. The news pushed the CAD/USD lower.