Key Moments:Thursday saw the USD/CHF pair surge 0.46% to around 0.8300.The Dollar Index breached 100.000 after the US Federal Court blocked President Trump’s use of emergency powers to impose broad ta

USD/CHF Climbs 0.46% to Over 1-Week High, Dollar Index Rebounds to 100.058 USD/CHF Climbs 0.46% to Over 1-Week High, Dollar Index Rebounds to 100.058

Key Moments:

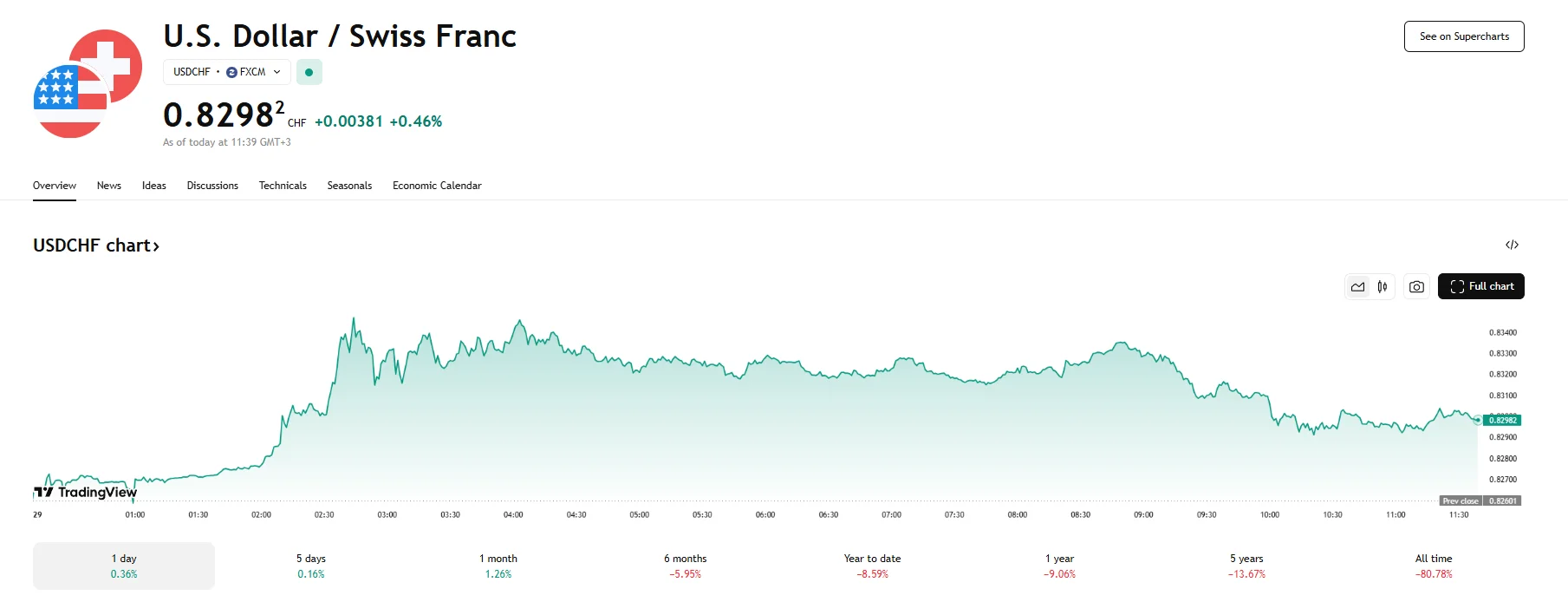

- Thursday saw the USD/CHF pair surge 0.46% to around 0.8300.

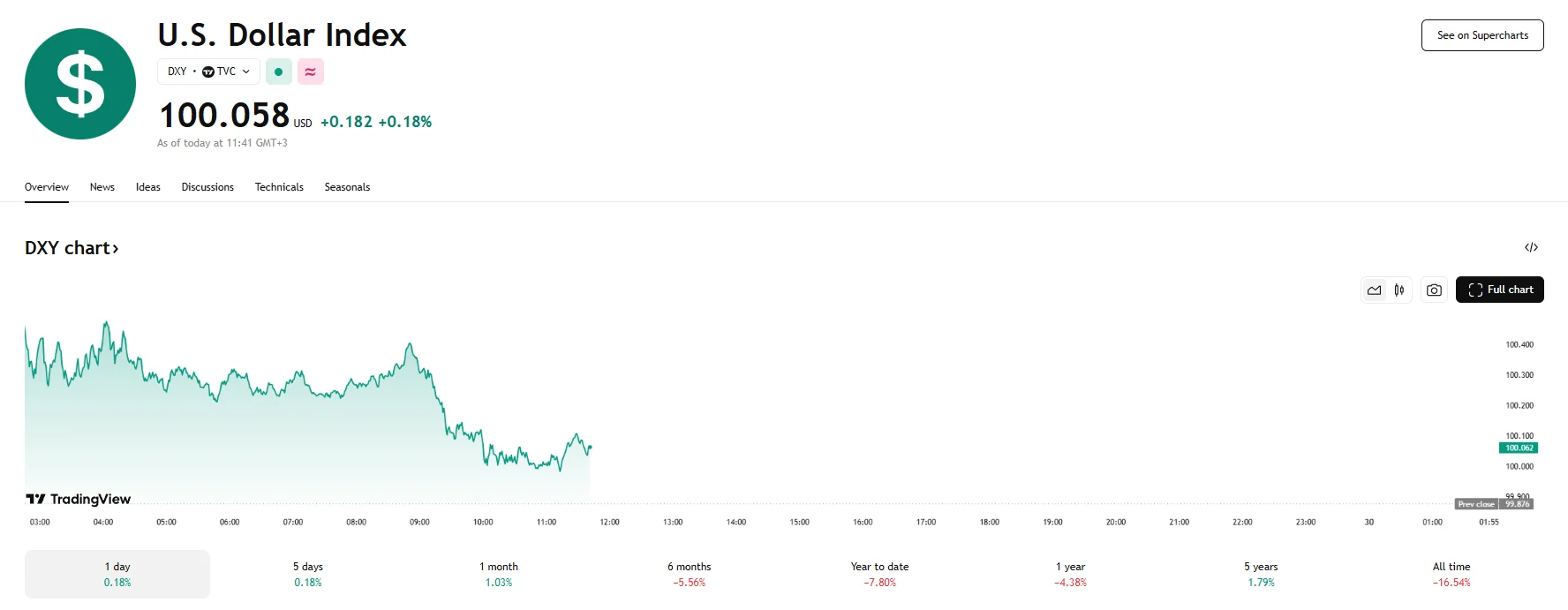

- The Dollar Index breached 100.000 after the US Federal Court blocked President Trump’s use of emergency powers to impose broad tariffs.

- The Swiss franc lost ground amid speculation around potential SNB interest rate cuts.

USD/CHF Climbs as Swiss Franc Slips

The US Dollar gained ground versus the Swiss franc on Thursday, with the pair surging to 0.8346. Although momentum slowed as the USD/CHF retreated to levels around 0.8300, the pair is still trading around 0.4% higher today.

The weakness in the Swiss franc corresponded with its decline toward 0.83 per dollar, its lowest point since May 19th. The drop in demand for the safe-haven currency followed a key US court decision surrounding Trump’s tariff policies that eased market concerns and temporarily cleared away protectionist uncertainty.

US Court Blocks Broad Tariff Powers

Sentiment shifted after the US Court of International Trade ruled that President Donald Trump was not authorized to apply sweeping tariffs using the International Emergency Economic Powers Act (IEEPA) without congressional approval. The court determined that Trump’s attempts to address trade imbalances through this legal channel were not justified. The news provided support for the greenback, allowing the US Dollar Index to soar above 100.400. At press time, the index continues to trade near the 100.000 mark.

According to the ruling, the administration has 10 days to enforce a permanent injunction, eliminating a range of tariffs. These include so-called reciprocal duties announced in early April, as well as import levies linked to fentanyl enforcement and border-related measures involving Canada, Mexico, and China.

Swiss Franc Falls on Potential Monetary Easing

In addition to court-driven sentiment, pressure on the Swiss franc intensified on expectations that the Swiss National Bank (SNB) may implement further interest rate cuts. Furthermore, market participants grew concerned that the SNB’s upcoming policy decision could see rates reach negative values in response to downward pressure on inflation.