Key Moments:The Indian rupee hovered around 85.77 per US dollar today.This follows an overall 1% decline in May due to tariff tensions, border disputes, and interest rate concerns surrounding the RBI’

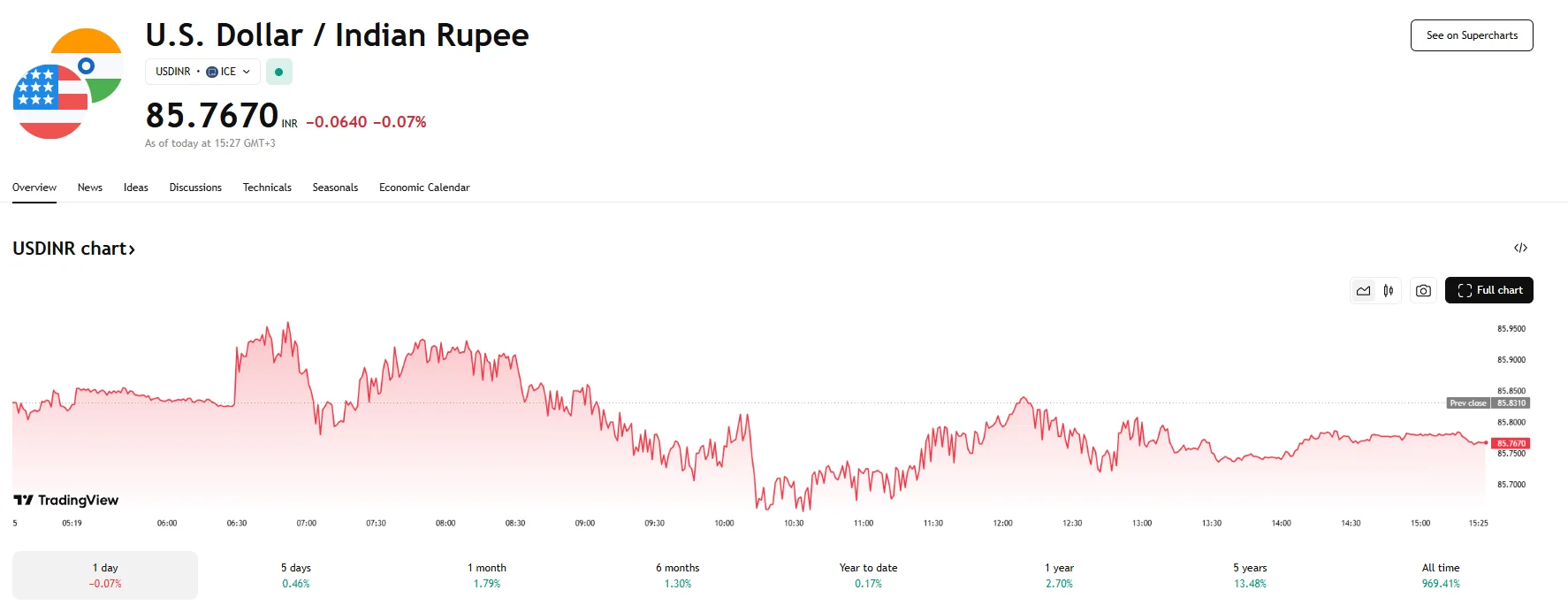

USD/INR Slips to 85.7670 as Latest Round of US-India Trade Talks Commence USD/INR Slips to 85.7670 as Latest Round of US-India Trade Talks Commence

Key Moments:

- The Indian rupee hovered around 85.77 per US dollar today.

- This follows an overall 1% decline in May due to tariff tensions, border disputes, and interest rate concerns surrounding the RBI’s monetary policy.

- Indian and US officials have begun the latest round of trade negotiations in New Delhi.

Rupee Firms Amidst Global Uncertainty

The USD/INR pair fell to 85.7670 on Thursday, with the rupee being supported by a broadly weaker dollar. Market sentiment turned cautious as heightened trade tensions and the risk of new tariffs continued to pressure US assets.

Today’s USD/INR depreciation coincided with the start of high-level meetings between Washington and New Delhi. The closed-door negotiations, held today and on Friday, aim to finalize a provisional trade agreement that includes tariff reductions in areas such as agriculture and automobiles. This was confirmed by two anonymous government sources who spoke with news agency Reuters on the matter. They also suggested that a joint statement may be issued as early as Sunday.

Strategic Bargaining and Bilateral Trade Goals

According to US Commerce Secretary Howard Lutnick, who commented on US-India trade relations earlier this week, trade discussions with India have been moving forward, and a deal may be within reach.

The US has raised concerns over India’s average agricultural tariff of 39%, pointing out that some duties go as high as 45–50%. American officials are also urging India to permit corn imports for ethanol production. However, Indian negotiators are reportedly pushing back against Washington’s demands to open up India’s agricultural and dairy sectors due to the potential for opposition from rural regions.

RBI Decision Looms

Despite this recent stability, the rupee weakened by nearly 1% against the dollar in May. Currency depreciation was driven by ongoing tariff disputes, unresolved border issues, and increasing expectations that the Reserve Bank of India would deliver further monetary easing during the meeting scheduled for this week. At present, expectations point toward another 25-basis-point interest rate cut, which would be the RBI’s third reduction in a row in recent months.

Additionally, billions of dollars will be sold by the bank via the usage of derivative instruments. As per current market expectations, the RBI will also ramp up dollar purchases to safeguard its foreign exchange reserves from significant erosion.